Air cargo demand rises 5% in August, but rates continue to fall

Average global spot rates fell by 3% to USD 2.55 per kg, marking the fourth consecutive monthly decline.

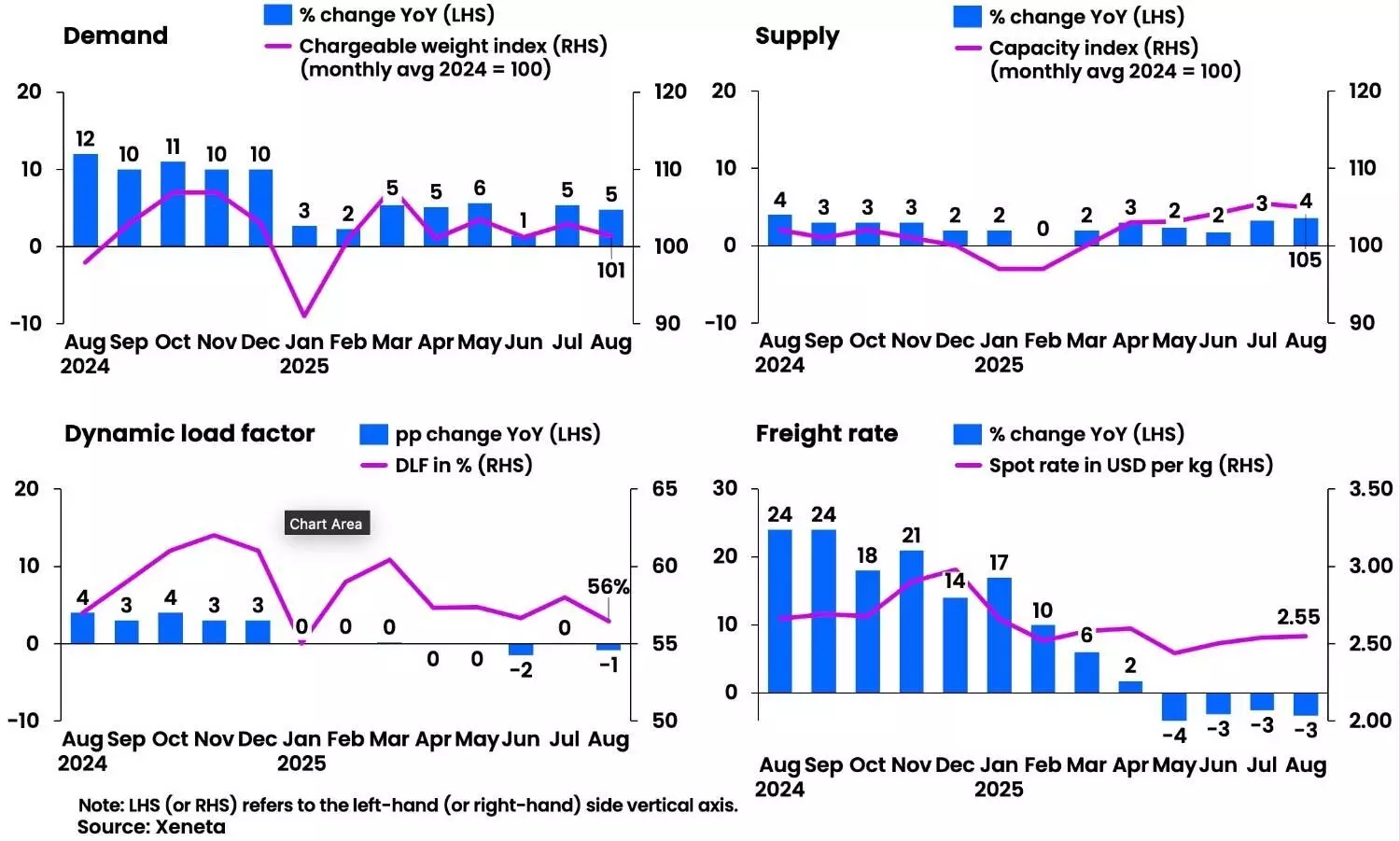

Global air cargo demand increased by 5% year-on-year in August 2025, matching July’s growth, according to industry analysts Xeneta. The rise in volumes came alongside a 4% increase in capacity, but average global spot rates fell by 3% to USD 2.55 per kg, marking the fourth consecutive monthly decline. This points to continued uncertainty for shippers, airlines, and forwarders.

Niall van de Wouw, Chief Airfreight Officer at Xeneta, said the growth does not yet reflect stronger economic activity. “We’ve now reported +5% growth in demand for July and August, and it would be easy to take some comfort from these volumes were it not for the current market conditions. Right now, volumes are certainly not as bad as people feared but also not as good as people hoped,” he said.

Spot rate declines were sharper when adjusted for currency, with the U.S. dollar weakening by 4% over the past year. Trade shifts were also visible, with China-U.S. rates at USD 4.30 per kg compared to USD 3.65 per kg on China-Europe routes, influenced by the suspension of U.S. de minimis exemptions. A 7% fall in jet fuel prices helped keep airline costs in check.

Van de Wouw noted that shippers are divided into three groups: those who avoid airfreight due to cost, those who always use it for speed and value, and a larger group that switches between air and ocean freight depending on necessity.

“It is this segment of the market which is driving the upturn in airfreight demand we are seeing,” he said, adding that e-commerce remains a supporting factor but not a sign of overall economic growth.

Regional performance in August showed Southeast Asia-to-North America and Europe spot rates down more than 20% year-on-year, while NortheastAsia routes were more stable with declines of less than 10%. Transatlantic traffic remained an exception, with spot rates up 5% to USD 1.82 per kg compared to last year, though this growth slowed from July.

Market uncertainty has been heightened by the end of U.S. de minimis exemptions, with countries including Canada, the UK, and Mexico adjusting compliance requirements. Purchasing Managers’ indices in major exporting nations also fell in August, and U.S. consumer sentiment weakened.

E-commerce demand remains strong, but van de Wouw said recent regulatory changes could shift trade patterns again. “The starting point for closing the de minimis threshold was mainly politically motivated against the big Chinese e-commerce platforms. But the widening of this legislation is levelling the playing field again for all e-commerce shipments entering the U.S.,” he said.

Van de Wouw added that while some demand is being supported by mode shifts and tariffs, questions remain about sustainability. “In terms of disruption to world trade, the uncertainty seems set to remain with so many questions unanswered. The predictions are concerning, but because of all the uncertainty, the hurt for airfreight has been softened and delayed. But for how much longer is anyone’s guess,” he said.