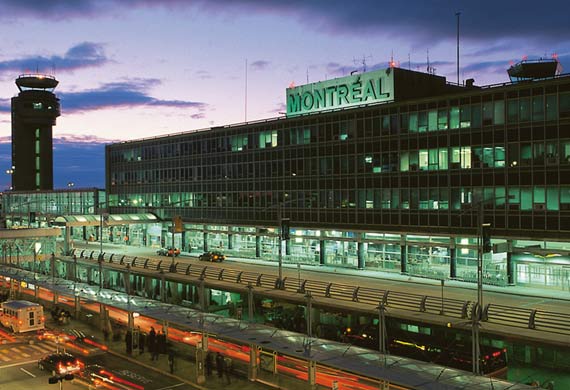

Aeroports de Montreal announces results for the second quarter

AUG 3, 2015: Aéroports de Montréal (ADM) announced its consolidated operating results for the three- and six-month periods ended June 30, 2015. These results are accompanied by data on passenger traffic and aircraft movements at Montréal–Trudeau and Montréal–Mirabel international airports. On June 12, ADM issued a new series of revenue bonds to raise total capital […]

AUG 3, 2015: Aéroports de Montréal (ADM) announced its consolidated operating results for the three- and six-month periods ended June 30, 2015. These results are accompanied by data on passenger traffic and aircraft movements at Montréal–Trudeau and Montréal–Mirabel international airports.

On June 12, ADM issued a new series of revenue bonds to raise total capital of $200 million in a private placement with institutional investors. This new bond series bears interest at 3.918 percent and matures in June 2045. It is ADM’S ninth bond issue since 2002, bringing to a total of $2 billion the amount of capital raised to finance airport expansion and modernization projects that have practically tripled the size of the terminal.

Compared with the corresponding periods last year, the number of passengers enplaned/deplaned at Montréal–Trudeau reached new heights in 2015, at 3.8 million passengers for the second quarter, up 3.9 percent , and 7.5 million for the first half-year, an increase of 4.1 percent.

EBITDA (excess of revenues over expenses before financial expenses, income taxes and depreciation) totalled $59.1 million for the second quarter of 2015, a rise of $5.8 million, or 10.9 percent, compared with the same 2014 quarter. For the half-year ended June 30, EBITDA stood at $112.5 million, up $13.1 million, or 13.2 percent, from the corresponding year-ago period.

The Corporation invested a total of $60.1 million in the second quarter and $89.8 million in the first six months (against $36.0 million and $62.6 million respectively in 2014). Investments in the airports were financed by cash flows from airport operations, including airport improvement fees (AIFs), and by long-term debt.

Consolidated revenues amounted to $119.5 million for the second quarter of 2015, an increase of $6.8 million, or 6 percent, over the same period of 2014. Cumulative revenues as at June 30, 2015, rose by $13.1 million, or 5.8 percent, to $239.7 million for the first six months of 2015, compared with $226.6 million for the same period of 2014. This growth is mainly attributable to the rise in passenger traffic and to higher revenues from commercial activities.

Operating costs for the quarter under review totalled $38.7 million, up $0.7 million, or 1.8 percent, from the corresponding period of 2014. Operating costs for the six months ended June 30, 2015, declined by $1.1 million, or 1.3 percent, to $82.5 million in 2015 from $83.6 million for the first half of 2014. This variance is due among other factors to the decrease in certain operating expenses following the signing of new contracts, and to lower energy costs at Mirabel.

Transfers to governments (payments in lieu of taxes [PILT] and rent paid to Transport Canada) reached $21.7 million for the second quarter of 2015 ($21.4 million for the same period of 2014) and $44.7 million for the six months ended June 30, 2015 ($43.6 millions in 2014), representing nearly 19 percent of the Corporation’s total revenues.

Depreciation of property and equipment amounted to $27.1 million for the second quarter, representing an increase of $0.8 million, or 3 percent, over the same year-ago quarter. For the six months ended June 30, 2015, depreciation totalled $54.4 million, up $1.9 million, or 3.6%, from the corresponding half-year of 2014. The main reason for this rise was the commissioning of projects completed during 2014.

Financial expenses declined to $22.1 million in the second quarter of 2015 from $23.0 million for the year-ago quarter, down $0.9 million, or 3.9 percent. Cumulative financial expenses as at June 30, 2015, decreased by $1.7 million, or 3.7 percent, for the half-year, totalling $44.4 million, against $46.1 million for the first half of the prior year. The main reason for this decrease is higher capitalized financial expenses for work in progress.