70% of air traders prefer to bear higher cost than opt for modal shift: DTI

The DHL Hong Kong Air Trade Leading Index (DTI) has published its results for Q2 2021. A notable improvement was seen this quarter in the overall results across all areas.

The DHL Hong Kong Air Trade Leading Index (DTI) has published its results for Q2 2021. A notable improvement was seen this quarter in the overall results across all areas, with local air traders generally optimistic about the development of international trade.

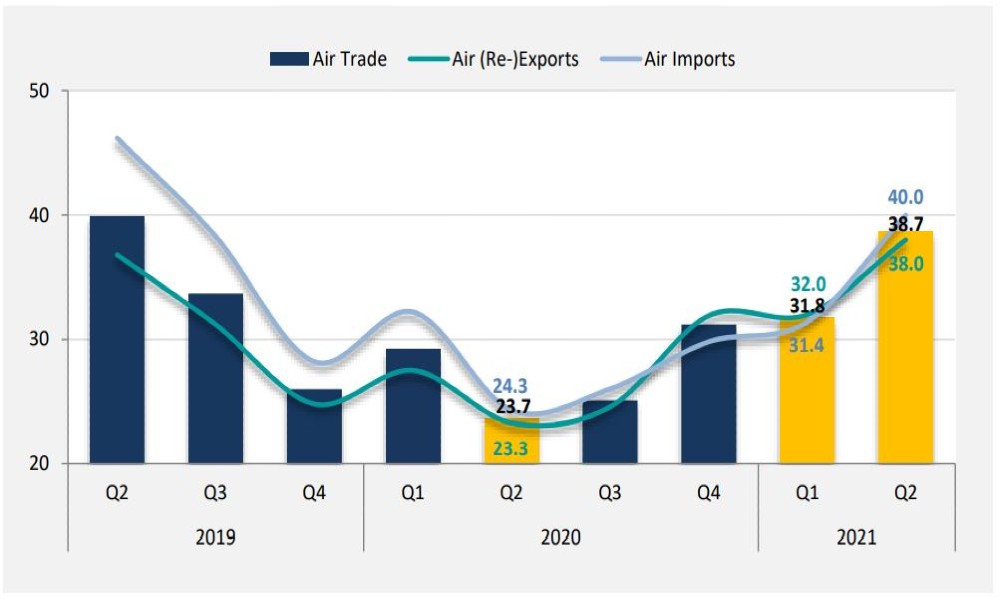

The overall air trade saw a considerable increase from the previous quarter, with both air imports and air (re-) exports also gaining improvements across multiple regions. Supported by the strong growth on imports and exports, Americas recorded the highest index among the regions. Asia Pacific, Europe and the rest of the world also saw improvements this quarter. Another noteworthy development is the shipment urgency attribute for Americas reaching the level of 50, which is the first time since mid-2018.

The Covid-19 pandemic continues to affect many parts of the world and has been changing the way people live. As a result, the B2C market has recorded a significant jump this quarter. Fewer local air traders have been reporting losses amid the pandemic. Those who have reported a balance finally overtook those who experienced loss, while the percentage of those who reported gains remains steady.

Food and beverage saw an increase this quarter and remains to be the best performing among the commodities, followed by watches, clocks and jewellery, which also saw a significant increase. Indices for electronic products and parts, gifts, toys and houseware as well as apparel and clothing accessories also witnessed improvements.

Amid the tightening of the quarantine policy for aircrew in Hong Kong and the severe weather in Americas and Europe, 70 percent of local air traders still prefer bearing a higher cost than taking alternative measures, such as choosing export ports other than Hong Kong, lowering their trade volume or delaying shipments.

The first quarterly DTI was released in Q2 2014 by analyzing the key attributes of business demand based on a survey of more than 600 Hong Kong companies that focus on in- or out-bound air trading. An index value above 50 indicates an overall positive outlook while a reading below 50 represents an overall negative outlook for the surveyed quarter. The further the reading is from 50, the more positive or negative the outlook is.

The overall air trade index rose 6.9 points from 31.8 in Q1 2021 to 38.7 in Q2 2021. Both air imports and air (re-) exports showed notable improvements. The air (re-) exports index rose by 6 points from 32 points in Q1 2021 to 38 points in Q2 2021, while the uptrend was observed across multiple regions. The air imports index rose 8.6 points from 31.4 points in Q1 2021 to 40 points in Q2 2021, with growth reported in most regions. Europe and Americas were expected to have the strongest rebound among the continents.

Both shipment urgency and product variety indices rose to 45 in Q2 2021, going up 10 points and 4 points respectively. Americas and Mainland China are the key contributors to the growth of two attributes with indices close to or exceeding 50 neutral points. The sales volume index rebounded by 8 points to 37 points after a slight drop in the previous quarter. Growth was registered in all regions while Mainland China recorded the most significant increase.

Edmond Lai, chief digital officer of the Hong Kong Productivity Council (HKPC), shared, “With Covid-19 showing signs of softening from its peak after the rolling out of vaccination programmes since the start of the year, the world is foreseeing a better control of the pandemic moving forward. This has made local air traders more optimistic about the economic outlook. To be in a position to make hay of the anticipated upturn, enterprises must work out ‘resumption plan’ in advance, given the possible challenges from the market rebound on the supply chain operations, market capacity and logistics costs. Digitalisation would remain a key in business operation. To assist Hong Kong enterprises in undertaking this path, the HKSAR Government has announced various support initiatives in the 2021-22 Budget. Enterprises are strongly advised to leverage on the available supports for continuous investment in the development and application of technologies to enhance competitiveness.”

Commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council, the DHL Hong Kong Air Trade Leading Index is the first indicator of its kind in Hong Kong that aims to provide a forward-looking perspective on overall air export and import trade volumes.