UPS reports $21billion in the second-quarter of 2025 revenue

The US-based multinational parcel delivery and supply chain management company boosts efficiency with building closures, volume strategy shifts and $3.5 Bn in targeted 2025 cost savings.

1907-founded, US-based United Parcel Service (UPS) reported consolidated revenue of $21.2 billion for the second quarter of 2025, reflecting the company’s continued operational execution and acceleration of its long-term strategic transformation in a complex macroeconomic and trade environment. Consolidated operating profit stood at $1.8 billion, or $1.9 billion on a non-GAAP adjusted basis. Diluted earnings per share (EPS) were $1.51, with non-GAAP adjusted diluted EPS reported at $1.55.

GAAP (Generally Accepted Accounting Principles) results for the quarter included a net charge of $29 million, or $0.04 per diluted share, composed of $57 million in after-tax transformation strategy costs, partially offset by a $15 million gain from the divestiture of a business within the Supply Chain Solutions segment and a $13 million benefit from the partial reversal of an income tax valuation allowance.

“Our second quarter results reflect both the complexity of the landscape and the strength of our execution. We are making meaningful progress on our strategic initiatives, and we’re confident these actions are positioning the company for stronger long-term financial performance and enhanced competitive advantage,” said Carol Tomé, CEO, UPS.

The multinational parcel delivery company confirmed it is on track to deliver approximately $3.5 billion in expected cost savings in 2025. These savings are being driven by strategic initiatives launched in the first quarter and accelerated during the second quarter, including the company’s ‘Efficiency Reimagined’ and network reconfiguration programmes. As part of these initiatives, UPS has closed 74 buildings year-to-date and plans to close additional sorts and facilities in the second half of 2025. A voluntary separation programme for all full-time US drivers was also announced.

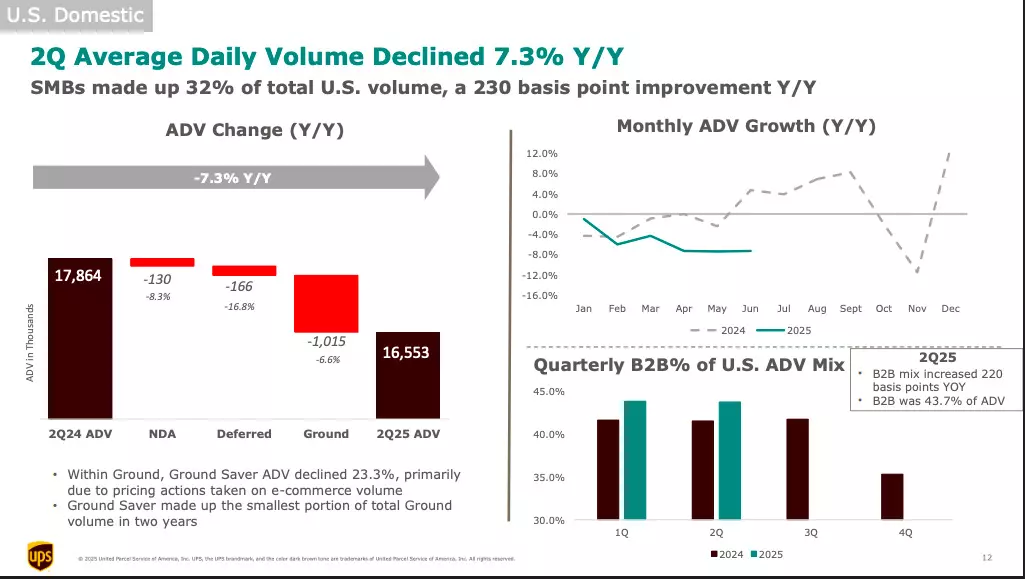

The company is actively reconfiguring its US network and accelerating the planned reduction in Amazon volume, which declined approximately 13% in the first half and is expected to decline by about 25% for the full year. To manage lower-margin e-commerce volumes, UPS implemented pricing actions for its Ground Saver service, resulting in a 23% year-over-year decline in average daily volume (ADV) for that product.

In the US Domestic segment, revenue declined 0.8% year-over-year to $14.1 billion, primarily due to volume reductions. However, revenue per piece (RPP) increased by 5.5% year-over-year, supported by base rate improvements, favourable package mix, and fuel surcharges. The segment posted a non-GAAP adjusted operating profit of $982 million with a flat adjusted operating margin of 7.0%. Non-GAAP adjusted cost per piece rose by 5.6% year-over-year, driven by short-term pressure from Ground Saver volume and the timing of workforce attrition associated with the network reconfiguration.

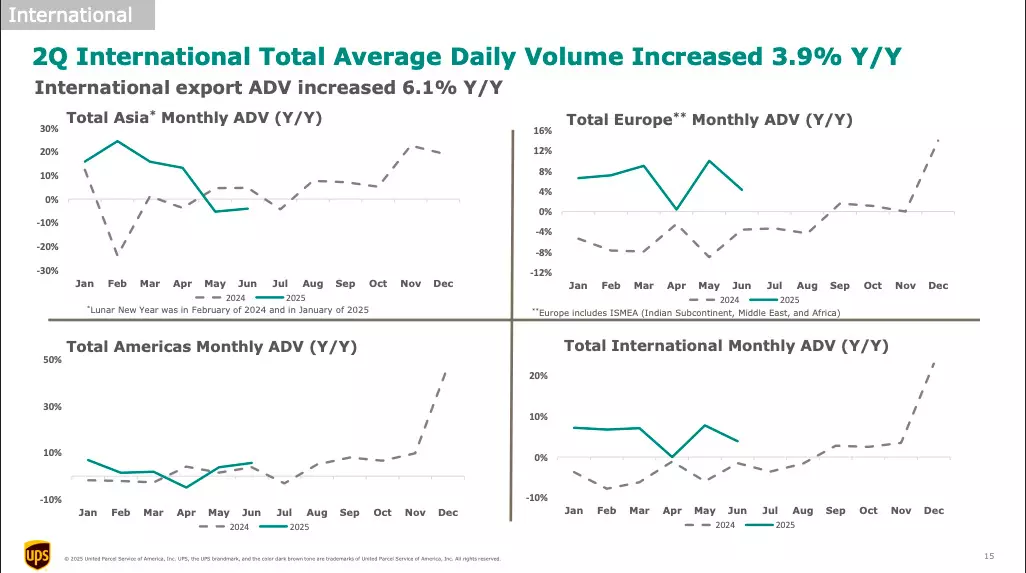

International segment revenue grew 2.6% to $4.5 billion, driven by a 3.9% increase in average daily volume and a 6.1% year-over-year increase in export volume. Despite this, non-GAAP adjusted operating profit declined 17.2% to $682 million. The operating margin for the segment fell to 15.2% from 18.9% a year earlier, impacted by trade lane shifts, product trade-downs, lower demand-related surcharges, and investments in expanding weekend services in Europe.

In the Supply Chain Solutions segment, revenue declined 18.3% year-over-year to $2.7 billion, largely due to the divestiture of Coyote in Q3 2024, which accounted for 90% of the year-over-year decline. Within this segment, air and ocean forwarding revenue decreased due to tariff-related demand softness and lower market rates. However, healthcare logistics revenue increased 5.7%, and UPS Digital (including Roadie and Happy Returns) saw 26.4% year-over-year growth. The segment delivered a non-GAAP adjusted operating margin of 8.0%, up from 7.5% in the same quarter last year.

As mentioned in the UPS 2Q 2025 Earnings Call report, UPS continues to refrain from offering revenue or operating profit guidance for the full year due to prevailing macroeconomic uncertainty. Nevertheless, it reaffirmed expectations for capital expenditures of approximately $3.5 billion, dividend payments of around $5.5 billion (subject to board approval), and share repurchases totalling $1.0 billion, which were completed in the first quarter. Pension contributions are expected to total $1.4 billion, with $921 million already paid, and the effective tax rate is estimated at approximately 23.5%.

Year-to-date, UPS generated $2.7 billion in cash from operations and $742 million in free cash flow. The second quarter included voluntary pension contributions, accelerated investments in the reconfigured network, and temporary working capital pressure primarily due to changes in tariffs.

In the broader business context, UPS noted that the US economy showed continued resilience in the quarter, but the domestic small package market remained pressured by evolving consumer buying behaviours and soft manufacturing activity. Internationally, trade flows were negatively impacted by changes in tariffs and trade policies.

“Our second-quarter results reflect the impact of a complex macro environment, driven by ever-evolving trade policies, as well as the significant actions we are taking to strengthen UPS’s competitive and financial positioning,” said Tomé.

With 2024 revenue of $91.1 billion, UPS operates in over 200 countries and territories and employs approximately 490,000 people. Earlier in June 2025, UPS announced it had nearly doubled air freight capacity between Delhi and Cologne with a new Boeing 747-8 flight, strengthening India-Europe and US connectivity. This expansion supports key sectors like automotive, healthcare, and retail, and enhances export opportunities for Indian businesses.