Unexpected air cargo volume surge from mid-December: Dimerco

Though the market typically slows down after December 5, there's been a significant uptick in air cargo volumes this year from mid-December, which is expected to extend to late January.

Air cargo volumes have experienced a significant increase since mid-December, marking an unexpected departure from typical market behaviour, according to a recent report by Dimerco. This surge, expected to continue until late January, contrasts sharply with the usual slowdown observed after December 5. The rise in demand is noteworthy for its timing and the factors driving it, including shifts in global trade dynamics, politics and changes in manufacturing activity.

Air cargo: A surge in volumes and shifting trade patterns

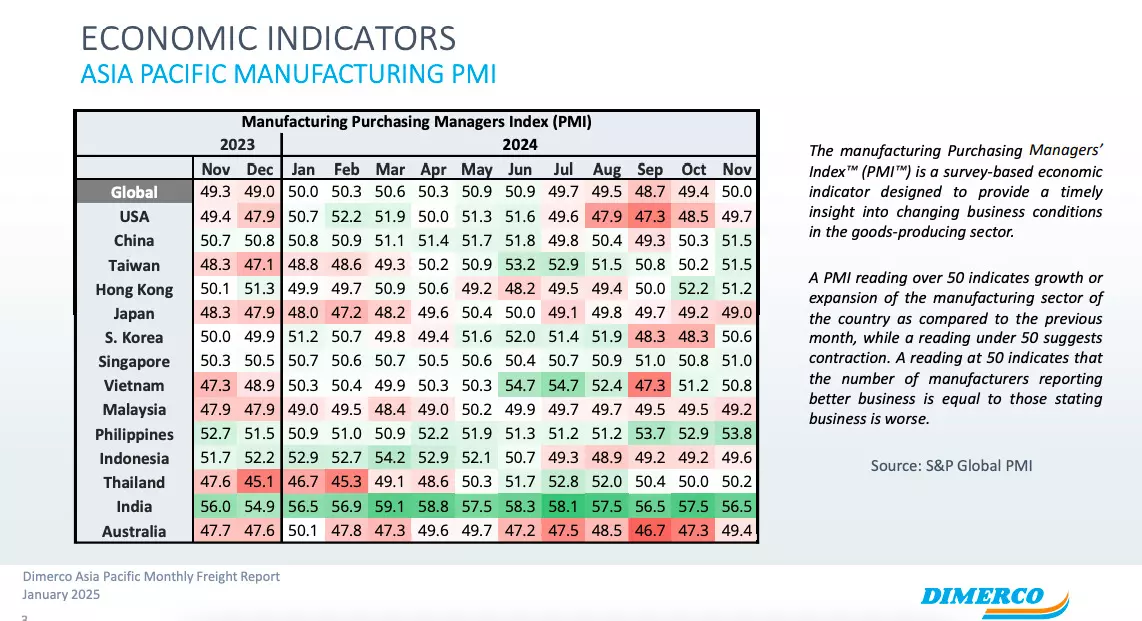

The report emphasises a notable increase in air cargo volumes despite a historically expected seasonal decline. Dimerco attributes this unusual rise to several factors, including port strikes, tariffs and a modest increase in the global Manufacturing Purchasing Managers' Index (PMI). The global PMI improved from 49.4 in October to 50.0 in November, indicating a slight expansion in the manufacturing sector. This uptick aligns with projections for 2.7% growth in 2024, suggesting a broader economic recovery impacting global trade flows. The Purchasing Managers' Index (PMI) is a survey-based economic indicator designed to provide timely insights into changing business conditions in the goods-producing sector.

A significant factor contributing to the surge in air freight is the ongoing shift from ocean shipping to air transport. This transition is primarily driven by port strikes, the potential implementation of new tariffs under the administration of newly elected US President Donald Trump, and the urgent need for shippers to meet deadlines before potential cost increases. Many businesses, particularly those in China, are rushing to ship goods to the United States via air freight to avoid expected tariff hikes that are set to take effect in second last week of January.

"Many shippers are rushing to move stock via air freight from China to the US."Kathy Liu, Dimerco Express Group

"Starting mid-December, we’ve seen a significant uptick in cargo volumes, particularly for consumer electronics. This is unusual, as the market typically slows down after December 5. However, this year, the peak is expected to extend all the way to late January, just ahead of Chinese new year. What's interesting is how general cargo has avoided the usual October-November eCommerce rush to better optimise capacity and costs—this could indicate a new trend going in to 2025," said Kathy Liu, VP, Global Sales and Marketing, Dimerco Express Group.

"At the same time, many shippers are rushing to move stock via air freight from China to the US, hoping to beat potential tariff increases before January 20 under the Trump administration. This has created a surge in demand, pushing capacity to critical levels," added Liu.

2025 outlook: Air freight and growing trade between Asia and Taiwan

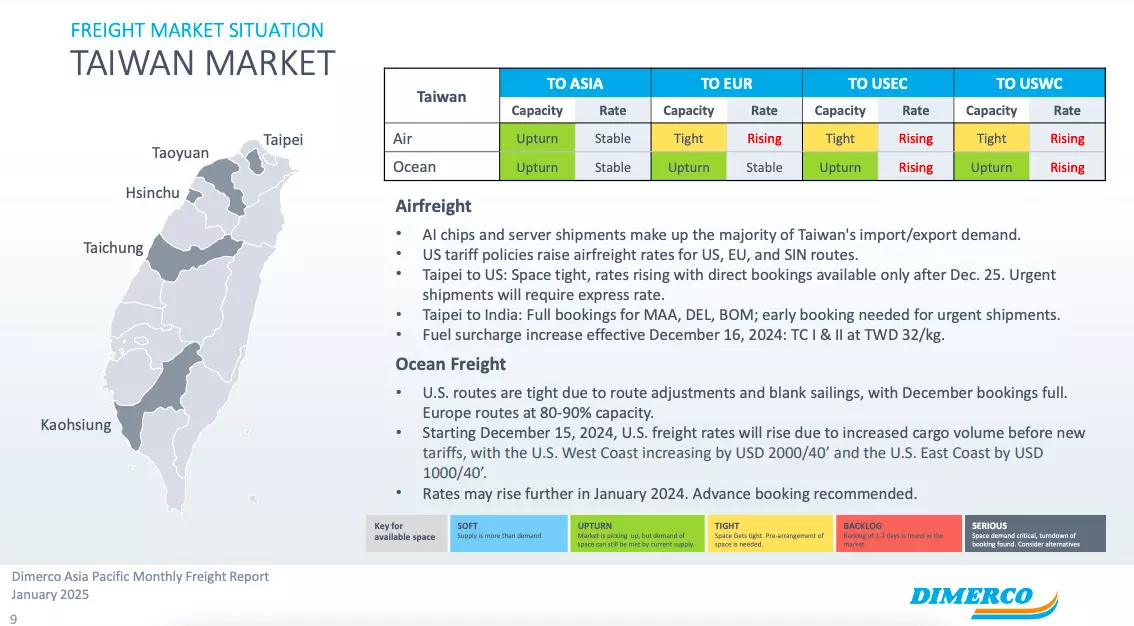

As we look ahead to 2025, airlines have announced a 10% increase in contract rates for both long-haul and intra-Asia routes. However, the market remains cautious, with rates still below the peak levels seen in 2023. Trade between Asia and the United States is uncertain, particularly due to potential tariff policies. Notably, the China-Taiwan trade route is expected to experience significant growth, driven by Taiwan's advanced production capabilities in semiconductors and consumer electronics. This trend is likely to result in more parts being shipped from China to Taiwan for assembly before being exported to the US to avoid tariffs.

Rising rates and tight capacity in air freight

Air freight has seen significant rate increases due to heightened demand and capacity shortages. Asia-Europe lanes remain stretched, exacerbated by flight cancellations from China Cargo Airlines and Japan Airlines, which have constrained space and pushed rates higher. However, relief is anticipated after January as pre-Lunar new year demand subsides. Transatlantic routes have also experienced similar trends, with rates rising due to reduced capacity during the winter season and strong European imports from the Middle East driven by sea-air logistics and disruptions in the Red Sea region.

In the US air freight market, capacity remains tight as shippers rush to move goods ahead of potential tariff changes under the Trump administration. Charter services are helping to stabilise rates, but advanced bookings are crucial to avoid delays. Taiwan's significant role in exporting AI chips and servers has further tightened capacity, with soaring demand for routes to the US, EU and Singapore.

A complex freight market in transition

The freight market in late 2024 and early 2025 reflects a unique convergence of challenges and opportunities. North American air cargo demand has shown consistent growth through the end of Q4, driven by rising e-commerce and shippers expediting goods ahead of potential regulatory changes in the US. While the new appears promising for air cargo, caution is advised as 2025 could bring significant disruptions.

The newly elected President of the United States may implement substantial tariffs on key trade partners such as Canada, China and Mexico. These measures could disrupt global supply chains and dampen consumer confidence. The report also highlighted that according to Willie Walsh, Director General of IATA, the air cargo industry’s resilience will be tested by a range of geopolitical and economic factors, including ongoing conflicts in the Middle East and Ukraine, uncertainties within the EU and NATO, and a potential International Longshoremen's Association (ILA) strike starting January 15, 2025.

The upcoming Chinese new year in 2025, which falls on January 29, adds another layer of complexity. With public holidays in China spanning January 28 to February 4, factory closures during this period could significantly disrupt global supply chains, causing production halts and shipping delays. According to the report, shippers are advised to plan proactively by placing orders well in advance, securing sufficient inventory, and coordinating with logistics partners to mitigate potential impacts. Moreover, Taiwan-China trade is expected to grow, particularly in semiconductors and electronics, as manufacturers move parts for assembly and export to bypass tariffs.

As global supply chains adapt to these evolving dynamics, the freight industry faces both challenges and opportunities. Effective planning, collaboration, and adaptability will be critical for shippers and carriers to navigate the uncertainties of 2024 and 2025.