Trade tensions hit air cargo in US, Europe; Asia-Pacific surges

June data reveals how instability and tariffs are weighing differently on global air cargo routes.

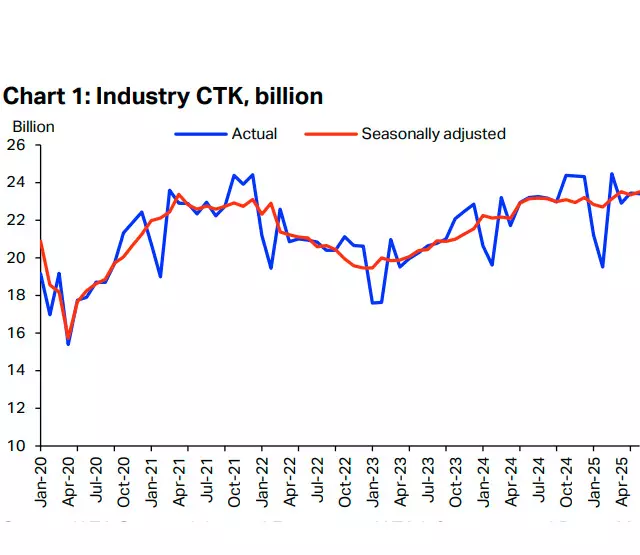

The International Air Transport Association (IATA) reported that global air cargo demand rose by 0.8% year-on-year in June 2025, with Asia-Pacific airlines leading the growth with a strong 9.0% increase. This came even as North America saw an 8.3% decline and Europe showed flat growth at 0.8%.

Total demand, measured in cargo tonne-kilometers (CTK), increased by 0.8% compared to June 2024 levels, with international operations rising by 1.6%. Available capacity, measured in available cargo tonne-kilometers (ACTK), grew by 1.7% year-on-year and 2.8% for international routes.

IATA’s Director General Willie Walsh highlighted the contrasting regional performances, noting that while Asia-Pacific bucked the overall modest growth trend with a 9.0% expansion, North American traffic was dragged down by trade tensions, and military conflict in the Middle East led to a 3.2% fall in cargo volumes there. He said Europe remained mostly stagnant, growing only 0.8%.

Walsh also emphasized that the June data reflected the importance of stability and predictability in global trade. He said that emerging clarity around US tariffs gave businesses more confidence to plan, but also warned that the new deals being made are significantly raising tariffs on goods imported into the US. The long-term economic impact of these cost barriers remains uncertain. He urged governments to focus on making trade easier, faster, and cheaper by pushing digitalization.

IATA also pointed to key developments in the global operating environment. World industrial production rose by 3.2% in May, while global goods trade grew by 3.5%. Jet fuel prices in June were 12% lower than the same period last year, marking the fourth consecutive year-on-year monthly decline, although they rose by 8.6% compared to May. Global manufacturing showed signs of improvement, with the Purchasing Managers’ Index (PMI) climbing above the 50 mark to 51.2. However, the PMI for new export orders, despite a 1.2-point improvement, remained below the neutral threshold at 49.3, still affected by recent US trade policy shifts.

Region-wise, Asia-Pacific airlines recorded the strongest performance with a 9.0% increase in demand and a 7.8% rise in capacity. North American carriers experienced the steepest decline, with demand falling by 8.3% and capacity down by 5.1%. European carriers saw a slight 0.8% increase in demand alongside a 2.6% rise in capacity. Middle Eastern carriers posted a 3.2% drop in demand while capacity rose by 1.5%. Latin American airlines reported a 3.5% increase in demand, though their capacity slipped by 0.4%. African airlines registered a 3.9% growth in demand and a 6.2% increase in capacity.

In terms of trade lanes, air freight volumes in June rose on key corridors from and within Europe and between the Middle East and Asia. However, significant declines were seen in trade routes from and within Asia, as well as from North America.