Tonnages fall further while rates hold firm: WorldACD

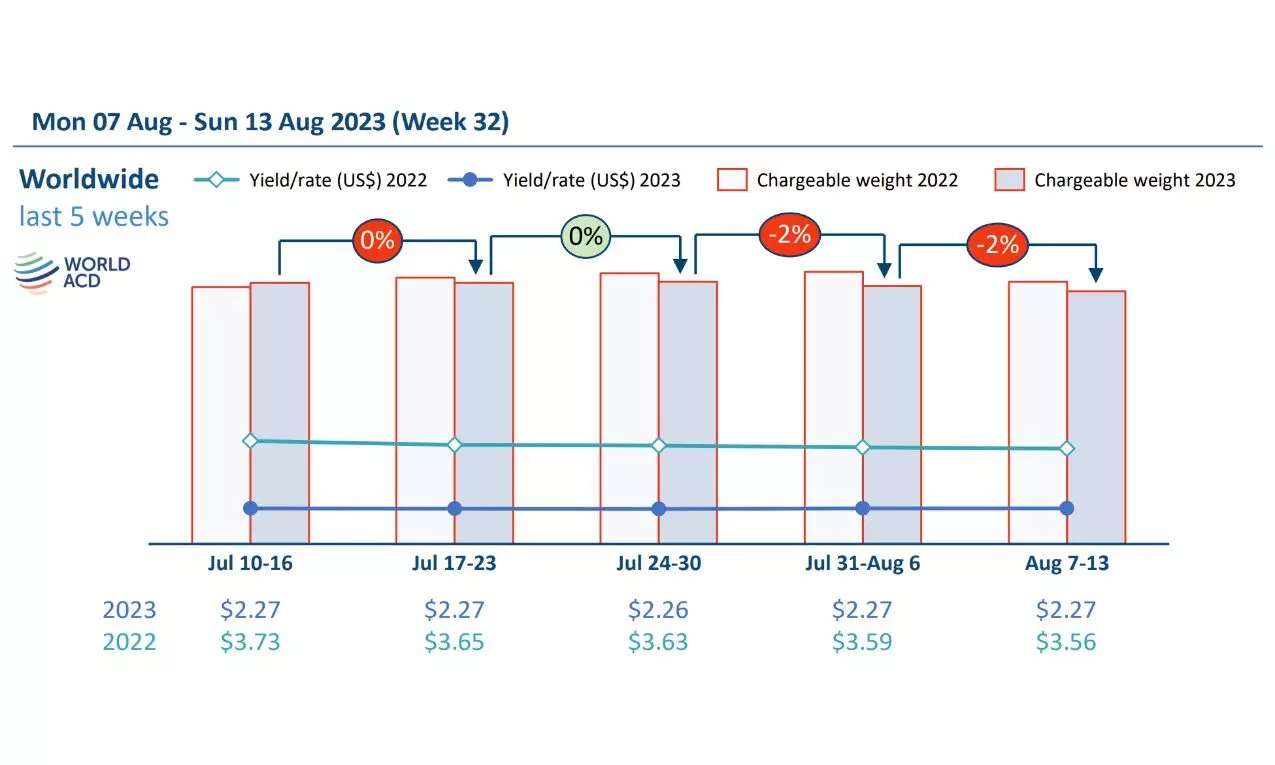

Average global air cargo rates have stabilized in the last five weeks at around -37 percent below their levels this time last year - still being more than +30 percent above their comparable pre-Covid levels - while the decreasing trend in global tonnages continued into the first full week of August, with volumes around -4 percent year-on-year, according to the latest figures from WorldACD Market Data.

Figures for week 32 (7 to 13 August) show a -2 percent drop in tonnages compared with the previous week, while average worldwide air cargo prices remained flat, week-on-week (WoW), based on the more than 400,000 weekly transactions covered by WorldACD’s data.

Comparing weeks 31 and 32 with the preceding two weeks (2Wo2W), overall tonnages dropped by -2 percent versus their combined total in weeks 29 and 30, while worldwide rates were stable and capacity was slightly down (-1 percent).

At a regional level, significant decreases in tonnages were recorded (2Wo2W) on flows ex-North America to all main regions, notably to Asia Pacific (-9 percent), Central & South America (-6 percent) and Europe (-4 percent). Volumes dropped in both directions between Europe and Central & South America (-9 percent northbound, -5 percent southbound), and between Europe and Africa (northbound -4 percent, southbound -8 percent), while tonnages on the key Asia Pacific to Europe lane also fell significantly (-5 percent). There was only one notable increase recorded, on flows ex-Middle-East & South Asia to Asia Pacific (+5 percent).

On the pricing side, average global rates remained stable (2Wo2W), along with prices from the main origin regions. But there were some noteworthy shifts in pricing on certain lanes to, from and within Asia, with rates decreasing on flows ex-Middle East to Asia Pacific (-6 percent) and intra-Asia Pacific (-4 percent), but rising (+4 percent) on the big Asia Pacific to North America lane.

Year-on-Year perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 31 and 32 was down -4 percent compared with the equivalent period last year (YoY), with strong decreases in tonnages ex-North America (-17 percent) and ex-Europe (-9 percent). Increases were observed from three main regions, most notably ex-Middle East & South Asia (+4 percent).

Overall capacity has increased by +9 percent compared with last year, with capacity ex-Asia Pacific up by a noteworthy +27 percent. Other significant YoY capacity increases can be observed ex-Middle East & South Asia (+11 percent), ex-Europe (+8 percent) and ex-Africa (+6 percent), while a decrease was recorded ex-Central & South America (-5 percent).

Worldwide average rates are currently -36 percent below their levels this time last year, at an average of US$2.27 per kilo in week 32, although they remain significantly above pre-Covid levels (+33 percent compared to August 2019).