Time for air cargo to adopt digitalisation like passenger business

Air cargo industry is poised for significant growth and transformation in digitalisation over the next five years

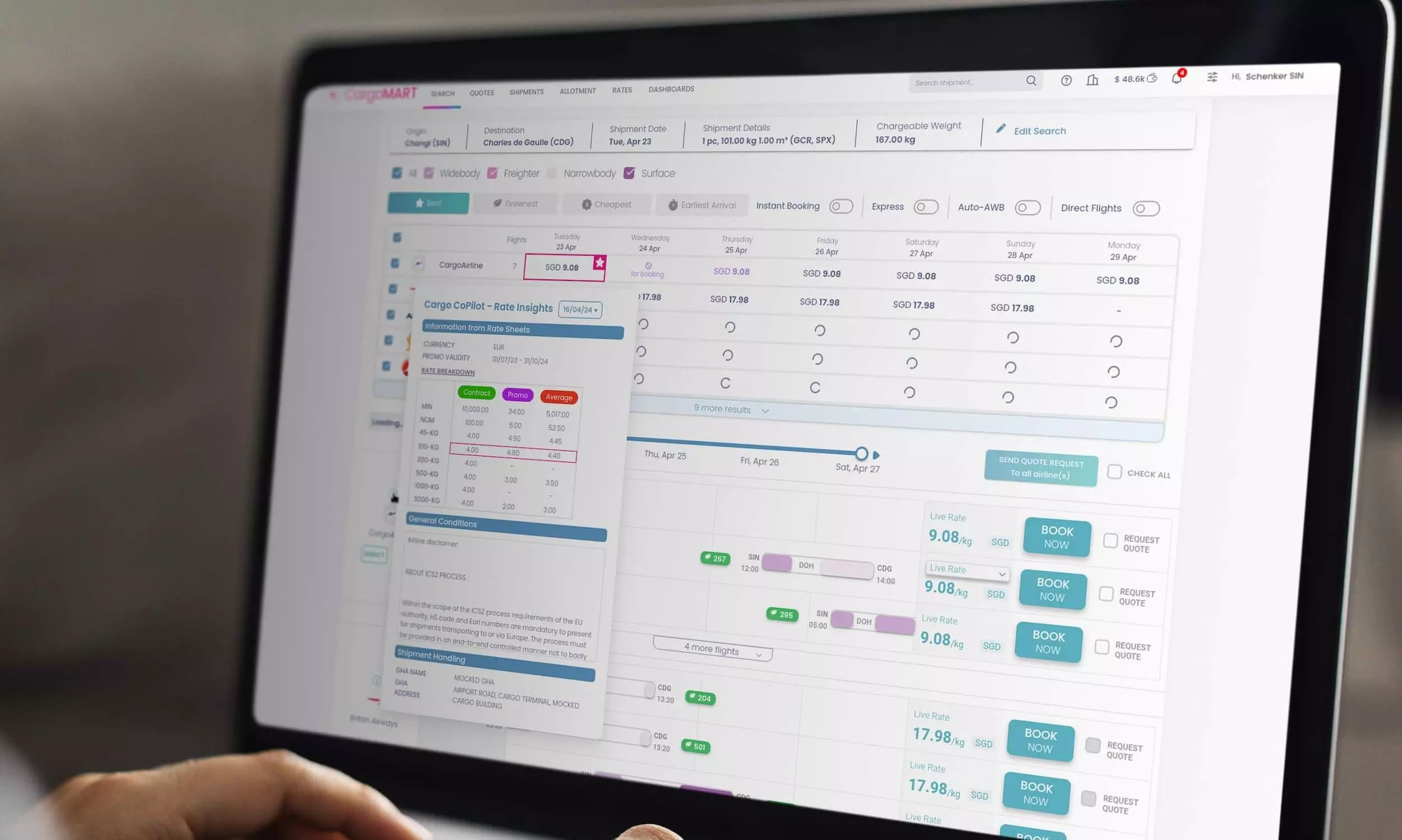

Photo Credit: CargoAi

A market size of more than $175 billion with a volume of over 58 million tonnes, the air cargo industry has become a powerhouse for global trade, especially with rising e-commerce shipments, according to an update from Maersk Air Cargo.

"The following industries and products rely on air freight due to its quick delivery timelines,

*E-commerce: Facilitates expedited shipping for high-value goods such as electronics, luxury and high-demand fashion items.

*Manufacturing: Ships time-sensitive components critical for production lines to enable just-in-time inventory management.

*Humanitarian aid: Delivering relief supplies to disaster zones, including medicines, food, water and shelter materials, enabling quick response during emergencies.

*Aerospace and defence: Supply of avionics, aircraft engines, and military equipment and armaments like missiles and drones, crucial for armed forces.

*Perishables: Produce, seafood, dairy items, chemical materials, plants and flowers are quickly transported to the market, reducing spoilage and preserving freshness; and

*Pharmaceuticals: Transporting temperature-sensitive immunisations worldwide, crucial during health crises like the Covid-19 pandemic."

And digitalisation is gaining momentum to keep up with the sheer pace of volume growth.

"Digitisation tends to follow an 80/20 power law where the more common types of bookings, say smaller Freight All Kinds (FAK) shipments, are digitised first," says Eytan Buchman, CMO, Freightos. "From there, we began to digitise common cases like blockspace bookings, temperature-controlled bookings, hazardous bookings and more. The long-term challenge of the industry is how disjointed the end-to- end process for a shipment can be, taking place across multiple levels of actors. A typical shipment can span a carrier, co-loader, multiple forwarders and a shipper. Unifying these also requires unifying additional services, say cartage or insurance, as well as streamlining access to this information.

"With the core booking digitised, and, in some cases, already spanning multiple forwarders (in the case of booking delegation), carriers (in the case of interlining) and shippers (like with our enterprise shipper product that enables shippers to price from forwarders online), this challenge is already being addressed but we’re still at Day 1 when it comes to industry digitisation. Okay, maybe Day 2."

"An enterprise organisation would worry less about the underlying cost and more about rollout, security and internal efficiency. Understanding the complexity of these processes and working together with our customers as partners rather than buyers helps us address these challenges effectively, and has been a driving force in our rapid industry adoption."

Eytan Buchman, Freightos

The tools and technology exist today to enable a large percentage of all shipments to be booked electronically but adoption lags this capability, adds Stuart Hayman, Head, Carrier Integration and Transformation, WiseTech Global. "However, with ongoing disruptions experienced in global supply chains (pandemics, sanctions, weather events and political unrest), logistics companies must embrace innovative approaches – particularly technology.

"The key is to address the people factor as part of a digital transformation. Last year, we conducted research that found logistics and supply chain companies cite lack of resources to drive adoption (53 percent) and workforce resistance (38 percent) as the top two challenges to implementing technologies that enabled more visibility throughout their operations.

"I’m sure we all wished it were as easy as flicking a switch but in reality this is a change management process. Successful digital transformation in the logistics industry involves more than just great technology. The ‘human factor’ is critical. People may be hesitant to abandon familiar methods in favour of new technologies if they don’t see the anticipated business benefits, if they don’t believe the benefits can be achieved or if they are not confident that they can succeed with the new tools or methods.

"The air cargo industry is still a people business that relies on talent in all sorts of sales and operational roles in order to maximise the uplift on every departing flight. The process of managing cargo bookings at airlines and freight forwarders is typically a front-line role. For such change management to be successful, leaders need to clearly communicate the vision of the transformation to their front-line team members, and be ready to hear and address any questions and concerns their people might have.

"The change required to drive positive adoption is as much with freight forwarders as it is with airlines. Both parties to the booking transaction need to collaborate and agree on a pathway to transition from manual methods to digital. There has been noticeable improvement over the past couple of years with more airlines recognising their customer’s desire to embed digital processes into the systems they use. Airlines are increasingly providing their customers with choice by adopting a multi-channel distribution strategy – in many cases learning from digital transformation in the air passenger sector."

"In air transport, the passenger side of the business has led revolutionary change - we should seek to replicate that on the cargo side. We need to be at a similar point with air cargo within the next five years."

Stuart Hayman, WiseTech Global

The challenges for faster adoption of digitalisation in the air cargo industry primarily revolve around (1) traditional inherited processes, (2) legacy systems, and (3) digital savvy workforce, according to Matt Petot, Founder and Chief Executive Officer, CargoAi. "Many companies in our industry are used to manual processes and may be hesitant to transition to digital solutions due to fear of disruption or lack of understanding about the benefits. While many airlines and forwarders still rely on traditional methods such as emails and phone calls to book and track updates for every shipment, leading to fragmented approaches and intense manual workload throughout the shipment lifetime, we believe in driving awareness of tools such as CargoMART that shows instant value from the first booking onward – saving hours of time for every operator.

"On the other hand, interoperability and standardisation issues between different systems across airlines and forwarders can create challenges for seamless integration and collaboration. Infrastructure and resources varying across different countries with different standards worldwide is one of the challenges, which we’ve tackled with our CargoCONNECT API portfolio, supporting the industry standardisation of milestones, steps and more across 100+ countries."

By providing comprehensive solutions that address the unique needs of freight forwarders, airlines and other stakeholders, our company is laying the foundation for a more efficient, sustainable and interconnected airfreight industry.

Matt Petot, CargoAi

Lufthansa Cargo has always been at the digital forefront on the global air cargo stage, says Jasmin Kaiser, Head of Information Management & Chief Data Officer, Lufthansa Cargo. "In the last years, we have focused on new booking channels, seamless tracking options for our customers and more efficient and digitised warehouse handling. But to take full advantage of digitalisation, the air cargo industry needs to change its structures, systems and data flows more broadly. In this regard, there are still many challenges.

"For example, numerous, country-specific regulations, a partial lack of industry standards and high upfront investments to overcome paper-based processes and increase penetration of modern technologies hamper faster adoption. As the air cargo industry in total is rather small and fragmented compared to other industries, only a limited number of IT suppliers are providing standardised and future-proof IT systems. The more digitalisation progresses within the air cargo industry, the higher the requirements on information and data security as well as continuity measures will also be. However, especially with the new AI possibilities, it is important to continue the digitalisation and data roadmaps to leverage the efficiencies and opportunities for the air cargo business."

Digitalisation and current offerings

"We are proud to be the only cargo booking platform that publicly and transparently shares booking data," says Buchman of Freightos. "All booking data is available in our SEC filings. Freightos is on a run-rate of over one million bookings annually, surpassing one million bookings in total in 2023. This is a dramatic shift online for a B2B industry from a run rate of under 100,000 bookings in 2020 with a significant majority being air cargo.

"Let me just emphasise that while airlines representing 66 percent of capacity are digitised, that doesn’t mean that all capacity by those airlines is available for eBooking."

CargoMART has received positive feedback from customers since its launch in 2019, adds Petot of CargoAi. "Users appreciate its user-friendly interface, robust features and seamless integration with existing workflows. We regularly solicit feedback from our users to drive continuous improvement and prioritise updates based on their needs and preferences. As part of this feedback loop, we’ve heard the needs for a set of new features connecting the forwarders’ different teams together – ranging from sales quoting tool, supporting instant quotation based on real-time procured air cargo rates for the sales teams to better rate management system (RMS) helping P&L owners to find and forecast rate levels in our dynamic environment.

"That’s why we just released CargoMART Pro, available as of April, to all forwarders – small or big sizes – to help them better manage their end-to-end operations. On the flipside, the airlines have been requesting new tools for their teams to manage and find more volume – thus the launch of our CargoMART Airline Pro version earlier this year.

"As the world converges into a digital marketplace, we see our clients requiring more embedded solutions from external providers such as CargoCONNECT supporting the overall digitalisation journey of our sector. CargoCONNECT continues to drive a lot of interest – ranging from transport management systems (TMS), forwarders, airlines and other players.

"CargoINTEL plays a crucial role in helping customers make more informed decisions by providing actionable insights and data-driven analysis. By leveraging real-time data and advanced analytics, CargoINTEL empowers customers to identify opportunities for optimisation, mitigate risks and drive better business outcomes.

"At Lufthansa Cargo, we are also committed to developing and introducing new digital solutions that align with our sustainability goals and measures. We leverage digital technologies that reduce CO2 emissions."

Jasmin Kaiser, Lufthansa Cargo

Our business and IT teams have jointly achieved a lot of milestones, says Kaiser of Lufthansa Cargo. "This ranges from real-time pricing to the online bookability of new products such as td.Zoom or add-on services like reduction of CO2 emissions and digital alternatives for former paper-based procedures. We invested into APIs to leverage bookings via third-party platforms or allow seamless e-commerce business. Moreover, we drive our data capabilities forward as well as exploring IoT and physical automation opportunities.

Technology-wise, we moved our applications to the cloud and modernised our network infrastructure over the last three years, allowing for further business growth.

"We also continue to invest in IATA’s ONE Record initiative as an industry-wide data sharing standard, which is to improve the flow of information and data exchange throughout the entire supply chain. As a first milestone in modernising the industry’s data exchange infrastructure, we recently offered shipment tracking options based on the ONE Record standard. Building on that, we will develop further use cases and explore them with our partners to support the introduction of the new standard by 2026."

cargo.one is loved by freight forwarders for equipping them with digital superpowers that make their lives easier and win them more shipments, adds Veit Dinges, VP, Enterprise Solutions, cargo.one. "Even single branch forwarders today enjoy global market visibility in seconds, and can quote and secure capacity effortlessly 24/7 - unthinkable just a few years ago.

"cargo.one is known for its seamless digital booking process and the largest portfolio of airline and agent rates in the market. With our direct integrations with over 50 airlines, we guarantee both the best quantity and quality of market offers, and so forwarders can be sure that cargo.one has the best rate for every shipment. We currently serve over 20,000 forwarders, enabling them to quote and book capacity effortlessly.

"The return on investment from using cargo.one for air freight procurement is impressive. For example, the time saved from replacing countless emails and calls in quotation and booking is commonly around 20 percent of team hours, which can be reinvested into winning more shipments and improving customer service.

"On the airline side, we are the go-to industry standard for digital sales. From early adopters to those just joining, airlines have learnt that we have the expertise, infrastructure and market knowledge to guarantee the high performance and usability their customers demand – that’s why even the largest global airlines choose to work with us. Our airline growth teams are unique in the industry for supporting airline partners to optimise their offer quality, raise efficiencies and stay ahead of the curve in an increasingly dynamic and competitive market."

What's blocking digitisation?

The size of investment required can be a block but this is often a misconception, according to Hayman of WiseTech. "Building a solid business case requires understanding of all current costs and how they may be reduced through the adoption of digital solutions. Often the focus is on just labour costs but you should take a wider view to consider other inputs such as existing distribution costs and maintenance of the existing system that may offset any initial investment. It also depends on the way the solution is delivered. For example, in-house designed and managed technology requires high up-front investment compared to a Software as a Service (SaaS) solution like CargoWise that can be easily scaled to meet changes in the business.

"Solutions that simply digitise existing manual processes between players can be complex. True digital transformation looks at the overall desired outcome afresh and challenges the status quo process to, where possible, simplify and improve processes.

"To support the adoption of eBookings in CargoWise, we developed AirlineConnect which provides freight forwarders with direct access to real-time airline information for dynamic pricing, available cargo capacity, accurate flight information, transparent visibility of airline charges, eBooking capabilities and automatic updating of status information – all within the CargoWise platform."

Investment could be a barrier for financially less strong parties in the cargo supply chain, resulting in a slower adoption of technology, says Kaiser of Lufthansa Cargo. "The costs associated with upgrading or implementing new technologies can be prohibitive. At Lufthansa Cargo, we provide many customer-self service solutions via our own website like online booking, tracking, digital pre-check, enabling our customers to digitise workflows without their own investments. At the same time, we consult and support customers who want to integrate end-to-end workflows with Lufthansa Cargo in their own transport management system."

Investment can be a significant barrier for carriers, forwarders and shippers when it comes to adopting new technology, adds Petot of CargoAi. "A lot of players in this industry are set in their ways, and moving to new technologies can appear to be not only a monetary investment but also a big operational and training time investment. However, CargoAi’s innovative approach, based on our user-centric focus and cloud-native technology, is set to reshape our airfreight industry landscape.

"By providing comprehensive solutions that address the unique needs of freight forwarders, airlines and other stakeholders, our company is laying the foundation for a more efficient, sustainable and interconnected airfreight industry. Our aim is to provide cost-effective digital tools that deliver tangible value, enabling companies to justify their investment in digitalisation – from our marketplace CargoMART digitising cargo bookings between airlines and forwarders, our API portfolio CargoCONNECT connecting TMS, forwarders and airlines seamlessly, our carbon emission tracking tool Cargo2ZERO to our cross-border payment solution CargoWALLET reducing payment transfer cost.

"As a core to our mission, we place great emphasis on customer support and collaboration, working closely with airlines and freight forwarders to tailor solutions that meet their specific needs and ensure maximum value and satisfaction – and that’s why we’ve been able to release multiple products at an unmatched speed based on our client’s requests."

Buchman of Freightos says costs are typically not a large blocker for customers across the board; in the vast majority of cases, the case for both operational efficiency and improved customer service makes a very strong argument for adoption.

"Adoption can sometimes be slower due to the B2B nature of the business. Companies that are supporting many thousands of shipments owe it to their customers to ensure that they are prepared for all edge cases. For a more simplified example, it's easy for a person to go online and spend $9/month on to-do software. An enterprise organisation would worry less about the underlying cost and more about rollout, security and internal efficiency. Understanding the complexity of these processes and working together with our customers as partners rather than buyers helps us address these challenges effectively, and has been a driving force in our rapid industry adoption."

Digitalisation and payment challenges

The most effective form of response, according to Buchman of Freightos, is bookings. "We continue to see strong adoption with more than a 6X growth in payments on the platform between Q42022 and Q42023. We have also seen more airlines join WebCargo Pay including IAG, Qatar, China Eastern, Nippon Air Cargo and JetBlue via Aeronex.

"We believe that this will continue to play a broader role in the industry; the idea of buying products on Amazon but paying separately with a bank transfer is absurd. This is all the more so in air cargo where additional fees, cancellations and such all contribute to reconciliation challenges that can be addressed with direct booking and payment alignment."

The good news, according to Hayman, is that 95 percent of logistics companies plan to maintain (50 percent) or increase (45 percent) their investment in technology. "The areas of greatest investment are supply chain management systems, digital documentation and warehouse automation showing a desire for greater efficiency, visibility and interoperability.

"In the air cargo industry specifically, digitalisation is about much more than being able to search for rates and flights and make a booking. It’s about the underlying shipment record (Air Waybills) and the ability to create an accurate record and share it digitally as a single source of the truth throughout the shipment’s journey. It’s also about providing real-time visibility of actionable information to initiate and support decisions where they are required."

Air cargo and digitalisation - way forward

We’re well past the point of no return when it comes to digitisation, says Buchman of Freightos. "The industry has made an enormous transformation from focusing on siloed internal technology stacks - like freight rate management tools - to platforms that span carriers, forwarders and shippers. That is an unlock that will let far more technology be built on top of these platforms.

"In the immediate future, I believe there is opportunity to progress on the following axes:

*More types of transactions: For example, expand to temperature-controlled goods, cartage, linehaul and more

*More aspects of each transaction: With transactions digitised, additional aspects of each booking can also be digitised. This can include, for example, payments, insurance and customs brokerage services.

*New business combinations: When digitised on one platform, new business opportunities emerge. For example, we’ve already seen interlining bookings between airlines take off over the past few quarters. Similarly, forwarders selling to their agents or partners has also begun to emerge as a serious forwarder opportunity for additional revenue at lower costs of sale.

"All of this generates a tremendous amount of data. By providing insights from this data back to customers, whether through our platform or integrated with their systems like TMSs, forwarders can operate far more efficiently.

"For example, we recently launched our Air Volatility Index, which shows forwarders pricing trends by lane and carrier and can help project whether prices will rise or drop in the future. This can help them educate customers, lock in prices before they rise or hold off on booking if they appear to be dropping."

Air Volatility Index. Photo Credit: Freightos

The pandemic did help to advance digital transformation in logistics but the rate of adoption needs to continue and even pick up pace, adds Hayman of WiseTech. "In air transport, the passenger side of the business has led revolutionary change - we should seek to replicate that on the cargo side. As consumers, we think nothing these days of jumping online to search for flights and airfares and then go ahead and make our booking online. We pay, receive our booking confirmation and e-ticket digitally and can access our boarding pass digitally on our phones and pass through the airport without having to print anything on paper and maintain visibility of the status of our flight. We need to be at a similar point with air cargo within the next five years and I believe we will with the leadership driven change management approaches that comprehensively address the technology, processes and people."

Petot of CargoAi is very clear that there will be significant growth and transformation in the digitalisation of the air cargo industry over the next five years. "As technology continues to evolve and mature, we expect to see greater adoption of digital solutions across the entire supply chain, from booking and tracking to warehouse management and customs clearance. Fintech is another area where we see digitisation benefiting the cargo industry, reducing a lot of manual work and increasing speed of operations.

"There is still a lot of underutilised data in this industry, and with growing emphasis on valuable and actionable data, artificial intelligence, blockchain, and Internet of Things (IoT) will play increasingly prominent roles in optimising operations, enhancing visibility, and improving decision-making."

Over the next few years, digitalisation in the air cargo industry is expected to advance further, driven by the increasing demand for faster, more efficient and transparent logistics solutions, according to Kaiser of Lufthansa Cargo. "Therefore, we are constantly striving to refine and enhance our digital solutions to meet the needs of our customers and internal employees more accurately and effectively.

"We also expect the integration of more collaborative platforms that enable seamless communication and data sharing among all stakeholders in the supply chain. The development of trustworthy AI and automation solutions, both within the company and in collaboration with stakeholders in the industry, is one of our top priorities. It will be crucial to develop and pursue an AI and automation roadmap to secure our position in the global competition.

"At Lufthansa Cargo, we are also committed to developing and introducing new digital solutions that align with our sustainability goals and measures. We leverage digital technologies that reduce CO2 emissions for e.g., paper or fuel consumption. Sustainability, digitalisation, and AI acceleration are and will continue to be the key topics in the near future."

We are working hard to expand our community, currently in 116 countries, to include many more within all continents. We expect to see further acceleration in digital adoption with forwarders in regions such as Asia Pacific.

Veit Dinges, cargo.one

cargo.one was the first to advocate for digital sales and encourage airlines and forwarders to embrace it – we will always be somewhat of a visionary, and never be satisfied with the status quo, adds Dinges. "We are working hard to expand our community, currently in 116 countries, to include many more within all continents. We expect to see further acceleration in digital adoption with forwarders in regions such as Asia Pacific.

"Our mission as a platform is to have every carrier available, and the depth and diversity of our supply continues to be a huge asset to forwarders. While we have most of the world’s largest airlines already onboard, carrier additions are still accelerating per month.

"We apply our wealth of market knowledge to help both airlines and freight forwarders operate at their best. We always have a laser-focus on enhancing forwarders’ daily performance and experiences in a meaningful way. We are not just tinkering at the edges nor will we ever sacrifice our data accuracy. By showing forwarders the power of digital air freight procurement for their needs, we will further enlarge our community globally."