Spot rates rise further as peak season builds: WorldACD

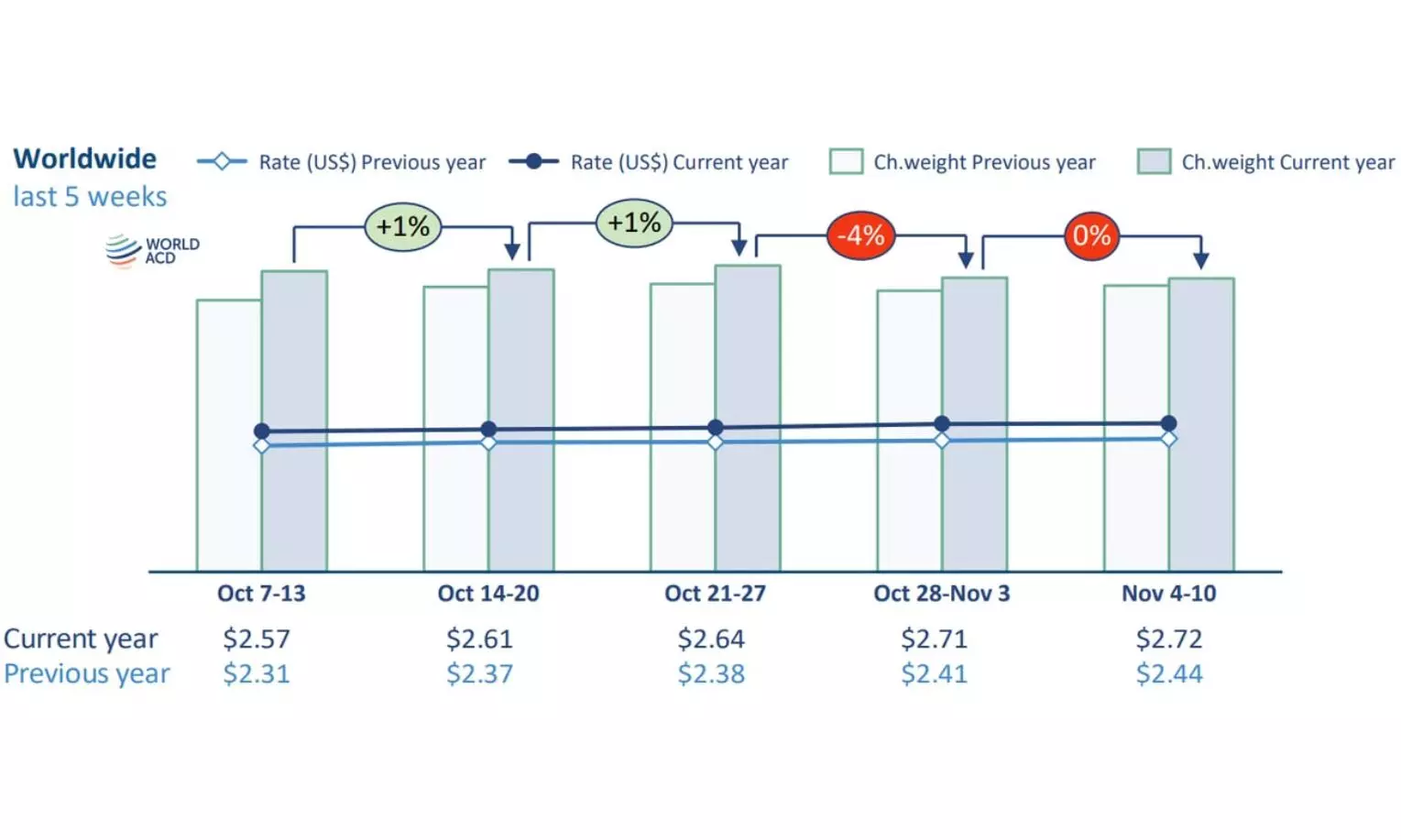

Average global spot rates recorded a further +5% WoW rise in week 45 (4 to 10 November), taking them +24% above their equivalent levels this time last year.

Worldwide air cargo average spot rates have continued to rise in the first full week of November, driven by significant week-on-week (WoW) increases from Asia-Pacific and other origin regions, in an ongoing peak-season strengthening of the market.

According to the latest weekly figures and analysis from WorldACD Market Data, average global spot rates recorded a further +5% WoW rise in week 45 (4 to 10 November), taking them +24% above their equivalent levels this time last year. Spot prices from the biggest worldwide origin region, Asia-Pacific, rose by a further +6%, WoW, to US$4.43 per kilo, with the second-largest origin region, Europe, showing also a +6% WoW increase, to $2.49 per kilo, based on the more than 450,000 weekly transactions covered by WorldACD’s data. Rates from Central & South America (CSA) rose even more steeply, by +10%, to $2.04 per kilo, with prices from North America recording a +5% increase, to $1.83 per kilo. There were WoW falls in spot rates from Africa (-4%) and Middle East & South Asia (MESA, -2%).

Compared with the equivalent week last year, when various markets were already experiencing the effects of strong peak-season demand, spot prices this year remain significantly elevated, year on year (YoY), notably from Asia Pacific (+25%), MESA (+70%), Europe (+14%), and CSA (+14%), with Africa also +10% higher and North America recording a +5% increase, YoY.

On the demand side, worldwide chargeable weight flown in week 45 was stable, WoW, with small increases from Europe, Africa and CSA origins wiped out by decreases from North America and MESA (both -4%, WoW). Compared with last year, worldwide tonnages were up, YoY, by just +2% in week 45. That’s a significantly smaller YoY growth figure compared with most weeks in the last six or seven months, although the comparison period this time last year was a tough one, as volumes were in the midst of a strong fourth-quarter peak season.

Comparing weeks 44 and 45 this year with the previous two weeks (a 2Wo2W comparison) reveals a +3% full-market increase in rates, 2Wo2W, driven by a +5% increase from Europe origins and a +4% increase from Asia-Pacific, taking average worldwide prices +12% higher, YoY. One market experiencing a particularly strong rise in rates is Europe to North America, where rates rose +16%, on a 2Wo2W basis, despite a -9% drop in tonnages flown on that lane. That reflects a fall in passenger belly capacity on the transatlantic following the start of the airline sector’s (northern) winter 2024-25 timetable from 27 October, combined with relatively high load factors on the westbound transatlantic market.

Meanwhile, worldwide flown chargeable weight in weeks 44 and 45 was down -4%, compared with the preceding two weeks, including declines of -8% from MESA origins and -5% from Europe and Africa origins. Compared with last year, worldwide flown tonnages were up +4% in weeks 44 and 45 this year, with YoY growth from all the main origin regions except MESA, which recorded a -3% YoY decrease, most likely reflecting the impact of the increased military and geopolitical tensions in the region, and Africa (-1%, YoY).

Global air cargo capacity in weeks 44 and 45 fell by -3%, on a 2Wo2W basis – partly reflecting the start of the winter timetable, although it was also down -2% compared with last year, chiefly due to -4% YoY drops from Europe and North America origins.

Analysis of the capacity situation in week 45 reveals a WoW drop in passenger capacity of slightly over -1%, despite some recovery from European airports. However, there was also a WoW increase in freighter capacity of around +3%, resulting in overall WoW cargo capacity growth of almost +1%, WoW. Some of that reflects a recovery of capacity following typhoon Kong-rey, which particularly impacted Taiwan but also parts of mainland China. But there were new routes and capacity being added to India, particularly to Delhi. And last week also saw a significant increase in capacity from the big global integrators, reflecting an ongoing rise in peak-season express traffic, including from the e-commerce sector.