Rates hold firm while tonnages weaken slightly at start of August

Average global spot rates rose by a further +3% in the first full week of August compared with the start of July, to US$2.71 a kilo, which is up +22% year on year (YoY)

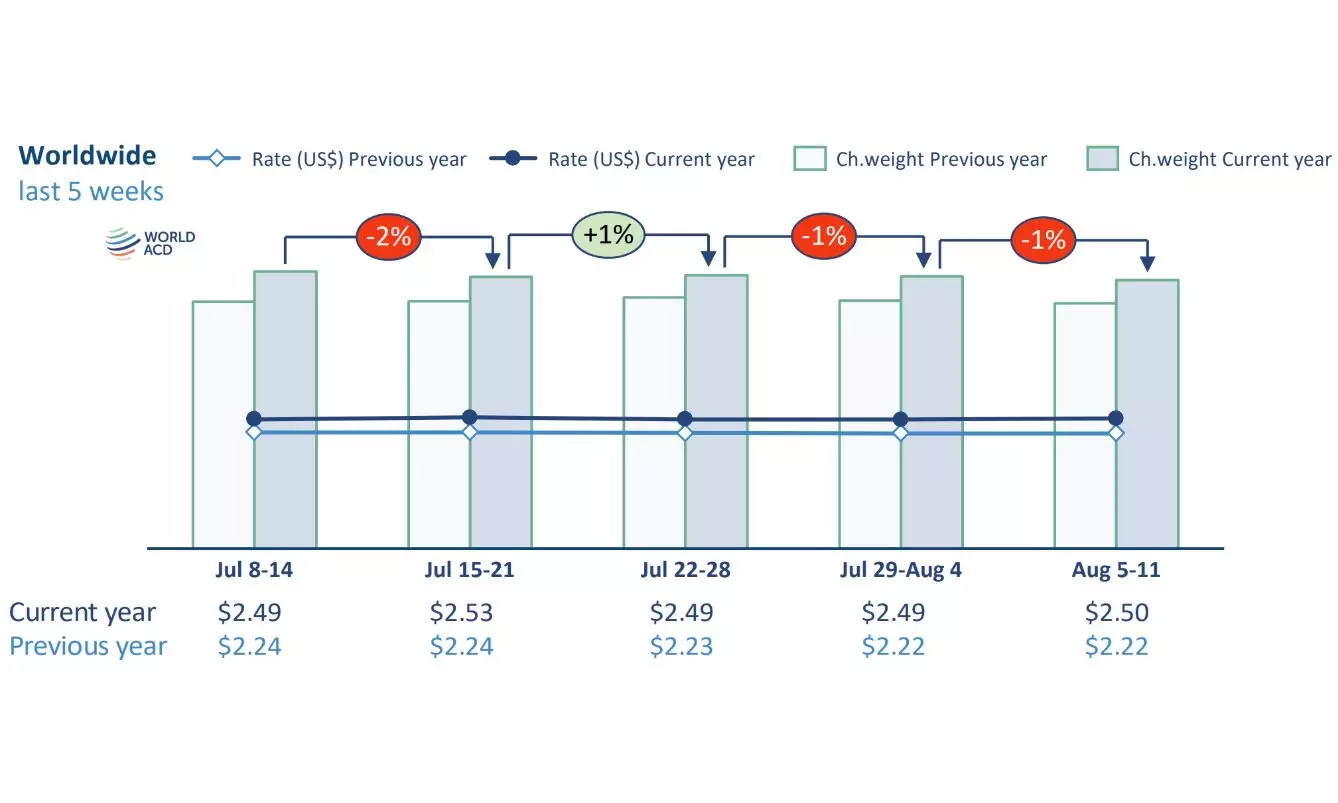

Average worldwide air cargo volume slipped -1% in the first full week of August, compared with the previous week, while rates continued to hold steady. With the latest decline, global tonnages have dropped since the start of July by -3%, while the average overall rate remained stable at US$2.50.

According to the latest figures from WorldACD Market Data, average global spot rates rose by a further +3% in the first full week of August compared with the start of July, to US$2.71 a kilo, which is up +22% year on year (YoY), while contract rates in the same period remained flat at US$2.40. The full-market average of spot rates and contract rates of US$2.50 is up +46% compared with the last pre-Covid equivalent period, August 2019.

Based on the more than 450,000 weekly transactions covered by WorldACD’s data, average worldwide pricing went up slightly (+1%) in week 32 (5 to 11 August) compared with the previous week, with rates from Africa origins down by -2%, but rates from the other main global origin regions holding firm or increasing slightly. Compared with last year, rates of $2.50 per kilo in week 32 were up by +13%, thanks largely to YoY increases of +55% from Middle East and South Asia (MESA) origins and +23% from Asia Pacific origins, while rates from Europe were down -11%.

Combining the figures for weeks 31 and 32, both tonnages and rates are down slightly (-1%) compared with the previous two weeks (2Wo2W), similar to last week's report. Tonnages and rates are still largely up compared with last year though, by +9% and +12%, respectively, mainly driven by Asia Pacific and MESA origin traffic, while worldwide capacity has increased by +5%, YoY.

When looking at specific developments by region or country, it is notable that tonnages out of China to the US decreased further with a week-on-week (WoW) drop of -7% in week 32, the fourth decline in five weeks, bringing the overall contraction on this country pair to -12% when comparing with the start of July. Tonnages out of Vietnam to Europe sank by -6% from week 31 to week 32, making it a third consecutive weekly decline, while spot rates are stable, at almost threefold last year's levels (+176% YoY to US$4.76).

As already mentioned in last week's report, outbound tonnages from Bangladesh were recovering from the unrest in July. The upward trend became much less pronounced though (+4% WoW in week 32, compared with +39% WoW in week 31), while spot rates continued to rise strongly (+151% in week 32, compared with +169% in week 31).

Asia Pacific to the USA has remained a key sector in driving up overall average prices since the end of June, with spot rates averaging slightly above $5.80 a kilo in the last three weeks. Compared with week 32 last year, spot rates from Asia Pacific to the USA were up by +64%. Tonnages from China to Los Angeles slid further with a -5% drop WoW drop in week 32, leading to the strongest year-on-year decline (-21%) since volumes started sinking six weeks ago, while spot rates stabilized around +30% YoY.