Middle East & South Asia air cargo tonnages drop sharply: WorldACD

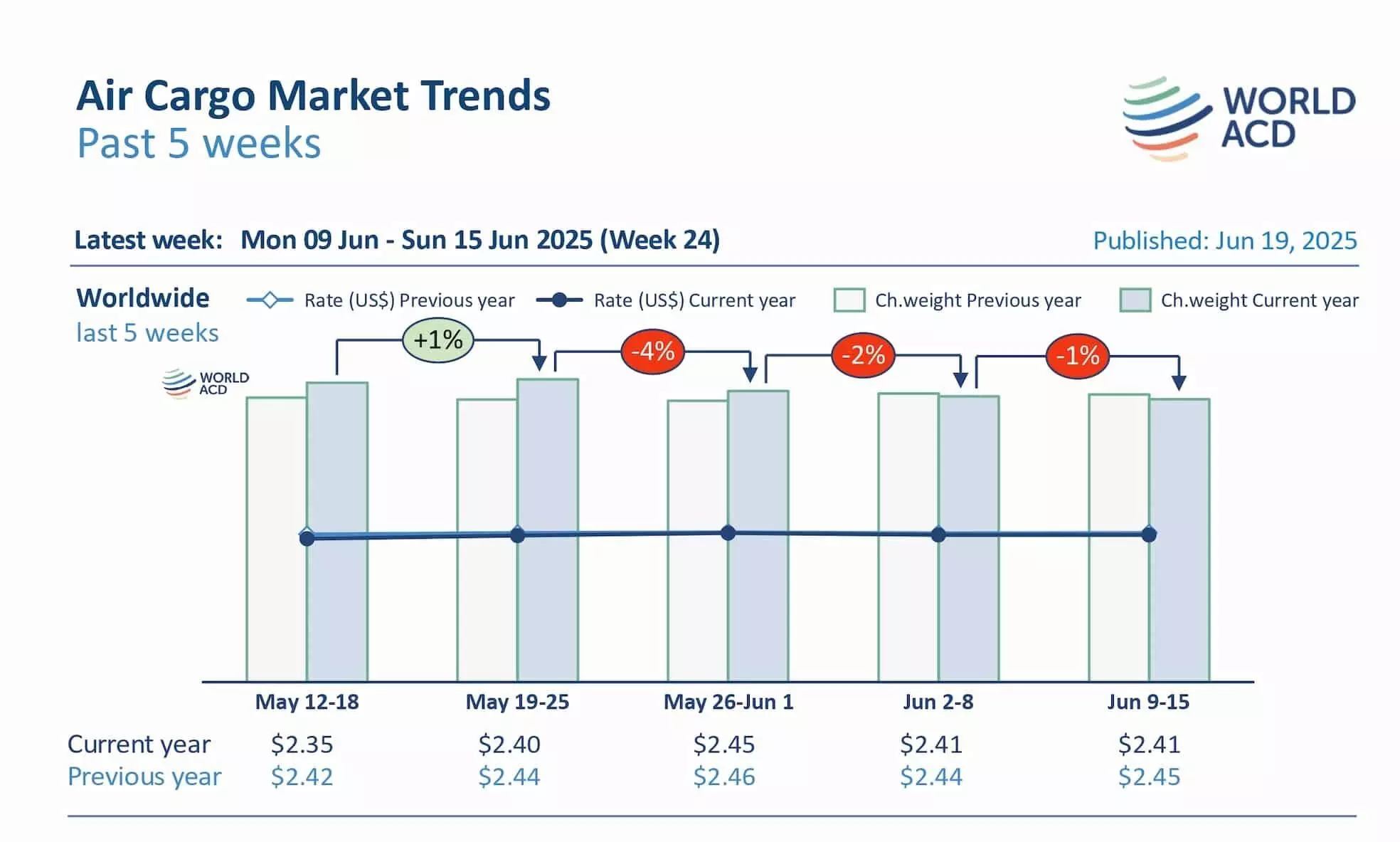

Global rates were broadly stable in week 24 at $2.41 per kilo, based on a full-market mix of spot and contract rates.

Air cargo traffic to and from the Middle East & South Asia (MESA) has fallen sharply in the last two weeks due to the effects of Eid Al-Adha holidays and the escalating conflict between Israel and Iran, which has slowed some of the post-Eid recovery of volumes.

"Tonnages flown from MESA origins declined by a further nine percent week on week (WoW) in week 24 (June 9-15) after already falling by around eight percent the previous week in response to Eid (June 6-9), especially intra-MESA traffic (-26 percent) and MESA to Africa flows (-17 percent)," according to the latest weekly figures and analysis from WorldACD Market Data.

Flown tonnages from Levant countries were down by -21 percent WoW in week 24 as a result of widespread flight cancelations in the area since Israel began directly attacking targets in Iran from June 13, the update added.

UAE cargo rebounds

Tonnages from most Gulf countries were also negatively impacted in week 24, although traffic from the UAE more than compensated for the drop in volumes from other Gulf countries with a +15 percent WoW increase, bringing total Gulf tonnages into overall growth (+eight percent) WoW. "Traffic increases from the UAE were mainly to destinations in Africa (+36 percent WoW) and other parts of the MESA region (+31 percent WoW) with especially big increases to West Africa (+76 percent) – notably to Nigeria, Chad and Senegal – and to East Africa (+25 percent), especially to Kenya (+83 percent). Within MESA, traffic from the UAE rebounded especially strongly in week 24 on intra-Gulf routes (+51 percent), particularly to Saudi Arabia (+107 percent), after falling the previous week due to Eid."

Asia Pacific tonnage rises

Air cargo tonnages from Asia Pacific origins rose by two percent WoW – the only global origin region to record a WoW increase in week 24 although the combined volumes ex-Asia Pacific for weeks 23 and 24 were negative (four percent) compared with the previous two weeks, the update added.

Much of the increase in tonnages from Asia Pacific origins in week 24 was to the U.S. – especially from China origins, which recorded a six percent WoW increase in week 24 after falling -10 percent the previous week. That market has remained highly volatile as cargo owners and air cargo stakeholders continue to adjust to the fast-changing U.S. tariff and trade policy landscape. Combined Asia Pacific tonnages to the U.S. rose by four percent WoW in week 24 after falling -10 percent the previous week.

Pricing relatively stable

Average global rates were broadly stable in week 24 at $2.41 per kilo, based on a full-market mix of spot and contract rates, the update added.

"The biggest change was from MESA origins (-four percent WoW). Globally, average rates are slightly (-one percent) below their level in week 24 last year. Spot price trends are similar, stable at an average of $2.59 per kilo globally, and down two percent YoY with the biggest drop coming from MESA (-22 percent) and Asia Pacific (-five percent)."