Global air freight rates ease as key Asia lanes stay firm

TAC Index reports a small weekly dip in average rates while Asia-US and Asia-Europe demand keeps major lanes tight.

Global air-freight rates dipped slightly last week, though capacity constraints and strong demand continue to support high rates on many key trade lanes, according to the weekly update by TAC Index.

The agency’s main benchmark, the Baltic Air Freight Index (BAI00), fell 1.5% in the week to 24 November. Despite the drop, the index remained marginally above its level a year ago, up roughly 0.3% year on year.

Even though the overall index eased, air-freight rates stayed high on many of the busiest routes from Asia. Forward-looking spot rates from Hong Kong, under the new “BAI Spot” indices rose again through the week. Meanwhile, the broader index for Hong Kong-origin routes (BAI30) slipped 1.4% week on week, leaving it slightly lower than at the same time last year.

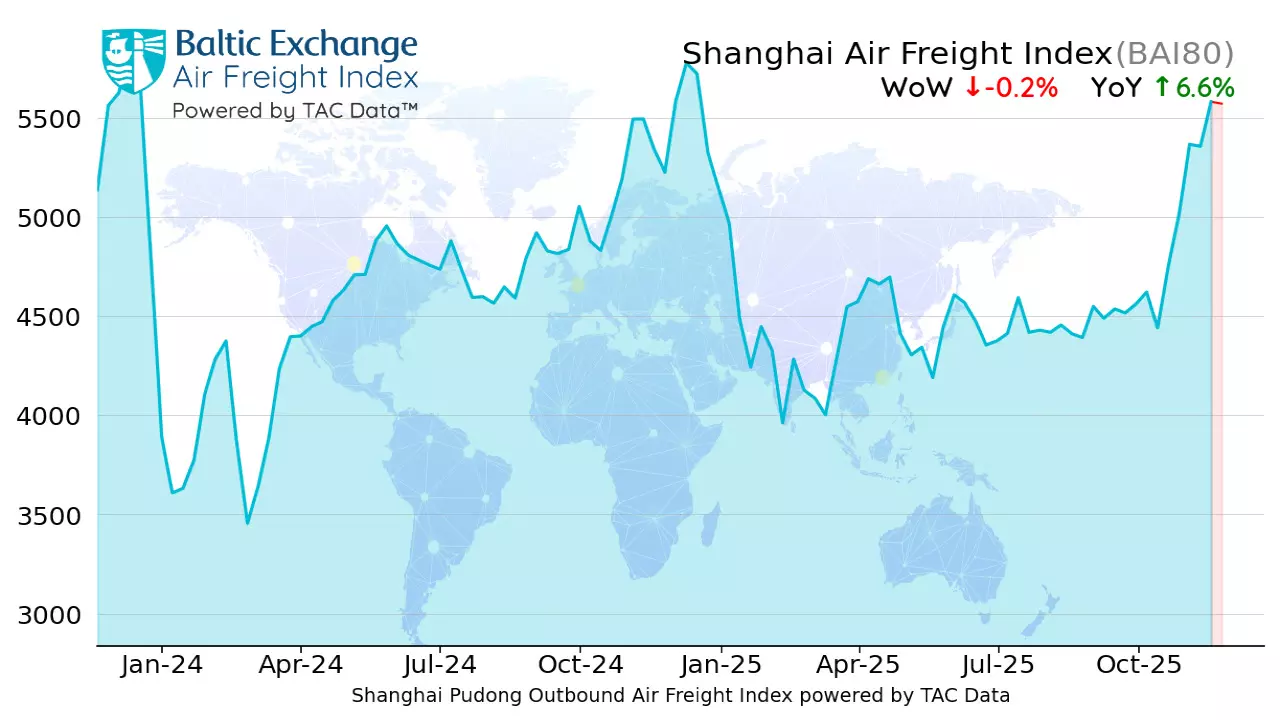

Routes out of Shanghai (BAI80) saw only a slight weekly drop of 0.2% but remained comfortably ahead year on year by 6.6%. Rates from other Asian hubs including Taiwan, Seoul, Bangkok and India moved up, especially on lanes to the United States and Europe, indicating persistent demand.

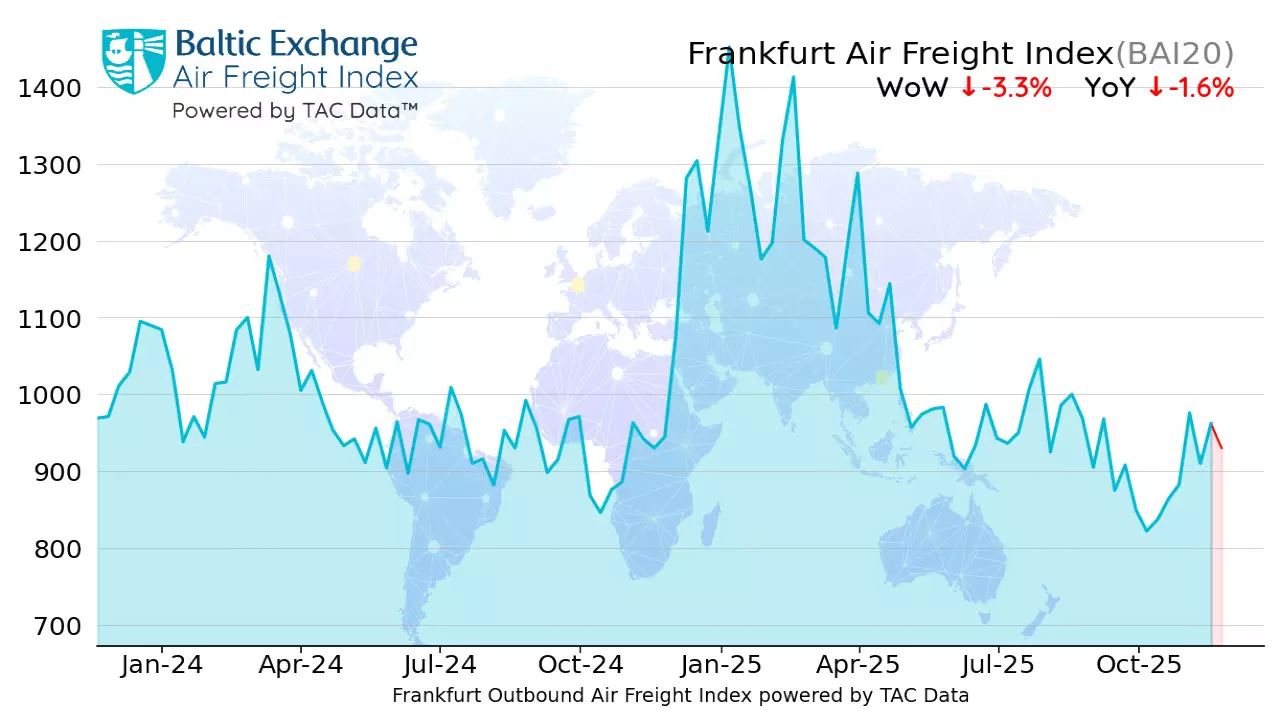

On the European side, some outbound lanes posted gains. The index from Frankfurt (BAI20) dipped by 3.3% for the week but was only slightly down compared with a year earlier. Output from London Heathrow (BAI40) fell modestly by 1.3% week on week, though it remains 7.9% ahead year on year.

By contrast, outbound rates from the US showed a mixed pattern. The index from Chicago (BAI50) dropped 6.1% week on week and stayed 13.8% below its level a year ago. Some lanes, for instance those from Mexico to Europe saw gains and remain significantly higher year on year.