Global air cargo rates rally in March to Q42023 levels: WorldACD

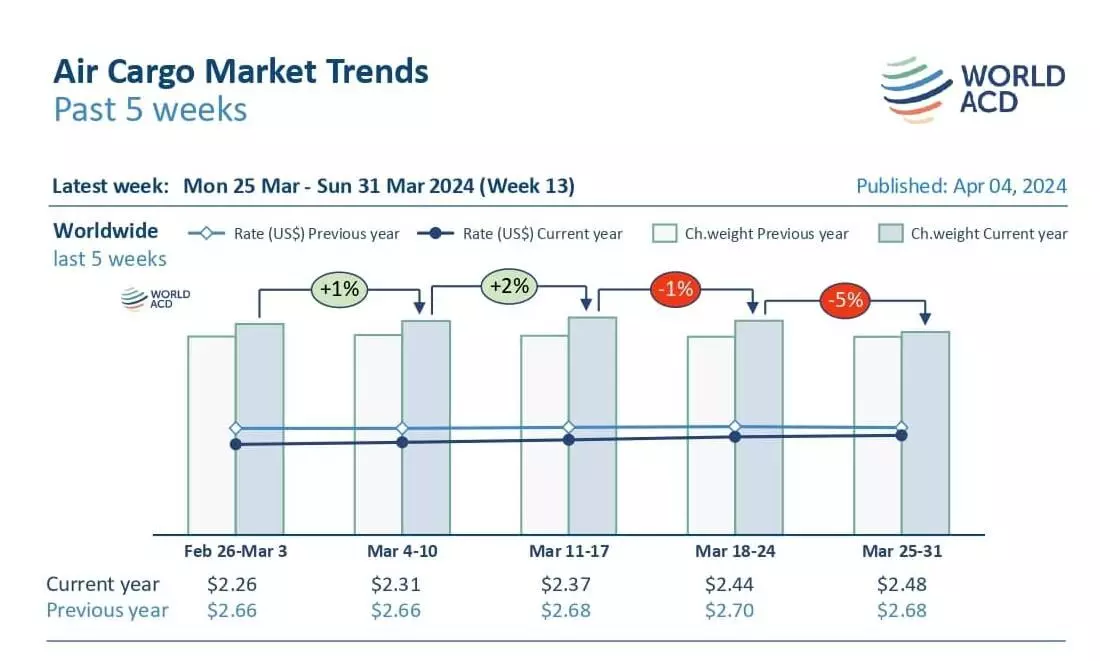

Average rates rose, week on week, by around 2% in week 13 (March 25-31) to $2.48 per kilo

Global air cargo rates continued to rise throughout March, thanks to strong demand and rising rates from Asia and Middle East origins, taking average prices to within (-) seven percent of their elevated levels this time last year and recovering to their levels during last year’s winter peak season, according to the latest weekly figures and analysis from WorldACD Market Data.

Average rates rose, week on week (WoW), by around two percent in week 13 (March 25-31) to $2.48 per kilo, following consecutive weekly WoW rises of between two percent and three percent last month, on a globalised basis, narrowing the gap between rates this year and the equivalent periods last year. "Average rates in January and February were 19 percent below their equivalent levels in 2023 but the gap narrowed throughout March from -15 percent in week nine to just -seven percent in week 13 based on the more than 450,000 weekly transactions covered by WorldACD’s data."

Rates recover to Q4 peak levels

The narrowing of the rates gap compared with last year partly reflects high comparison rates in January 2023 of $2.92 per kilo, which dropped to $2.70 in February and $2.68 in March 2023 as rates continued to gradually slide from the extreme highs of early 2022, the update added. "It also reflects a recovery in average rates since the start of the fourth quarter (Q4) of 2023. Despite the usual seasonal drop at the start of this year, and after Lunar New Year, average rates have recovered to close to their peak levels in Q4 last year."

The current average worldwide rates of $2.48 per kilo are almost exactly equivalent to their average level in Q4 – $2.47 per kilo – which, coincidentally, was also their average level for the whole of 2023. It is also significantly above pre-Covid levels (+38 percent compared to March 2019).

The consistent recovery in prices in March is chiefly driven by increases in rates for air cargo from Asia Pacific and Middle East & South Asia (MESA) origin points, boosted by strong demand from cross-border e-commerce and the on-going disruptions to container shipping in the Red Sea. "Rates from Asia Pacific went up significantly to all regions in March with average Asia Pacific-Europe rates ($3.78, flat YoY) and Asia Pacific-North America rates ($4.69, +three percent YoY) by week 13 reaching or exceeding their levels this time last year. For MESA, the main driver was MESA to Europe destinations. MESA to Europe rates averaged around $2.40 in week nine, already up 28 percent compared with the same week last year. By week 13, they had risen to $3 per kilo, up 62 percent YoY."

Average worldwide rates in weeks 12 and 13, combined, rose by five percent compared with the previous two weeks, boosted by a 11 percent 2Wo2W increase from MESA origin points and seven percent rise from Asia Pacific, the update added.

Tonnage comparisons

Global air cargo tonnages in March were up, year on year, by around six percent although the figures for the final few days of March are impacted by the Easter holiday in parts of the world. The year-on-year growth for the first three full weeks combined in March was eight percent – still a strong performance although growth has slowed compared to 13 percent, YoY, reported for the January-February 2024 period.

Tonnages for weeks 12 and 13, combined, were down three percent compared with the previous two weeks, led by declines from MESA (seven percent), North America (six percent) and Africa (five percent).

Tonnages from most of those origin regions were still up significantly compared with the equivalent two weeks last year with Africa up 15 percent, Asia Pacific up 10 percent and MESA up seven percent, the update added.