General air cargo outpacing special cargo growth in 2024

Hong Kong tops May rankings in terms of outbound increases in traffic with an increase of over 30,000 tonnes

The growth of general cargo air freight tonnages is outpacing that of special cargo products so far in 2024, reversing a trend in recent years in which demand from air cargo shipments requiring special handling and shipping has broadly outperformed general cargo, according to an analysis by WorldACD Market Data.

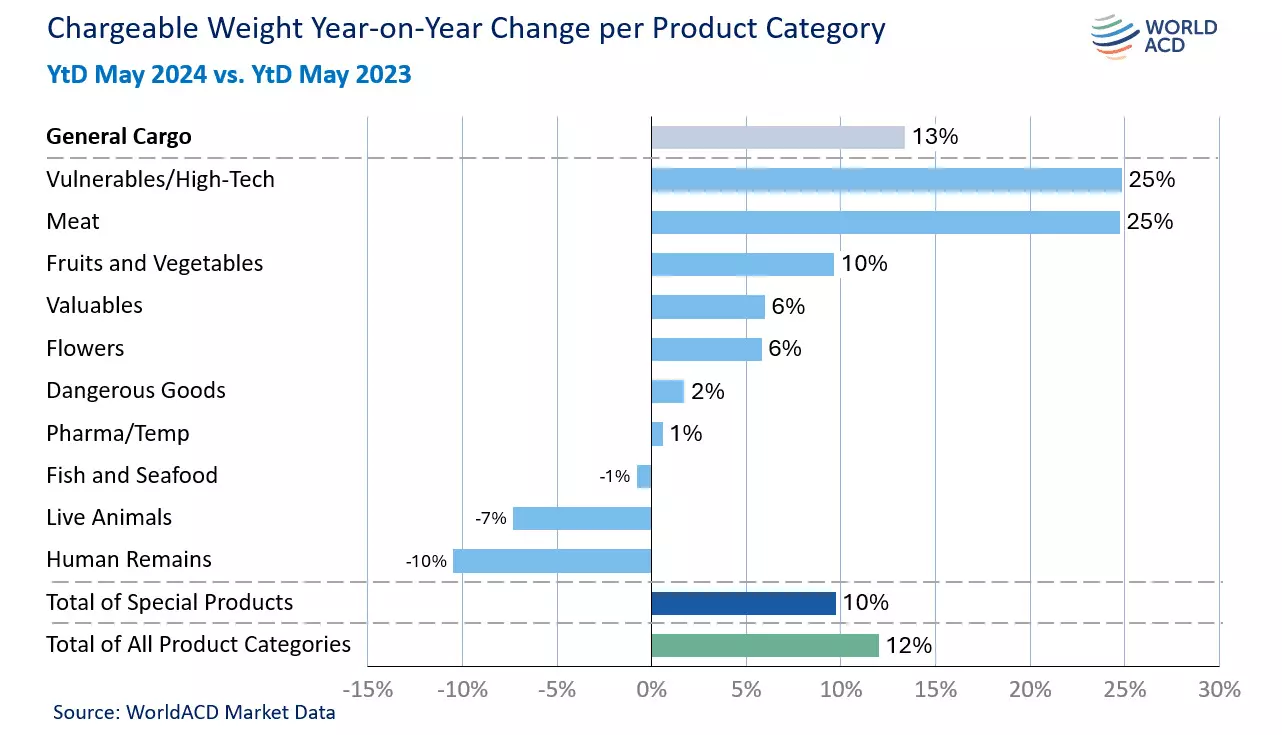

"Analysis of the first five months of 2024 by WorldACD, based on the more than two million monthly transactions recorded via its database, indicates that total worldwide chargeable weight from January to May was up 12 percent compared with the equivalent period last year with general cargo demand up by 13 percent and special cargo growth at 10 percent. This contrasts with findings late last year by WorldACD that in the first eight months of 2023, general cargo tonnages fell by 12 percent YoY whereas tonnages of special cargo products as a whole increased three percent at a time when the market as a whole was down by seven percent."

Vulnerables/hi-tech and meat logged the highest gains (+25 percent) while live animals (down seven percent) and human remains (-10 percent) reported negative growth.

General cargo makes up around 70 percent of the key Asia Pacific origin market although the growth of special cargo from Asia Pacific (+24 percent) is higher this year than for general cargo (+18 percent), the update added. "The +24 percent is the result of strong growth for all Asia Pacific origin special product categories except for pharma/temp, which fell four percent YoY. Other notable growth areas included +30 percent in vulnerables/high-tech (the #1 category in terms of special cargo business/kgs from Asia Pacific) and a 67 percent increase in meat shipments (the region’s fifth-largest special cargo category)."

One factor for the strong growth in general cargo since the start of last autumn is cross-border e-commerce traffic, the update added. E-commerce cargo often flies in bulk as general cargo rather than within a special product category as well as conversion of sea freight to air cargo has yielded the double digit growth. "These two factors have contributed to significant YoY rises in chargeable weight in the five months to May 2024 from Asia Pacific (+20 percent) and Middle East & South Asia +22 percent)."

Hong Kong leads May growth rankings

Examining specific country or sub-regional markets showing the largest increases and decreases worldwide also highlights some interesting developments. Ranked according to the markets’ absolute changes in weight, Hong Kong tops the May rankings in terms of outbound increases in traffic with an increase of over 30 million kgs (30,000 tonnes) followed by China South East, China East, India, and United Arab Emirates – meaning four out of the top five outbound YoY growth markets in May were in Asia, the update added.