Flying wafers: The intricacies of air cargo in semiconductor logistics

With today's chips packing more power into smaller footprints, getting them from fab to factory now demands a new level of logistical precision.

Semiconductors are among the most sensitive and high-value commodities in global trade, requiring speed, precision, and compliance.To meet these demands, air cargo has emerged as the preferred mode of transport, supported by highly specialised handling and advanced packaging solutions.

Tailored handling from fab to finish

Not all semiconductor shipments are alike. Their handling needs vary based on the stage of production and the specific type of cargo involved. Lufthansa Cargo’s Brinthavani Ehanantharajah-Przybilla, Senior Manager Industry Development – Semiconductors, said the company customises packaging protocols to suit these differences.

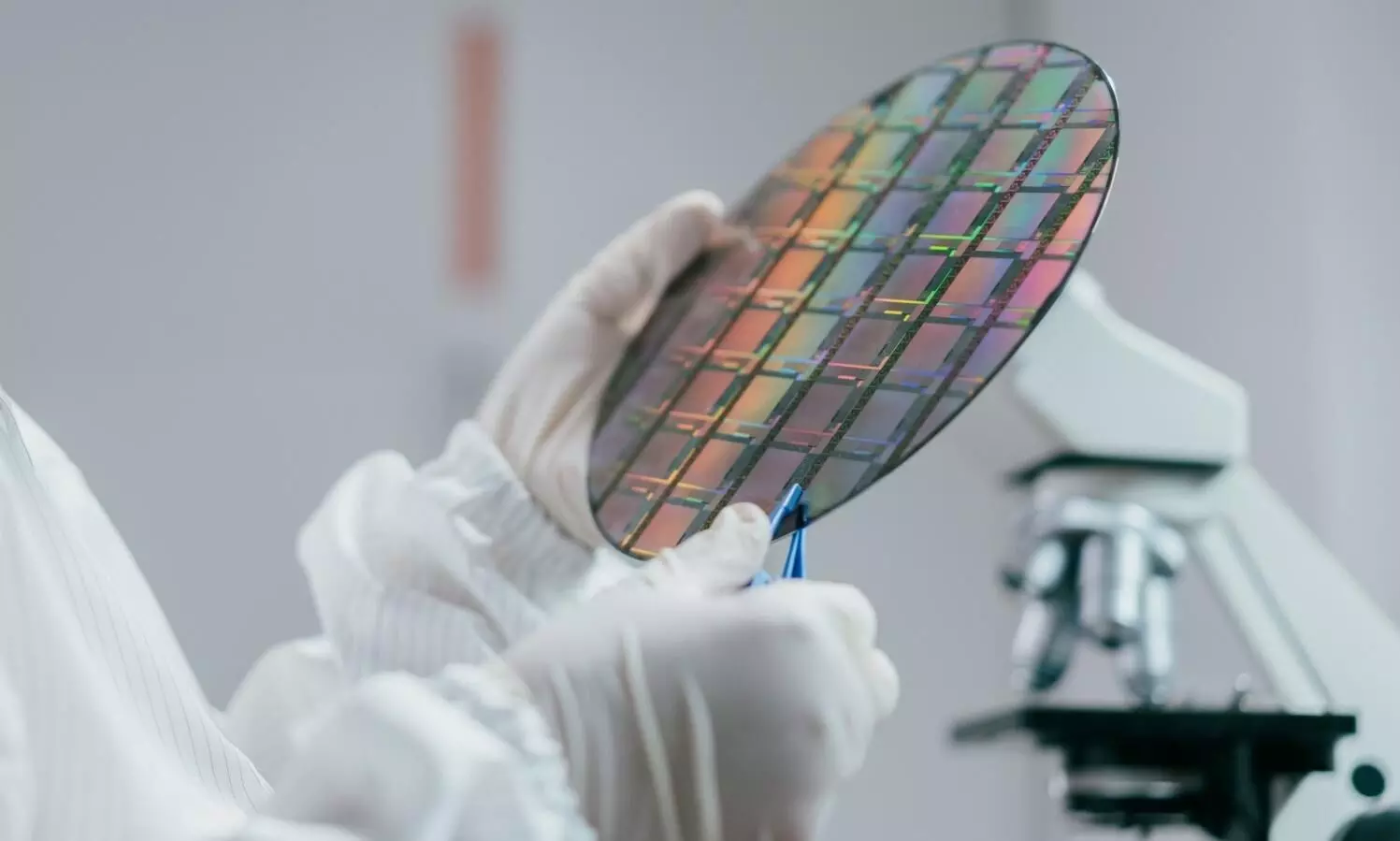

“For front-end fab products, we comply with customers’ standard operating procedures for sensitive handling to avoid damage of cleanroom-compliant packaging,” she explained. Items such as wafers and photomasks demand protection against vibration, humidity, and shock. On the other hand, back-end products like packaged ICs are generally more robust but still require regulated handling.

Capital equipment introduces a different challenge altogether. Large and sensitive machines such as photolithography tools are moved in custom crates with pneumatic or foam interiors, with shock and tilt indicators tracking any deviations in condition throughout the journey. Jono Liu, VP of Air Freight at Dimerco, noted, “Our teams use ShockWatch and Tip-and-Tell devices, ensuring full visual verification at multiple checkpoints: at pickup, prior to departure, and upon release from destination terminals.” He added that air-cushioned trucks and strict handling standards help prevent damage.

Precision temperatures in transit

Thermal control is equally critical. Many semiconductor materials and tools are highly temperature-sensitive, even over short distances. Lufthansa Cargo integrates both active and passive thermal control systems into its operations, particularly on its B777 freighter fleet.

“Active Temp Control provides seamless temperature control through state-of-the-art container technology,” said Ehanantharajah-Przybilla. Passive temperature support combines controlled storage with thermal covers and insulation materials. These systems can maintain ambient ranges between -20°C and +25°C, which are essential for different semiconductor materials.

Air freight transportation of semiconductors has seen increased scrutiny and regulatory changes, particularly regarding security and compliance with dangerous goods regulations.

Brinthavani Ehanantharajah-Przybilla, Lufthansa

Due to the special handling needs that semicon shipments require, Kuehne+Nagel launched its Semicon Chain – a quality label based on internationally recognized standards (ISO 9001:2015 and IATF 16949 Certification). “This is especially important for handling capital equipment, chips, wafers, and oversized shipments, each of which has their own specific handling requirements documented and deployed,” noted Abplanalp.

As global supply chains grow more complex, the need for high-yield, precision logistics has risen, especially in sectors like semiconductors where delays can halt production. In response, Qatar Airways Cargo launched TechLift, a specialised air freight solution covering a wide range of cargo, including microchips, wafers, test equipment, and doped chemicals, all under strict handling and temperature controls.

Logistics beyond air: Full supply chain support

While air freight is central to the movement of semiconductors, the ecosystem that supports it has expanded to include a range of services that enhance speed, safety, and reliability.

One critical area is the transport of capital equipment for semiconductor fabrication plants, including EUV lithography machines used to manufacture advanced nanochips for AI applications. ASML’s High NA and upcoming Hyper NA EUV systems are among the most complex. These machines are shipped in parts, requiring multiple cargo flights due to their size and sensitivity.

Air carriers coordinate closely with packaging engineers, loadmasters, and ground handlers to manage customised crates, temperature controls, and vibration-proof interiors. Monitoring tools such as shock and tilt indicators provide real-time data to safeguard the equipment throughout the journey.

Air cargo also plays a key role in the assembly and testing stages of production. Many chipmakers rely on offshore testing facilities, and air freight is often the fastest and most secure way to move components in and out of these locations. For time-critical prototypes and evaluation units, carriers offer express services with flexible routing options and precise handling protocols.

Finished semiconductor products are frequently moved by air to reduce lead times and maintain supply continuity. These goods are typically high in value and light in weight, making air transport a cost-effective and secure option. Many carriers offer value-added services such as real-time tracking, dedicated handling zones, and direct loading to reduce touchpoints and exposure to risk.

Security, compliance, and risk management

Given the high value and dual-use nature of many semiconductor components, compliance and security are fundamental. Lufthansa Cargo screens airway bill data against global export control lists such as the EU Dual Use and US Munitions List. “Our compliance experts work closely with customers to pre-identify export-control-relevant cargo,” said Ehanantharajah-Przybilla.

When conditions exceed safe ranges, our system triggers immediate alerts detailing the GPS location, time of the incident, and the carrier in custody.

Jono Liu, Dimerco

When delays occur, rapid response becomes critical. Lufthansa Cargo has developed a semiconductor vertical that brings together 24/7 monitoring, escalation protocols, and close coordination with airline operations teams. “We bring together sector-specific knowledge, real-time shipment monitoring, and rapid-response capabilities,” Ehanantharajah-Przybilla said.

Dimerco offers a similar level of coordination. From tracking alerts to planeside truck access, the focus is on reducing ground time and keeping shipments moving. “In transcontinental semiconductor shipments, where every minute counts, timing is critical,” Liu explained.

In late 2024, a semiconductor exposure machine described by Nikon as “historically the most precise machine” was flown by charter to eastern Malaysia. It measured 3 metres in length and weighed over 30 tonnes. Even slight shocks or temperature changes could cause damage to its internal parts or affect lens performance, risking serious impact on accuracy. ANA Cargo coordinated the delivery along with Nikon and K Line Logistics, using detailed load planning, controlled temperatures, and shock monitoring to complete the operation within a tight schedule.

Evolving alongside the chip industry

The semiconductor industry has transformed dramatically in recent years. Shifts in production, rising compliance requirements, and new sustainability demands have prompted logistics providers to rethink their strategies.

On-site monitoring ensures our customers’ cargo remains stable and secure whether it be temperature-controlled, high-value or time-critical.

Valentina Abplanalp, Kuehne+Nagel

Air cargo today plays a far more strategic role than simply transporting boxes. For the semiconductor industry, it enables just-in-time delivery across continents, supports cleanroom-grade movement, and provides visibility and control from start to finish.