Ex-China air cargo rates surge ahead of Lunar New Year

Rates for air cargo shipments from China to North America rose by 14% WoW in week 5 (Jan 29-Feb 4): WorldACD Market Data

Air cargo rates from China have surged in the final full week ahead of Lunar New Year (LNY) on February 10 as shippers rush to get goods shipped before the LNY holiday period, according to the latest figures from WorldACD Market Data.

Rates for air cargo shipments from China to North America rose by 14 percent week on week (WoW) in week 5 (January 29 to February 4) although rates are still well below their level in early December, the update added. "Similarly, China to Europe rates rose by eight percent WoW although rates on this lane are also still well below their fourth-quarter peak levels in early December."

It is unclear to what extent this pre-LNY demand is being boosted by the disruptions and delays to container shipping in the Red Sea, which have also reportedly led to some conversion of China-Europe sea freight to sea-air shipments via the Gulf and to some extent via the U.S. west coast, the update added.

On the tonnage side, WorldACD data continue to indicate strong traffic demand levels from China to Europe as well as to North America and also ex-Gulf to Europe. "The magnitude of the Red Sea impact on air freight will probably only become clear well after LNY when it may be possible to identify whether we have structurally different flows, depending also on the development of that crisis and many other factors."

Weekly analysis

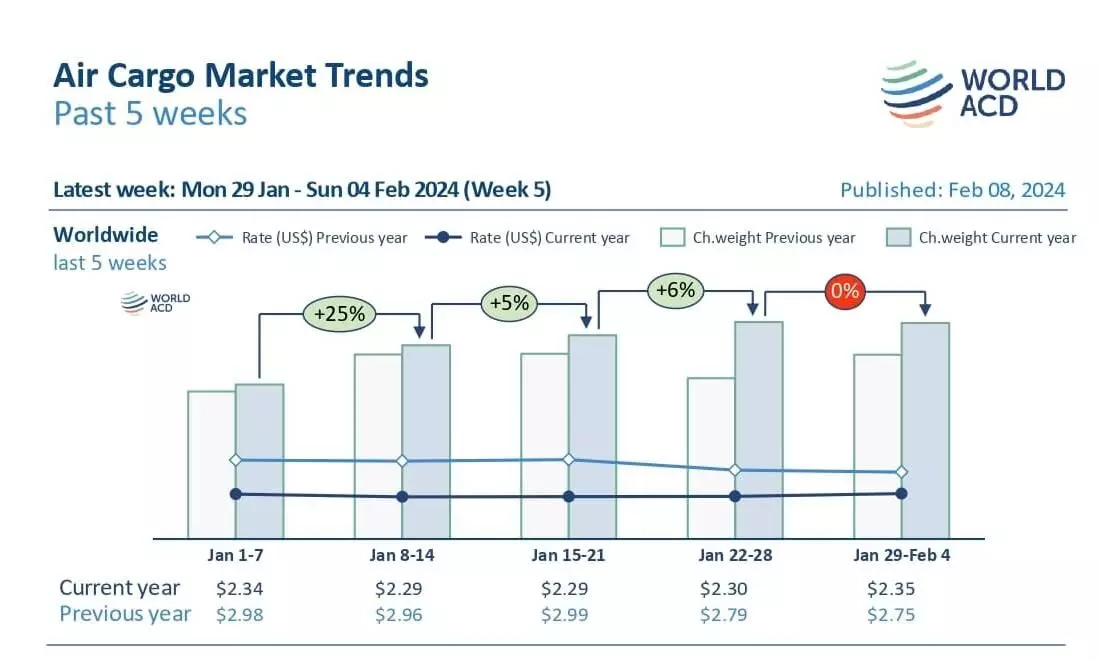

Revised figures for January show a 15 percent increase in tonnages compared with January 2023 based on more than 400,000 weekly transactions covered by WorldACD’s data, and there was a slight increase in tonnages in week 5 with average global rates up by around two percent compared with the previous week.

Expanding the comparison period to two weeks, total combined tonnages for weeks 4 and 5 this year were up by nine percent globally compared with the preceding two weeks (2Wo2W) with average rates up by one percent and capacity up two percent, respectively.

Outbound tonnages rose from all the main global air cargo origin regions, on a 2Wo2W basis, including double-digit percentage increases from Central & South America (33 percent) and North America (10 percent).

Most of the main intercontinental lanes recorded increases in tonnages, on a 2Wo2W basis, with demand from Central & South America to North America recording by far the biggest increase (44 percent). "As noted last week, this surge reflects a spike in demand for flowers in North America for Valentine’s Day on February 14. With flower shipments a relatively low-yield trade, average rates on that lane fell by 10 percent."

Year-on-year perspective

Year-on-year (YoY) comparisons reveal some big changes this year although these are largely explained by the difference in the timing of LNY, the update added. "Total worldwide tonnages for weeks 4 and 5 this year were up by 25 percent compared with last year although those figures are massively skewed by a 70 percent rise, ex-Asia Pacific. The other big YoY tonnage difference was a 20 percent rise, ex-Middle East & South Asia, most likely in part reflecting some conversion of Asia Pacific to Europe traffic to sea-air."

On the pricing side, average worldwide rates of $2.35 per kilo in week 5 are 16 percent below their elevated levels this time last year although they remain significantly above pre-Covid levels (+32 percent compared to February 2019).

Global air cargo capacity remains significantly up on last year’s levels (+15 percent), boosted by a 33 percent rise, ex-Asia Pacific and a 18 percent rise, ex-Central & South America.