China to US tonnages and rates weaken again: WorldACD

On a WoW comparison, one of the biggest shifts in pricing was a -12% fall in spot rates from Hong Kong to the U.S.

After rebounding in the latter part of May, air cargo tonnages from China and Hong Kong to the U.S. dropped back sharply in the first full week of June, according to the latest weekly figures and analysis from WorldACD market data.

Spot rates also declined significantly on that lane on a week-on-week (WoW) and year-on-year (YoY) basis, the update added.

"Flown chargeable weight from China and Hong Kong (CN/HK) to the U.S. dropped by -10 percent WoW in week 23 (June 2-8), taking tonnages on that lane -19 percent below their level in the equivalent week last year, with spot rates down by five percent WoW, and by -17 percent YoY. This significant decrease in both tonnages and rates ex-CN/HK to the U.S. followed a short recovery during the previous three weeks after the most-recent set of U.S. import tariffs on CN/HK-made goods was paused."

With that pause in tariffs remaining in place for now, the latest slump in the market in week 23 suggests that last month’s rebound was a temporary rather than structural recovery, linked to delayed volumes catching up following the suspension of the punishingly high tariffs that had been imposed in April, the update added.

The weakening of the China to U.S. market was also a significant factor in an overall three percent drop in worldwide air cargo tonnages in week 23. Along with the impact of various major holidays around the world, overall volumes were down two percent YoY, based on the more than 500,000 weekly transactions covered by WorldACD’s data.

Relatively stable pricing

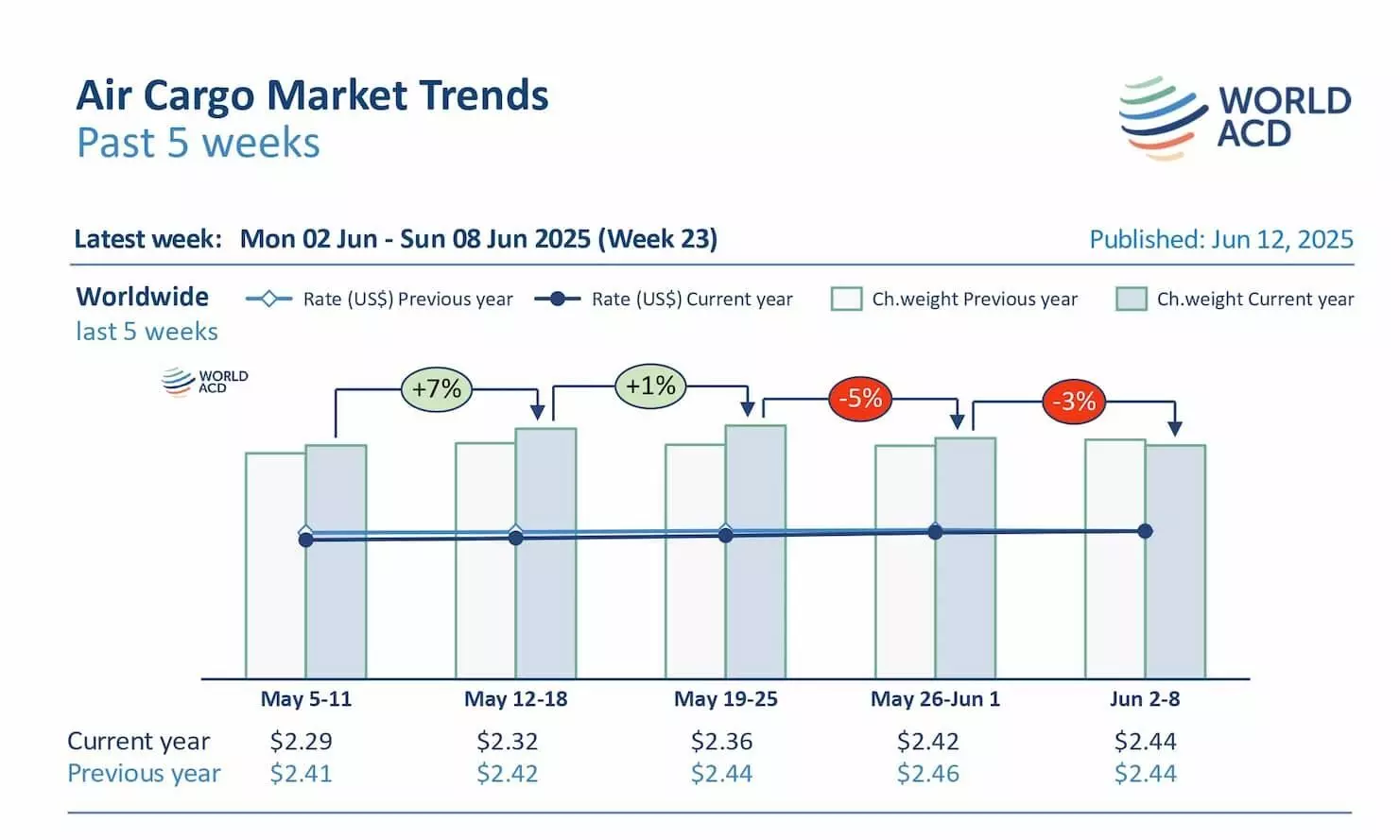

On the pricing side, worldwide rates – based on a full-market average of spot and contract rates – were relatively stable in week 23, rising just one percent to $2.44 a kilo, exactly their level this time last year with spot rates edging up two percent WoW to $2.63 per kilo.

On a WoW comparison, one of the biggest shifts in pricing was a -12 percent fall in spot rates from Hong Kong to the U.S. "That market, which has been heavily reliant on e-commerce traffic in recent years, has been particularly affected by the recent changes to US de minimis rules for low-value shipments from China and Hong Kong, which continue to face much higher import charges and processing costs since May 2."