China to U.S. market weakens in February

China and Hong Kong to U.S. average spot rates of $3.80 per kilo in February declined 9% YoY.

Full-month data for February suggest a weakening China to the USA air cargo market compared with China to Europe as shippers adjust to the fast-changing policies and statements of the new Trump administration.

Combined tonnages from China and Hong Kong to the U.S. in February – corrected for last February’s extra day – were down year on year by -10 percent whereas China and Hong Kong to Europe chargeable weight was four percent higher than last February, according to the latest figures from WorldACD Market Data.

"Those markets diverge on the pricing side as well with China and Hong Kong to the U.S. spot rates of $3.80 per kilo in February averaging nine percent below their equivalent levels last year whereas to Europe average spot prices of $4.58 per kilo were +17 percent higher than last February.

"Although it is still too early to form any firm conclusions about these differing patterns, the relatively weaker performance of the China to the U.S. air cargo market in February is consistent with an adjustment by Chinese e-commerce shippers to the suspension of China’s access to US customs-free de minimis exemptions in early February, before that was reversed a few days later. Companies that are more involved in the e-commerce business will have been more affected by this."

Global overview

Total worldwide tonnages in February were up, YoY, by five percent (corrected for February 29, 2024), led by YoY increases from Asia Pacific (up eight percent) and Central & South America (up eight percent) and Europe (up four percent), the update added.

"That was offset by a six percent YoY decrease from Middle East & South Asia (MESA) origins, compared with the heightened volumes from that region last February during the early stages of the Red Sea ocean freight capacity crisis. Combining the worldwide figures for January and February (corrected), to eliminate the complications of the timings of LNY, shows a YoY increase of three percent for the first two months of 2025."

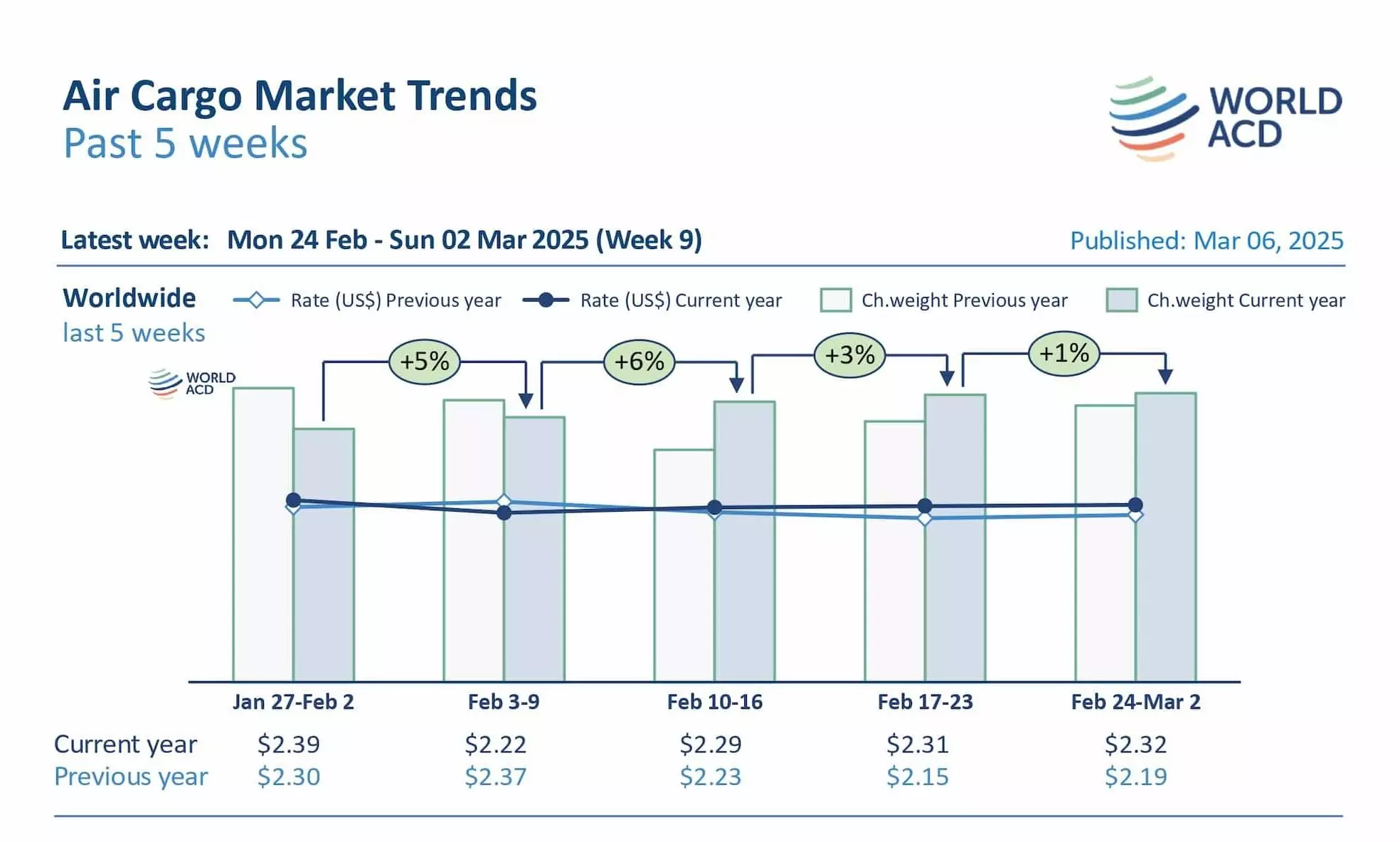

Average worldwide rates also edged slightly upwards in week nine to $2.32 per kilo, six percent higher than last year. Average global spot rates of $2.57 per kilo have been broadly stable for the last three weeks, and stand around 10 percent higher, YoY, with spot rates from Asia Pacific origins up +15 percent, the update added.