Asia Pacific generating more than 50% of global air cargo growth

Europe came in as the second origin region accounting for 17% of global tonnage growth in 2024.

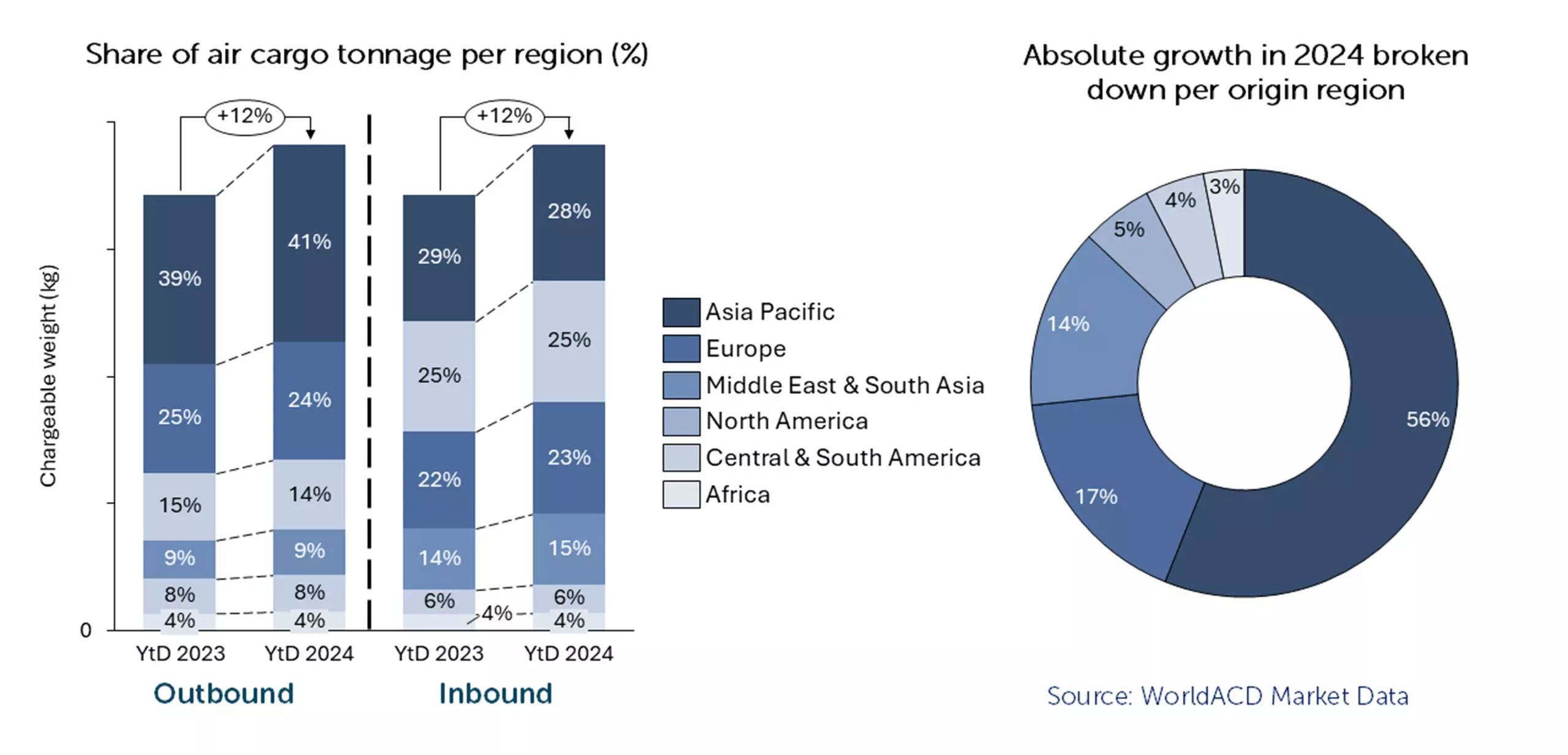

Asia Pacific origin markets are continuing to contribute an outsize share of worldwide air cargo growth this year, generating more than half (56 percent) of the global +12 percent year-on-year (YoY) increase in tonnages in the first 10 months of 2024, according to analysis by WorldACD Market Data.

"The region’s strong contribution this year means Asia Pacific’s share of worldwide outbound tonnages overall has risen two percentage points to 41 percent from 39 percent last year, well ahead of Europe on 24 percent, Central & South America on 14 percent, Middle East & South Asia (MESA) with nine percent and North America’s eight percent market share. Africa’s share of both outbound and inbound air cargo traffic remained stable at four percent, based on the more than two million monthly transactions covered by WorldACD’s database," says an official release.

Europe came in as the second origin region accounting for 17 percent of global tonnage growth in 2024, the update added. "The buoyant MESA region contributed 14 percent of outbound tonnage growth this year, despite its smaller nine percent share of global volumes, bolstered by traffic shifting to air this year due to continuing disruptions to the region’s ocean freight markets."

Vulnerables/high-tech dominates special cargo growth

Within Asia Pacific’s 56 percent share of worldwide growth in YTD to the end of October, general cargo contributed almost two thirds (64 percent), boosted by large volumes of e-commerce traffic flying consolidated as general cargo while special cargo generated 36 percent. "The special cargo element was dominated by the vulnerables/high-tech product category, which made up around 80 percent of growth in special cargo."

HK maintains lead position

Among the top five individual airport or city origin growth markets, the world’s busiest air cargo gateway Hong Kong also remained the biggest single generator of YoY outbound growth in October as it has for much of this year, the update added. "Hong Kong’s +15 percent YoY tonnage increase generated around twice the growth in absolute chargeable weight of second-placed Miami, even though the latter had recorded +31 percent YoY growth compared with its tonnages in October last year. Dubai was the third-biggest outbound growth market, thanks to its +45 percent YoY increase in October, closely followed by Shanghai and Tokyo."

For Hong Kong, the growth in October was generated by special cargo, predominantly vulnerables/high-tech with general cargo recording a slight YoY fall in chargeable weight. Miami’s growth was a balance of general cargo and special cargo whereas growth from Dubai, Shanghai and Tokyo came mainly from general cargo, the update added.

October increase in tonnages

Worldwide chargeable weight flown in October rose by eight percent compared with the previous month and was +11 percent higher than in October last year, according to analysis by WorldACD. "All six major global origin regions recorded month-on-month (MoM) and YoY increases in October, including double-digit percentage MoM increases in tonnages from Europe (+12 percent), Central & South America (CSA, +11 percent), North America (+10 percent) and Africa (+10 percent). And for the 10 months to the end of October, all six regions contributed YoY increases to the total chargeable weight growth of +12 percent, with Middle East & South Asia (MESA, +18 percent) and Asia-Pacific (+17 percent) recording the biggest YTD increases."

On the pricing side, average worldwide full market rates took longer to overtake last year’s levels but have been consistently higher than the equivalent week last year since week 20. Averaged across the first 10 months of 2024, YTD average full-market worldwide rates are roughly the same as their equivalent levels last year, the update added.