Asia Pacific export tonnages, rates continue to rise: WorldACD

Average global price ($2.37/kg) down by around 12% YoY but above pre-Covid levels (32% compared to March 2019)

Air cargo tonnages and rates from Asia Pacific are continuing to rise, five weeks on from the Lunar New Year (LNY) dip in early February as disruptions to container shipping and strong demand for cross-border e-commerce shipments continue to boost volumes and prices.

Combined export tonnages from Asia Pacific origin points rose by a further eight percent in weeks 10 and 11 (March 4-10 and March 11-17) compared with the previous two weeks (2Wo2W), and by 10 percent compared with the same period last year, according to the latest weekly figures from WorldACD Market Data. "Average rates from Asia Pacific origin points also rose by eight percent in weeks 10 and 11 compared with the previous two weeks, although, like most origin regions, rates were down on a year-on-year (YoY) basis, which is not surprising given that available capacity ex-Asia Pacific is up 19 percent YoY."

Asia Pacific to Europe routes recorded the biggest increases in tonnages (15 percent) on a 2Wo2W basis with rates up eight percent, the update added. "Asia Pacific to North America routes also saw increases in tonnages (11 percent) and average rates (eight percent) with e-commerce shipments and water level challenges in the Panama Canal adding to the demand-side pressures."

US freight forwarder C.H. Robinson expects the ongoing Suez Canal crisis will cause rates on Asia to Europe air freight trade lanes to stay elevated and perhaps moderately increase through to the end of the second quarter (Q2) of 2024.

Middle East & South Asia surge

The other big ongoing story at the moment is the continuing surge in demand and rates from Middle East & South Asia (MESA) origin points. "Although there has been a slight cooling down in demand in weeks 10 and 11 compared with the previous two weeks (three percent), tonnages are up YoY (17 percent) and average rates are up strongly (nine percent 2Wo2W and 23 percent YoY). This could be related to decreasing capacity in the last two weeks, since the start of Ramadan, although the impact is typically stronger at the end of Ramadan, when there is a holiday period."

Dubai-Europe tonnages remain particularly strong, up by 165 percent in week 11 YoY although they were slightly below (10 percent) their extraordinary level of the previous week, the update added.

Global picture

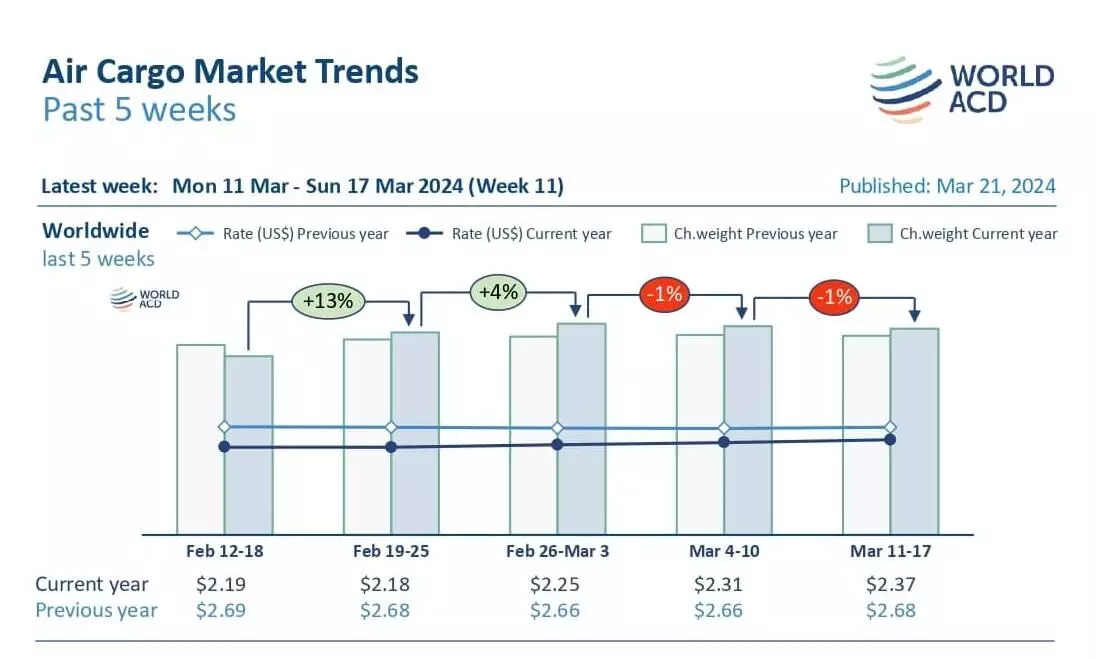

Total worldwide tonnages in week 11 were broadly flat compared with the previous week, flat on a 2Wo2W basis but up four percent compared with the same period last year.

"Average global rates rose again (three percent) in week 11 compared with the previous week to $2.37 per kilo, roughly their level in the weeks leading up to LNY, and they were also up by +6% on a 2Wo2W basis. Compared with last year, average global prices are down by around 12 percent but they remain significantly above pre-Covid levels (32 percent compared to March 2019)."

Worldwide air cargo capacity remains up on last year’s levels (eight percent), including capacity ex-Asia Pacific up by 19 percent and ex-Central & South America capacity up by 12 percent.