Asia Pacific, Europe rate rises lift global prices: WorldACD

Tonnages flown in week 44 (Oct 27-Nov 3) were down WoW on a worldwide basis & from all the main origin regions.

Rising air cargo rates from Asia Pacific and Europe helped to raise average worldwide prices in the first week of the airline sector’s (northern) winter 2024-25 timetable from October 27, according to the latest weekly figures and analysis from WorldACD Market Data.

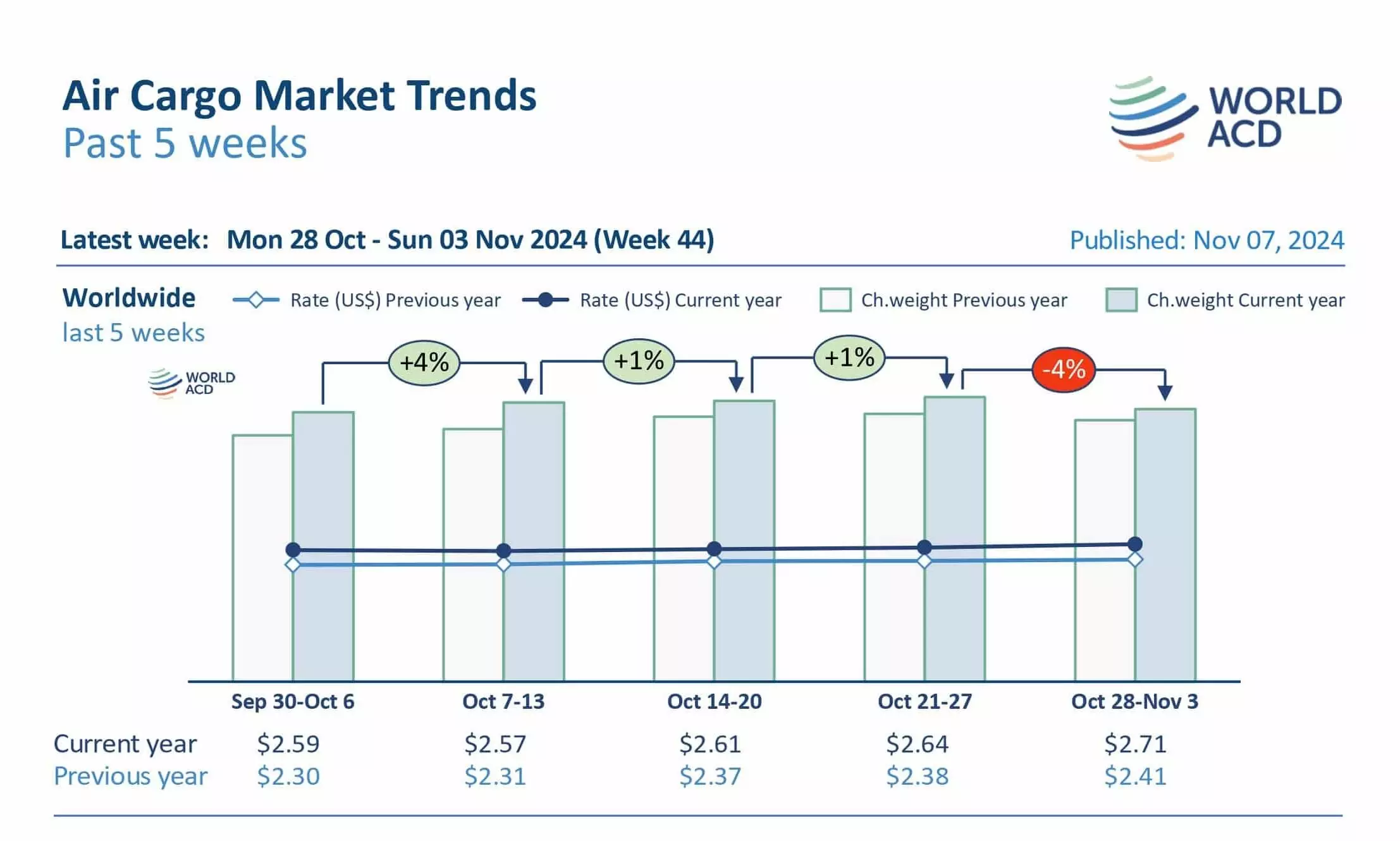

Average worldwide air cargo rates in week 44 (October 28 to November 3) rose, week on week (WoW), by a further two percent to $2.71, based on a full-market average of spot rates and contract rates, taking them +12 percent above their equivalent levels this time last year.

"Prices from Asia-Pacific and Europe origins rose by two percent, WoW, to $3.56 per kilo and $2.13 per kilo, respectively. Rates from Africa rose three percent to $1.98 per kilo with prices stable from North America, Central & South America (CSA) and Middle East & South Asia (MESA)."

Worldwide spot rates rose by three percent WoW to $2.97 per kilo, driven by a three percent increase from Europe origins to $2.34 per kilo, and a one percent rise from Asia-Pacific and MESA. "Those increases in week 44 spot prices follow increases in week 43 from Europe (+eight percent) and Asia Pacific (+three percent), based on the more than 450,000 weekly transactions covered by WorldACD’s data."

However, tonnages flown in week 44 were down, WoW, on a worldwide basis, and from all the main origin regions, the update added.

Asia-Pacific and MESA markets

Examining the Asia-Pacific market in more detail reveals a +12 percent WoW jump in spot rates from mainland China to Europe to $4.68 per kilo, and a eight percent increase from Japan to $4.58 per kilo, taking them +26 percent and +42 percent higher, respectively, than last year. Rates from China to the USA also increased in week 44, up three percent to a new high at $5.90 per kilo.

Spot rates from MESA to Europe rose by further four percent in week 44 to $3.29 per kilo, almost double their level this time last year, with a nine percent increase from the highly volatile Bangladesh market (to $5.12 per kilo).