Asia, Middle East, Africa see strong air cargo sales growth

By Sept, strong growth in chargeable weight pushed total air cargo sales into positive territory: WorldACD Market Data.

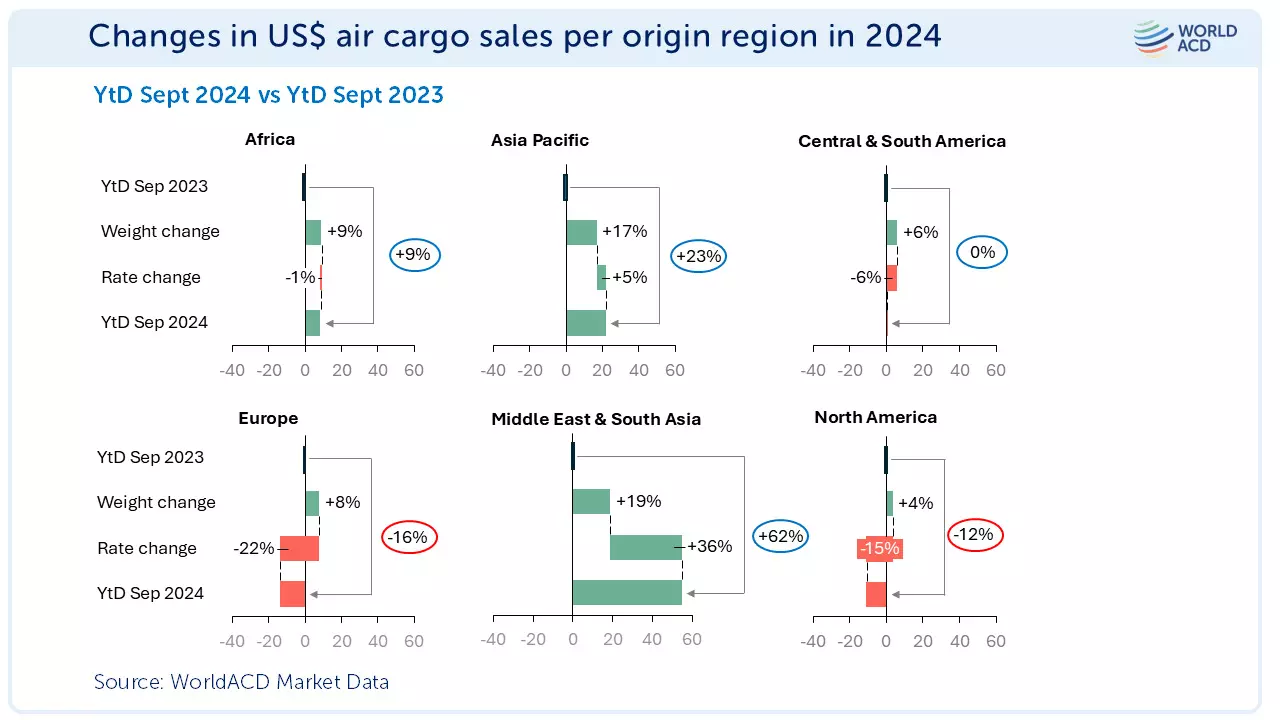

New analysis combining air cargo rates and tonnage figures this year highlights a contrasting regional experience in 2024 for carriers and their customers with overall sales declines in Europe and the Americas contrasting with strong growth in Middle East, South Asia and Asia Pacific.

By September, the strong growth in chargeable weight flown had pushed total air cargo sales into positive territory for most regions, according to analysis by WorldACD Market Data.

WorldACD reports highlight the worldwide and regional changes and trends in air cargo pricing and chargeable weight, the release added. "It is also relevant to examine the combined result of these weight and rate changes – revenue from the perspective of airlines, or charges from the perspective of forwarders or shippers. In the absence of any better terminology covering both sides of the buyer-seller relationship, WorldACD will call it air cargo sales. All figures in this report are in $."

Based on the more than two million monthly transactions covered by WorldACD’s database, while all six of the world’s main air cargo regions recorded YoY growth in outbound chargeable weight in the first nine months of this year, two regions saw YoY decreases in overall air cargo sales in that period: Europe and North America, the update added. "For example, despite a four percent increase in chargeable weight flown from North America origins, the -15 percent YoY decline in average rates from that region led to a -12 percent fall in overall air cargo sales for the year to date (YtD) to September. From Europe, the combined effects are even more striking: despite an eight percent increase in chargeable weight, the -22 percent drop in average rates generated a -16 percent fall in air cargo sales."

Middle East & South Asia (MESA, +62 percent), Asia Pacific (+23 percent), and Africa (+ nine percent) origins recorded significant YoY increases in overall air cargo sales in the first nine months, the update added. "For MESA origin cargo, that’s due to strongly increasing tonnages flown (+19 percent) and average pricing (+36 percent) while for Asia Pacific, the +17 percent rise in total cargo sales has been almost entirely generated by the +17 percent YoY growth in chargeable weight flown with a small (+ five percent) increase in average rates overall in that period. For Africa, the nine percent growth in chargeable weight flown combined with a small (one percent) reduction in average rates saw a YoY rise in air cargo sales of + nine percent."

Worldwide weight is up +12 percent, rates are down two percent and air cargo sales are up +10 percent, the update added. "In the first half of October, worldwide weight dropped by three percent compared to the second half of September and rates remained stable."

General cargo vs special cargo trends

The growth of general cargo tonnages has been outpacing that of special cargo products this year, and that continued into September with general cargo growing by an average of +13 percent in the January-September period compared with +10 percent for special cargo products. Much of this change from the longer-term trend is due to the exceptionally strong growth since last autumn in cross-border e-commerce traffic – which often flies as general cargo rather than within a special cargo handling category, the update added.

"The growth of special cargo products this year is also strong by historical standards. Among the special cargo product categories, there has been extremely strong YoY growth in worldwide shipments of meat (+25 percent) and vulnerable/high-tech cargo (+22 percent). Fruit & vegetables traffic grew by eight percent, flowers and dangerous goods each grew by five percent while live animal shipments dropped by six percent."

While general cargo forms the clear majority of shipments from Asia Pacific (70 percent), North America (73 percent), Europe (71 percent), and MESA (66 percent), the reverse is true for Africa and CSA where special cargo – particularly perishables – shipments dominate: 78 percent for Africa and 74 percent for CSA. Both these regions, however, have seen general cargo report the strongest YoY growth this year in chargeable weight: +23 percent for Africa and +14 percent for CSA compared with + six percent and + three percent, respectively, for special cargo growth in the first nine months of this year, the update added.