Asia-Europe sea-air hubs record strong surge in tonnages

Dubai, Colombo and Bangkok have seen flown tonnages to Europe rise by more than 50% YoY in first seven weeks of 2024

Several key Asia-Europe sea-air hubs have recorded a strong surge in tonnages in the last few weeks as shippers continue to seek alternative logistics solutions due to the disruptions to container shipping caused by the attacks on ships in the Red Sea, according to the latest update from WorldACD Market Data.

"Freight sources have reported, anecdotally, that some Asia-Europe sea-air hubs such as Dubai, Colombo and Bangkok have been inundated with air cargo in recent weeks as cargo owners seek to replenish stocks in Europe that have run low because containerships that would normally transit via the Suez Canal have been forced make the longer voyage around the Cape of Good Hope."

Analysis this week by WorldACD Market Data confirms that air cargo tonnages to Europe from Dubai, Colombo and Bangkok have been at significantly elevated levels this year compared with the equivalent period last year.

In the first seven weeks of 2024, all three of those sea-air hubs have seen their respective flown tonnages to Europe rise by more than 50 percent compared with the first seven weeks of 2023 with Dubai-Europe traffic up 71 percent, Colombo-Europe tonnages up 61 percent and Bangkok-Europe volumes up 58 percent. Despite some reports of elevated traffic volumes to Europe via Singapore and Doha, Singapore-Europe and Doha-Europe tonnages were up, YoY, by just 10 percent and three percent, respectively, in the first seven weeks of this year based on more than 450,000 weekly transactions covered by WorldACD’s data.

It’s unclear currently whether the elevated demand for sea-air solutions will continue significantly beyond the LNY period with ex-Asia Pacific normally associated with a spike in demand leading up to LNY followed by a subsequent fall in tonnages and prices, the update added. "Tonnages in week seven (February 12-18) remained up, YoY, to Europe from Dubai, Colombo and Bangkok. Dubai-Europe gains have almost tripled in week seven to 161 percent while the previous three weeks stood at +89 percent, +93 percent and +77 percent. Colombo-Europe volumes in week seven were more than double (+112 percent) the levels of week 7 in 2023 and Bangkok-Europe tonnages also remained highly elevated (+68 percent)."

Global comparisons

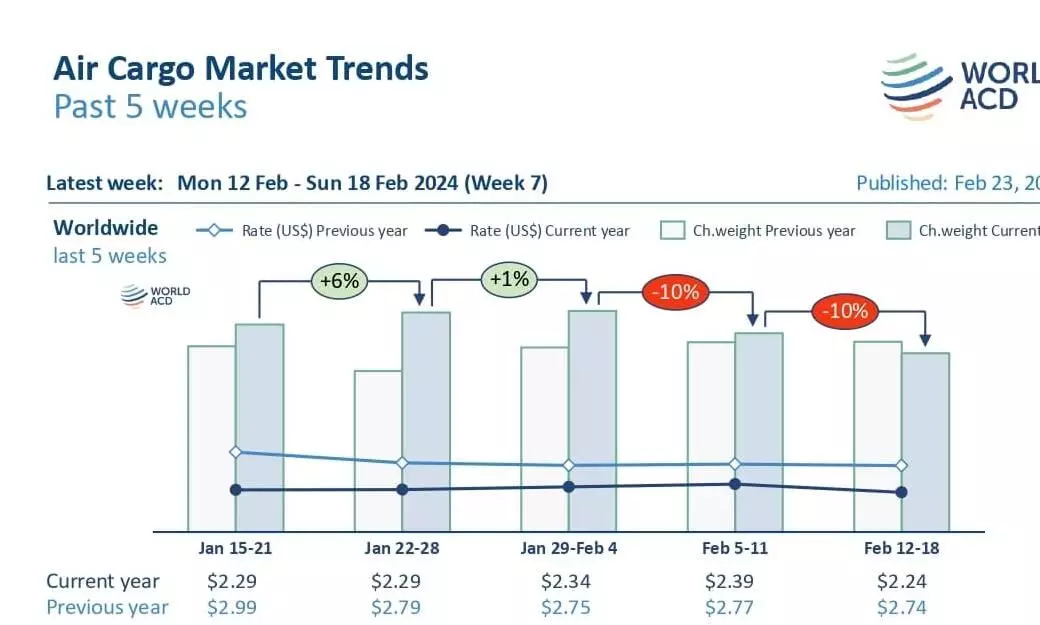

A big decline in tonnages ex-Asia Pacific pushed down overall tonnages in week seven by a further 10 percent following a similar tonnage drop in week six. "Looking at average global rates, we see a week-on-week (WoW) drop of six percent in week seven this year compared to an eight percent WoW decline in the equivalent post-LNY week (week four) last year, consistent with a broadly similar seasonal pattern. Those average global yield declines can be explained as a “mix effect”, with reduced high-yielding volumes ex-Asia Pacific causing a drop in the global average, and not by individual rates decreasing."

Total combined tonnages for weeks six and seven this year were down by 14 percent globally compared with the preceding two weeks (2Wo2W) with average rates stable and capacity down by four percent. The dominant effect of LNY on these figures can be seen in the 25 percent drop in tonnages, 2Wo2W, from the origin region of Asia Pacific.

The only origin region in weeks six and seven this year to record an increase in tonnages, on a 2Wo2W basis, was Middle East & South Asia (+two percent), mainly driven by a six percent rise to Europe. Middle East & South Asia were the only origin region to show a significant rise (11 percent) in average rates, 2Wo2W, with Middle East & South Asia to Europe the only major intercontinental lane to show a significant rise in average prices (18 percent)."

Year-on-year perspective

Year-on-year (YoY) comparisons show a one percent decrease in total worldwide tonnages for weeks six and seven combined compared with last year despite LNY occurring almost three weeks later this year, again suggesting a structural improvement in demand levels compared with last year, the update added.

On the pricing side, average worldwide rates of $2.24 per kilo in week seven are 16 percent below their levels this time last year with rates ex-Europe and ex-North America down by 32 percent and 21 percent, respectively. Nevertheless, average global rates remain significantly above pre-Covid levels (26 percent compared to February 2019).

Overall worldwide air cargo capacity remains significantly up on last year’s levels (nine percent) with, most notably, double-digit percentage increases ex-Asia Pacific (18 percent) and ex-Middle East & South Asia (11 percent).