Asia air cargo rates remain high despite seasonal slowdown

Average Asia Pacific spot rates at $3.8/kilo is 27% higher in second week of 2025 compared to same period last year.

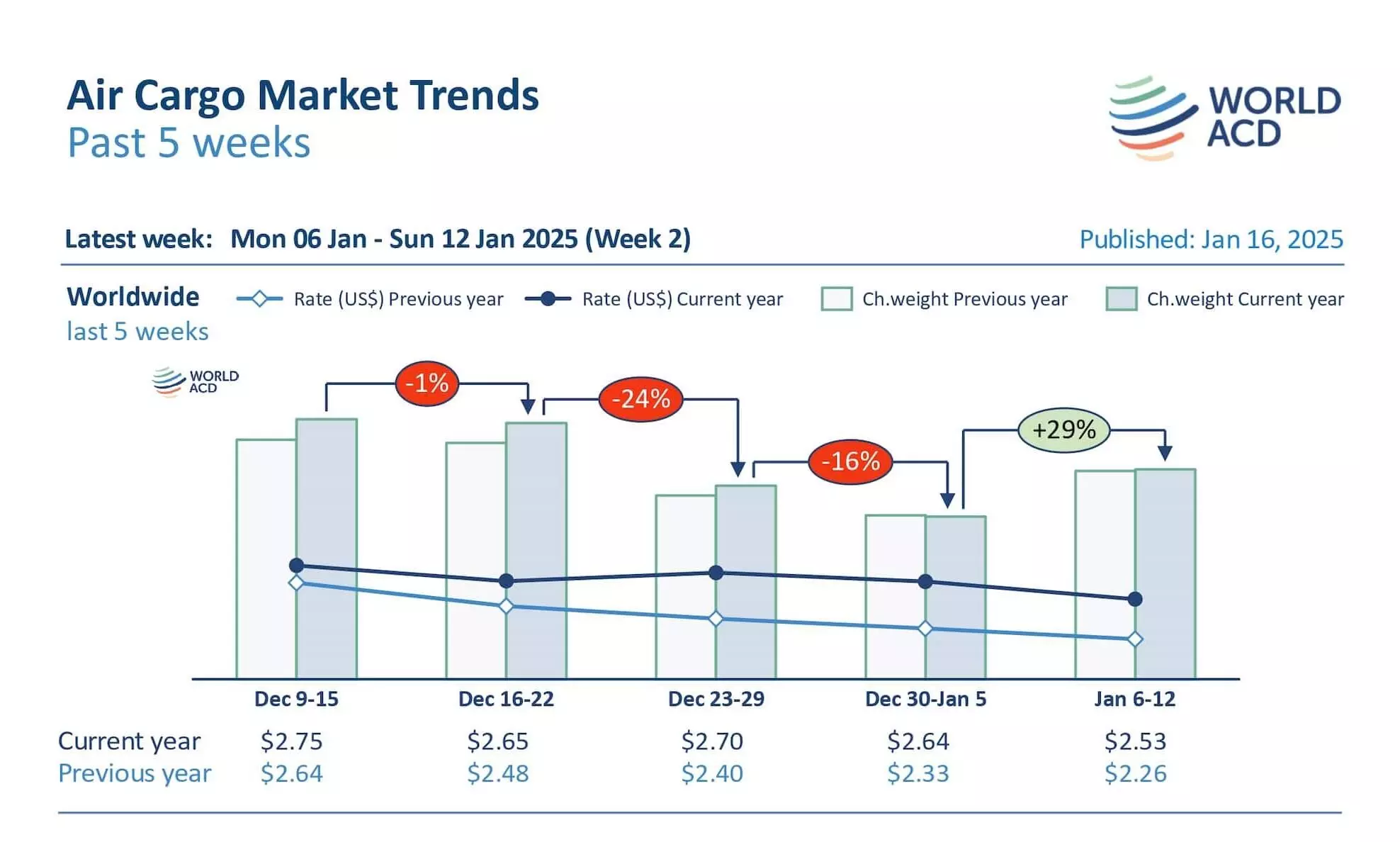

Global air cargo spot prices remain more than +20 percent up in the second week of 2025 (January 6-12) compared to their levels a year ago, despite the usual seasonal drop in early January, according to the latest figures and analysis by WorldACD Market Data.

"Relatively high rates from Asia Pacific and Middle East & South Asia (MESA) origins continued to prop up average prices," the update added.

Average worldwide spot rates dipped (three percent) compared with the previous week to $2.76 per kilo but they are still +22 percent higher on a year-on-year (YoY) basis . "A global full-market average mix of spot and contract rates edged downwards (-four percent WoW) to $2.53 per kilo but remained up YoY by +12 percent based on the more than 500,000 weekly transactions covered by WorldACD’s data."

Asia Pacific to US rates drop

Average Asia Pacific spot rates dipped by five percent to $3.81 per kilo WoW, down from a peak of $4.75 in week 49, but they stand +27 percent higher than in the second week last year. "Asia Pacific to USA demand and spot pricing had stayed surprisingly firm in the final two weeks of 2024, ending the year averaging $6.41 per kilo from Asia Pacific and $6.04 from China to USA. After Asia Pacific to US tonnages fell WoW by -24 percent in week one, they regained +14 percent in week two. Spot rates have continued to slide, dipping to $5.39 per kilo in week two from Asia Pacific to USA, and sinking to $4.25 from China to USA – although those spot rates are still up on a YoY basis, by +37 percent and +10 percent, respectively."

MESA rates still high but falling

Rates from MESA origins, which were highly elevated throughout 2024 due to the disruptions to ocean freight supply chains in that region, declined marginally in the last three months and have continued to slide in 2025. Full-market average rates from MESA in weeks one and two dropped by four percent compared with the previous two weeks (2Wo2W), although they are still up +36 percent YoY, the update added.

"Average spot rates from MESA to Europe of $2.60 per kilo in week two are down by around -20 percent compared with their levels in early November (week 45), although they are still up +65 percent YoY. Bangladesh to Europe spot rates, which rose above $5 per kilo in September, have fallen consistently for the last 10 weeks, from $4.92 per kilo in week 45 to $3.25 in week two this year but that’s still +35 percent higher YoY."

Air cargo rates and demand from MESA origins are likely to remain elevated as the fragile ceasefire deal in Gaza has not altered the current threat assessment for shipping in the Red Sea, and shipping lines will not be prepared to disrupt global supply chains by re-routing until there is hard evidence the Houthi threat has diminished, the update added.