Air cargo spot rates drop 4% in June, concerns over tough H22025

Despite turbulence, demand for the first half of 2025 still grew by 3% compared to the same period last year: Xeneta

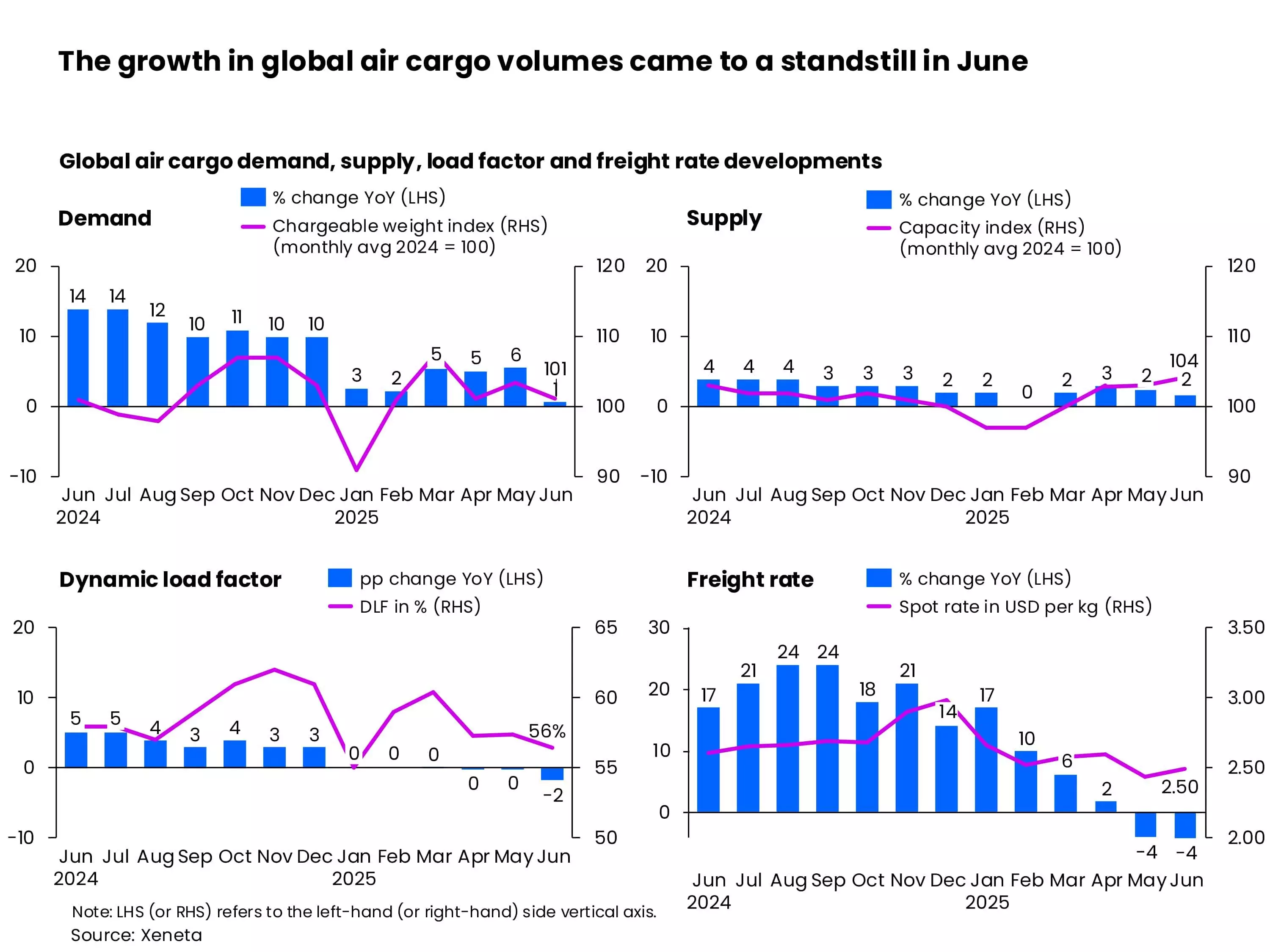

Global air cargo spot rates declined for the second consecutive month in June, down -4% year-on-year, as capacity overtook demand for the first time in 19 months, and concerns over a more challenging second half of 2025 rose on the back of uncertainty over the prospects for international trade, according to new data from Xeneta.

Global air cargo volumes were flat in June, up just one percent year-on-year, while available capacity measured over the same period edged up two percent.

Niall van de Wouw, Chief Airfreight Officer, Xeneta called the market performance "unsurprising," adding that while politicians are continuing to trade economic blows in the form of tariffs, the latest monthly intelligence also signals consumers are "voting with their wallets" and looking to save money on non-essential goods.

"The air cargo market is losing altitude amidst so much uncertainty," says van de Wouw. "For consumers who were already under severe financial pressure from the rise in the everyday cost-of-living, the added cost of tariffs means they are more likely to think twice about buying many of the types of goods which are exported and imported by air."

With tariffs, there are no winners

"When Xeneta reported April’s market data, we asked how bad will it be? over the rest of 2025. That’s certainly top of mind now for airlines and forwarders but also for shippers and consumers. Every economist will tell you that with tariffs there are no winners.

"It’s wrong to think falling air cargo rates on key trade corridors automatically represent a boon for shippers. With weaker consumer confidence, low rates are little comfort when underlying demand is deteriorating," adds van de Wouw.

First half demand still grew +3%

Despite the turbulence, air cargo demand for the first half of 2025 still grew by three percent compared to the same period a year earlier but the industry is preparing for a less rosy outlook for the remainder of the year, given the effects of looming tariffs and curbs on U.S. de minimis exemptions for cross-border e-commerce goods, the update added.

"Last month, we said sentiment was driving a downturn but now market fundamentals are starting to kick-in. In this environment, at a certain moment, something’s got to give. We are starting to see the longer-term effects of all this uncertainty because a lot of damage has been done. This might be the new reality for the foreseeable future as the industry is facing a much more challenging second half of the year," adds van de Wouw.

Most airfreight corridors saw a decline in June

Routes from South-East Asia to both Europe and North America were particularly weak, posting double-digit drops in rates compared with the same period last year when prices had spiked, the update added.

"In comparison, the North-East Asia to Europe corridor remained relatively steady. A surge in e-commerce volumes helped offset a shift in capacity toward the Asia–Europe market, keeping rates in balance. Backhaul routes from Europe and North America to Asia, however, continued their downward trend, reflecting persistent trade imbalances."

Faced with this uncertain landscape, shippers have adjusted their procurement strategies. "The second quarter, typically the peak season for tendering, saw a notable shift. The share of mid-term contracts (three to six months) rose by eight percentage points compared to a year earlier, largely at the expense of annual or longer-term agreements. Yet, compared to the first quarter, the share of three-month contracts declined 12 percentage points, suggesting that some tenders earlier in the year proceeded out of necessity, particularly for shippers who place a premium on service reliability," the update added.