Air cargo rates stay firm driven by Asia and Middle East

Average rates up 8% at $2.51 per kilo for week 24 compared with the equivalent week last year

Air cargo rates are holding firm during what is traditionally a quieter period for the market, boosted by continuing strong demand and high spot rates from Asian and Middle Eastern origins, according to the latest weekly figures and analysis from WorldACD Market Data.

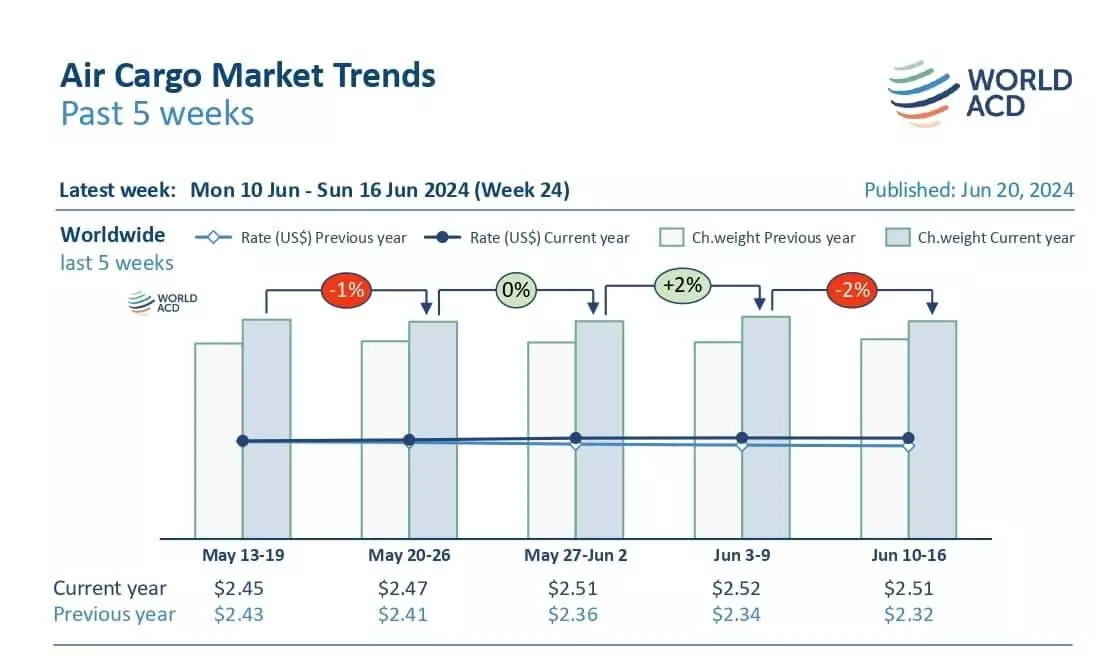

Although total worldwide tonnages in the last full week (week 24, June 10-16) slipped by two percent, average rates remained more or less stable at $2.51 per kilo, up eight percent compared with the equivalent week last year and significantly above pre-Covid levels (+42 percent compared to June 2019), based on more than 450,000 weekly transactions covered by WorldACD data.

"Combining the figures for the last two full weeks (weeks 23 and 24) reveals a one percent rise in both rates and tonnages compared with the previous two weeks (a 2Wo2W comparison)."

Both tonnages (+11 percent) and rates (up eight percent) are well above last year’s levels, thanks to significantly higher demand, led by higher rates (+52 percent) and tonnages (+13 percent) from Middle East & South Asia (MESA) origins and higher rates (+17 percent) and tonnages (+16 percent) from Asia Pacific origins, the update added.

"There have been some significant increases in average spot prices in the last five weeks to the USA from Asia Pacific as a whole (from $4.80 in week 19 to $5.34 in week 24, +11 percent) and China (from $4.91 in week 19 to $5.25 in week 24, up seven percent), taking those prices to +52 percent and +38 percent, respectively, above their levels this time last year."

China-Los Angeles story

China to Los Angeles tonnages have been down YoY for most of the last seven weeks. "For China to the USA as a whole, tonnages are up YoY in each of the last five weeks although they have also flattened off during that time, standing in week 24 at just two percent above their levels last year."

So, it seems there has been some decline in China tonnages to Los Angeles in the last month or so compared to the China-USA market as a whole, supporting the anecdotal observations about cancelled freighters to Los Angeles due to enhanced customs checks of inbound e-commerce-driven air cargo flights from China, the update added.