Air cargo rates rise as South Asia-Europe rates soar: WorldACD

Tonnages decline from most regions, linked to various holiday periods including Easter, Ramadan and Qingming Festival

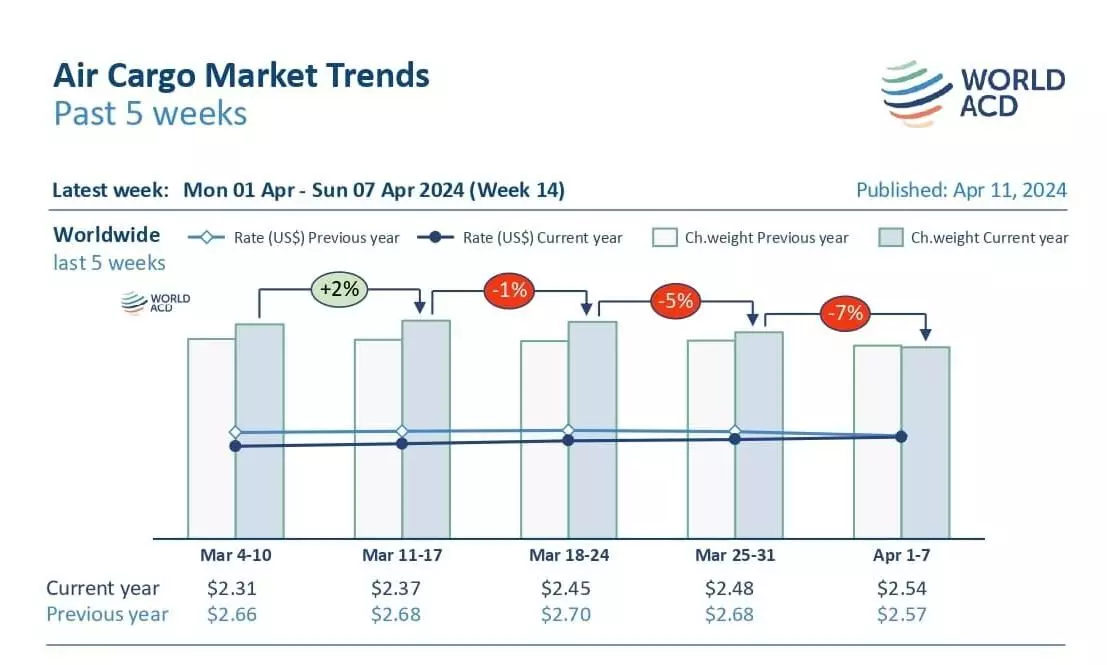

Worldwide air cargo rates continued to rise into the first week of April, boosted by a surge in prices and demand from Middle East & South Asia origins, according to the latest weekly figures and analysis from WorldACD Market Data.

Tonnages declined from most regions, linked to various holiday periods around the world including Easter, Ramadan and China’s Qingming Festival, the update added.

"Average global rates rose, week on week (WoW), by more than two percent in week 14 (April 1-7) to $2.54 per kilo, following consecutive weekly WoW rises of between two and three percent last month, taking them to just (-) one percent of their level in week 14 last year and significantly above pre-Covid levels (+41 percent compared to April 2019)."

Surging MESA-Europe spot rates

Data highlights a big surge in spot rates from Middle East & South Asia (MESA) to Europe in recent weeks, especially from India and Bangladesh, linked to strong demand developments combined with supply issues caused by disruptions to container shipping and Ramadan.

"MESA to Europe spot rates have soared in the last three weeks to around double their level this time last year, rising to $3.43 a kilo in week 14. The figures for India and Bangladesh origin points are even more dramatic, with India-Europe spot rates rising to $4.13/kg in week 14 (+160 percent) and Bangladesh-Europe spot rates soaring to $4.59 a kilo in week 14 – a near-trebling of their level this time last year."

Another factor beginning to have an impact on rates is increasing jet fuel prices, which rose by more than four percent in week 14, and rose more than three percent in the previous month, although they remain slightly below their level this time last year, the update added.

Year-on-year comparisons

Compared with last year, average worldwide rates in weeks 13 and 14, combined, were down by four percent with small increase in chargeable weight failing to keep pace with the seven percent year-on-year (YoY) growth in capacity. MESA was the only origin region to record a YoY increase in rates (+39 percent based on a mix of contract rates and spot rates), and the only origin region where growth in demand (+11 percent) outstripped increases in capacity (+six percent).

Dubai-Europe demand still booming

Dubai-Europe tonnages were still massively elevated (+114 percent) in week 14 compared with the same week last year with tonnages in week 14 very close to their peak levels recorded in week eight, the update added.

Bangkok-Europe tonnages are also still up significantly (+33 percent) compared with last year but Colombo-Europe tonnages have fallen back significantly from their exceptionally high levels in weeks six, seven and eight with demand in week 14 slightly below the same week last year.

Average rates to Europe from all three origins were up significantly, YoY, with Colombo up 39 percent, Dubai up 22 percent and Bangkok up 20 percent.