Air cargo rates from Asia Pacific fall further amid uncertainty

For the Asia Pacific region as a whole to the U.S., overall average rates were down 8% in week 16 to $4.93 per kilo.

Air cargo markets from Asia Pacific and worldwide weakened further in the week to April 20 due to the effects of Easter holidays and uncertainty caused by U.S. changes in tariff and trade policies, according to the latest weekly figures from WorldACD Market Data.

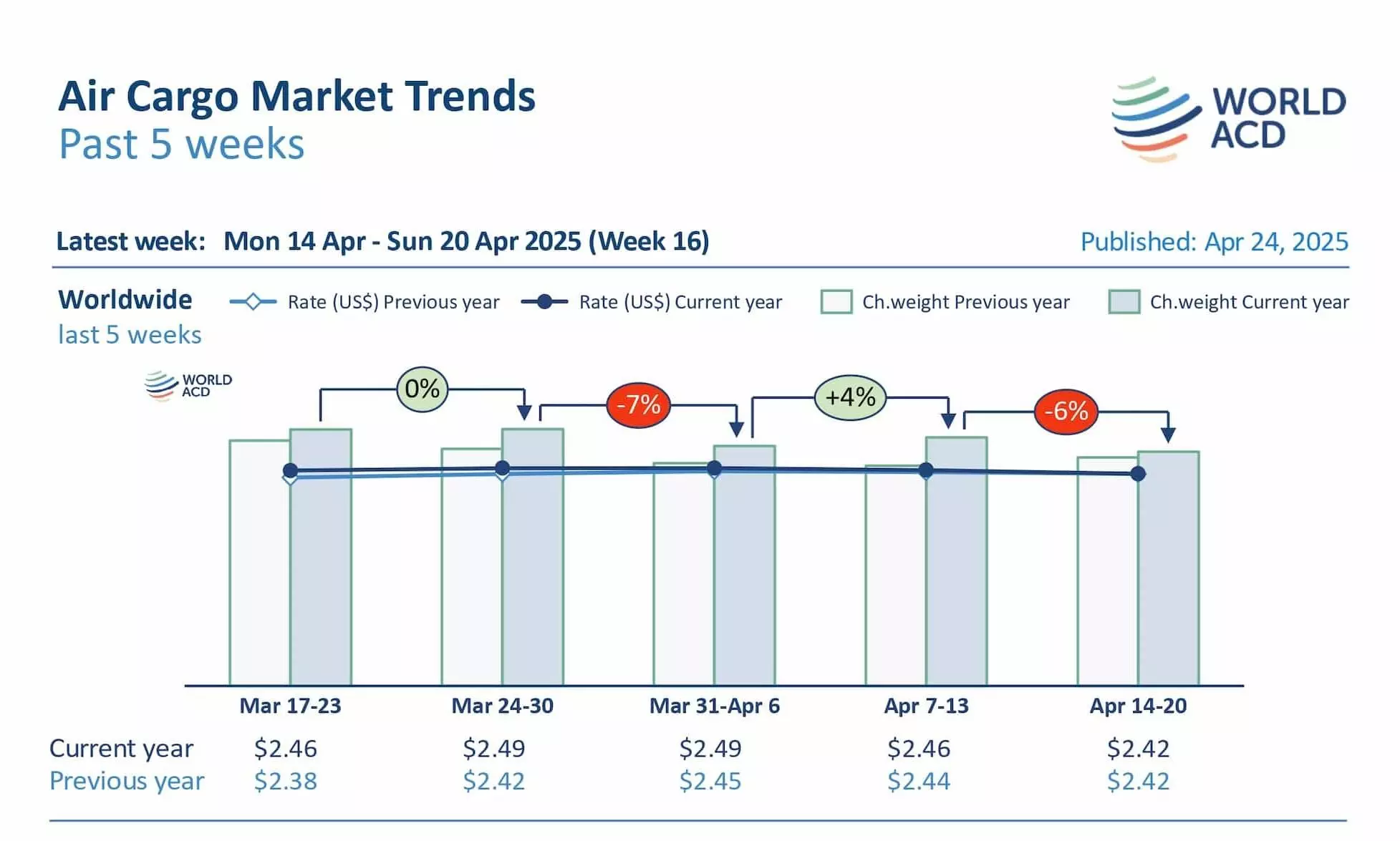

"Air cargo tonnages and rates from Asia Pacific fell week on week (WoW) by four percent and three percent, respectively, in week 16 (April 14-20) with worldwide chargeable weight dropping six percent WoW. That six percent WoW drop in demand is similar to the five percent decline in the equivalent Easter week last year, which took place in week 13. In both cases, demand from each of the origin regions fell WoW."

The big difference from last year is the development of rates, which were on the rise last year but declined from all the origin regions, except from Central & South America, this year, the update added.

Average global prices, based on a full-market average of spot and contract rates, dropped by two percent to $2.42 per kilo in week 16, including a four percent decline in spot rates to $2.58, led by six percent WoW declines in spot prices from Asia Pacific, Europe and Africa origins.

Asia Pacific to USA declines

Despite reports of a surge in e-commerce sales ahead of the May 2 end of de minimis customs duty exemptions for low-value imports from China and Hong Kong, traffic from China and Hong Kong to the U.S. fell for the fourth consecutive week, losing seven percent WoW, the update added. "Compared with week 16 last year, China and Hong Kong to the U.S. combined traffic is down by 16 percent, contrasting with a three percent drop for the Asia Pacific region as a whole to the U.S., driven by stronger exports from Vietnam (+42 percent), Taiwan (+30 percent), Thailand (+24 percent) and Japan (+12 percent). These figures do not include increased charter activity."

There were notable declines on the pricing side as well from Asia Pacific to the U.S., and particularly from China and Hong Kong where the combined average rates dropped by five percent on a WoW basis to $4.72 per kilo, although that follows seven consecutive weeks of rate rises since Lunar New Year (LNY).

For the Asia Pacific region as a whole to the U.S., overall average rates were down eight percent in week 16 to $4.93 per kilo, although that followed four consecutive weeks of WoW rises that had pushed up average rates to $5.38 per kilo in week 15, the update added.