Air cargo rates drift lower: TAC Index

Numbers continue pattern of a market that remains firm – notwithstanding uncertainties over tariffs and trade terms.

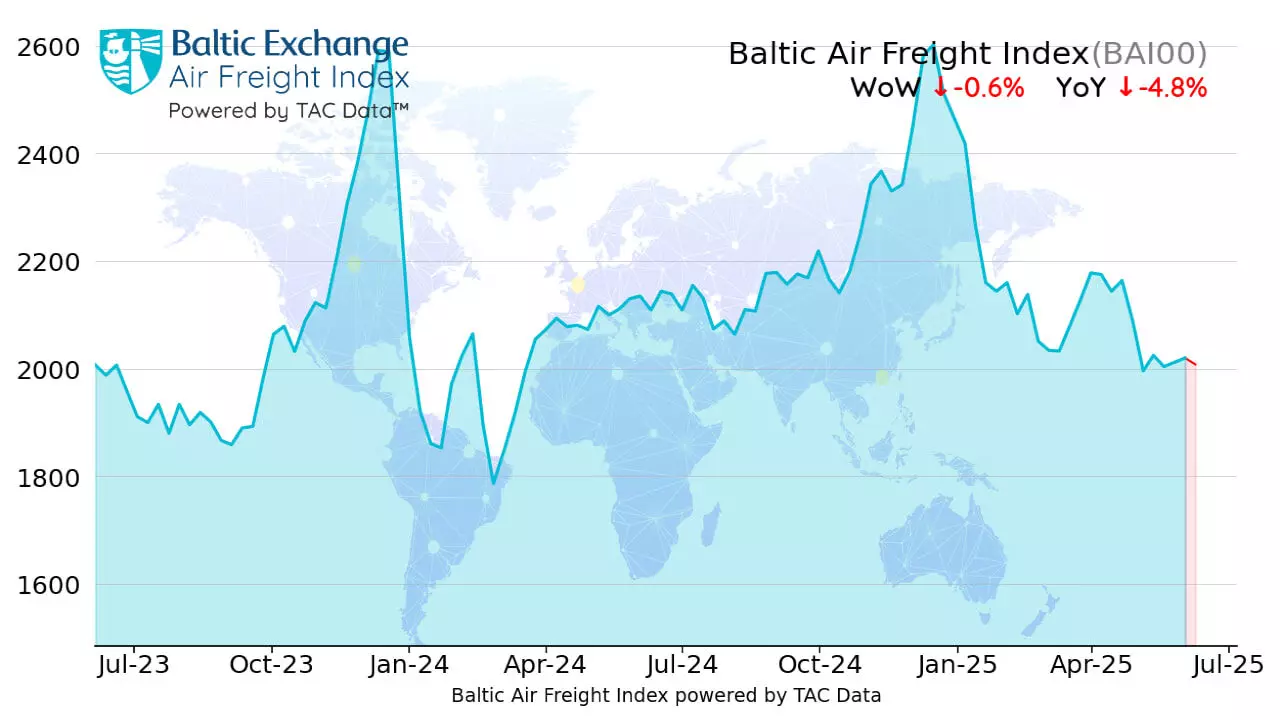

Global air freight rates edged slightly lower overall last week, according to the latest data from TAC Index.

"The global Baltic Air Freight Index calculated by TAC was lower by -0.6 percent in the week to June 9, leaving it lower by -4.8 percent over 12 months. Nevertheless, the latest numbers continue a recent pattern of a market that remains relatively firm – notwithstanding all the recent uncertainties over tariffs and trade terms – when compared with last year when rates were rising due to booming e-commerce activity and also set against significantly lower jet fuel prices."

Overall rates on the busiest lanes out of China were slightly lower WoW both to Europe and the U.S, the update added. "Spot rates from Hong Kong – as measured by the new BAI Spot indices, which are moving soon to public trials – were also trending down over the week. Nevertheless, the index of outbound routes from Hong Kong – reflecting the whole spectrum of both spot and contract business – actually edged higher by +0.8 percent WoW, leaving it lower by -7.6 percent YoY. Outbound Shanghai edged only slightly lower by -0.9 percent WoW, leaving it at down five percent YoY."

Elsewhere from Asia, rates from Vietnam were slightly up to Europe but lower again to the U.S., and now a long way down YoY. From India, rates were lower in both directions and well down YoY. Rates from Bangkok and Seoul were also both lower WoW to Europe though in both cases remained well up YoY amid continuing reports of higher demand and volume, the update added.

Out of Europe, rates were higher WoW to Japan, slightly up overall to the U.S. (and well up YoY) but lower again to China. The index of outbound routes from Frankfurt edged down -1.7 percent WoW but was still in positive territory at +0.7 percent YoY, led by higher rates on Transatlantic lanes. Outbound London Heathrow was similarly a tad lower by -0.7 percent WoW but remained ahead by +3.6 percent YoY, with rates to the Middle East rising strongly.

From North America, rates were higher WoW both to Europe and to South America, led by further gains on lanes from Miami but also lower on routes to China, the update added.