Air cargo market awaits impact of tariffs, de minimis changes: Xeneta

Approximately 50% of air cargo shipments on China–U.S. route is e-commerce, accounting for around 6% of global volumes.

Source: Xeneta

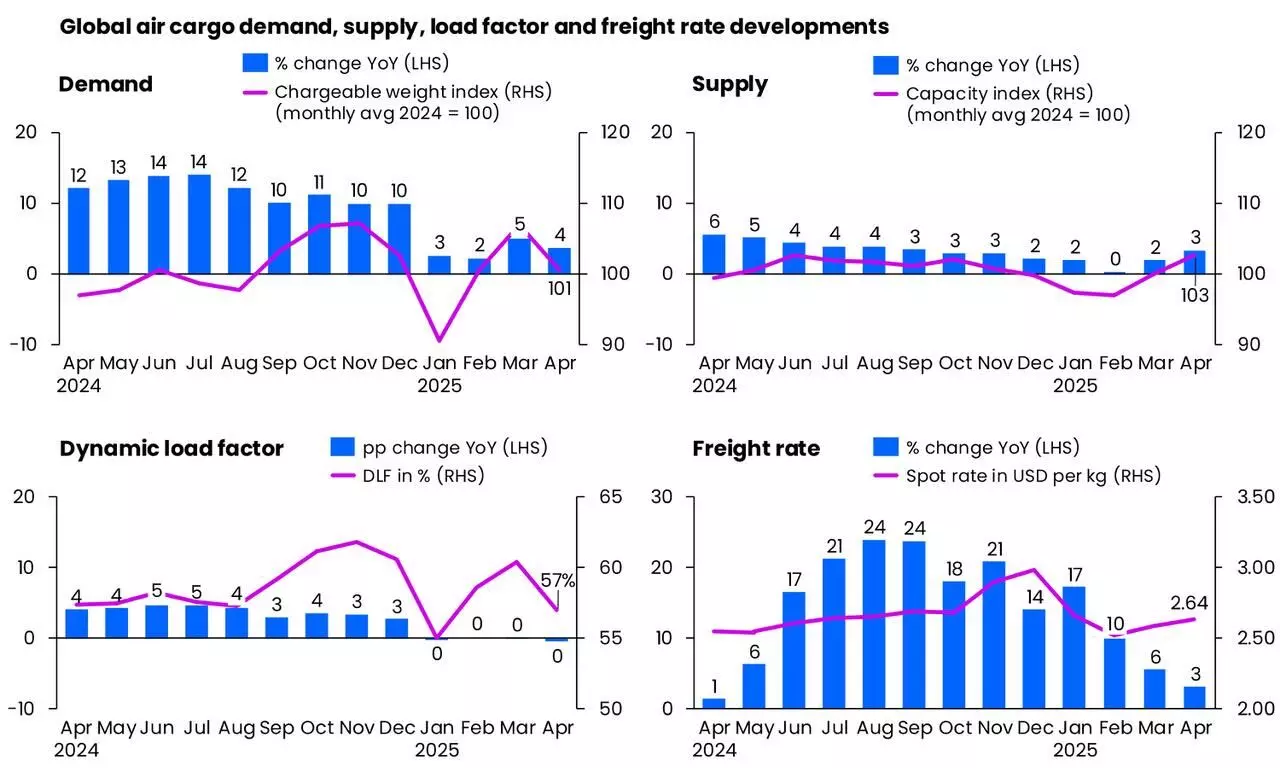

Global air cargo volumes increased four percent year-on-year in April but with the removal of the de minimis threshold for shipments from China into the United States expected to dramatically disrupt e-commerce volumes in the coming weeks and massive uncertainty hanging over the macroeconomic outlook - the question for the air cargo market in 2025 has become how bad will it be?, according to Xeneta.

"Over the past 10 years, U.S. consumers have paid no duty on shipments valued at $800 or less, causing the volume of cross-border packages into the U.S. to soar to some 1.35 billion annually. Similar (but lower) exemptions exist in other countries. From May 2, however, low-value products sourced from China and Hong Kong into the U.S. will now be subject to 145 percent new tariffs, with products sourced from postal services paying a different 120 percent duty on the value of the goods or a $100 flat fee, rising to $200 on June 1," the update added.

Approximately 50 percent of air cargo shipments on the China–U.S. route is e-commerce, accounting for around six percent of global volumes. A sharp drop in demand is likely to challenge carriers' capacity planning, with early signs already pointing to freighter flight cancellations and potential redeployments to other trade lanes, Xeneta says in its latest report.

One of China’s e-commerce behemoths, Temu, has already responded by dramatically reducing its advertising spend in the U.S., but the outlook for global air cargo – so dependent on e-commerce income for the last two-three years since Covid – extends far beyond the U.S. border, says Niall van de Wouw, Chief Airfreight Officer, Xeneta.

"This is a double-edged sword. A decrease in demand on one of the key airfreight lanes between Asia Pacific and North America will have a big impact, but so too will the redeployment of capacity on a global level. This may be a year when we grow weary of seeing the word unprecedented in market performance statements. The macroeconomic picture will depend on how long the uncertainty lasts and what will be at the end of it, but the outlook currently looks quite daunting.

"This is not about one industry being affected. This is about major trade lanes being affected, and we haven’t seen anything on this scale before."

Weak demand in April, downward pressure on rates

Global air cargo spot rates rose just three percent year-on-year in April, a second consecutive month of only a single-digit increase, the update added. "This slowdown aligns with weaker demand trends. Adding to the downward pressure on rates, jet fuel prices fell 24 percent year-on-year in the first three weeks of April. This drop, driven by ongoing economic and geopolitical uncertainties, likely played a role in tempering overall spot rate growth."

Available capacity increased modestly, up three percent, compared to April 2024, and the dynamic load factor declined three percentage points month-on-month to 57 percent. (Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.)

Waiting to see how bad it gets

April’s market data failed to provide many indicators for the year because the uncertainty since the start of the month was just pushed back, says van de Wouw.

"Nothing has really changed in the past month. The global air cargo market is in an intermediate state. It’s very difficult for companies to relocate their sourcing to avoid tariffs, but they are looking at ways to reduce the impact, still not knowing what the final impact might be. The big question for everyone is what will this year do? The de minimis change in the U.S. is going to disrupt the market and we’ll see its impact in the May numbers. I would say be prepared for a logistical mess.

"I wonder how many U.S. consumers are aware there was a de minimis rule and that now it has been revoked. But that’s about to change. One industry colleague from Cirrus Global Advisors in the U.S. posted earlier this week that the best-selling item from China, a $19.49 power surge protector, was $48.38 in his Temu shopping basket by the time shipping and import taxes had been added. His message, quite correctly, is that the days of free shipping from China are over."

After double-digit air cargo market demand growth in 2024, forecasts going into 2025 predicted another four-six percent growth year-on-year. "Any attempts to reassess the outlook in the current market conditions would be meaningless," says van de Wouw.

Will tariffs stick?

The likelihood of lower airfreight rates are better news for shippers and forwarders but if shippers can’t sell their goods because of tariffs, that’s bad news for the macroeconomic picture and the need for airfreight, the update added. van de Wouw says: "For most airfreight shipments, lower rates will not compensate for the tariffs that will have to be paid. Therefore, it’s still a waiting game to see how long this process takes and the order of magnitude of which the tariffs will stick."

Right now, he added, all eyes are on e-commerce. "This is quite likely the calm before the storm. If the new de minimis set-up remains - and why would they change it after the investment the authorities have reportedly made - then this will undoubtedly negatively impact airfreight volumes from China to the U.S. The traditional airfreight market will not be able to compensate for the decline in e-commerce volumes. Airlines will adjust their networks to this new reality, and this, in turn, will have a beneficial impact for shippers around the world as they will see more capacity coming (back) to their market – but they still need viable trading conditions to enjoy the benefit of this opportunity."