A flying start to 2025 but air cargo stakeholders remain cautious

Xeneta is forecasting demand growth of +4-6% in 2025, continuing to outpace capacity supply growth of +3-4%.

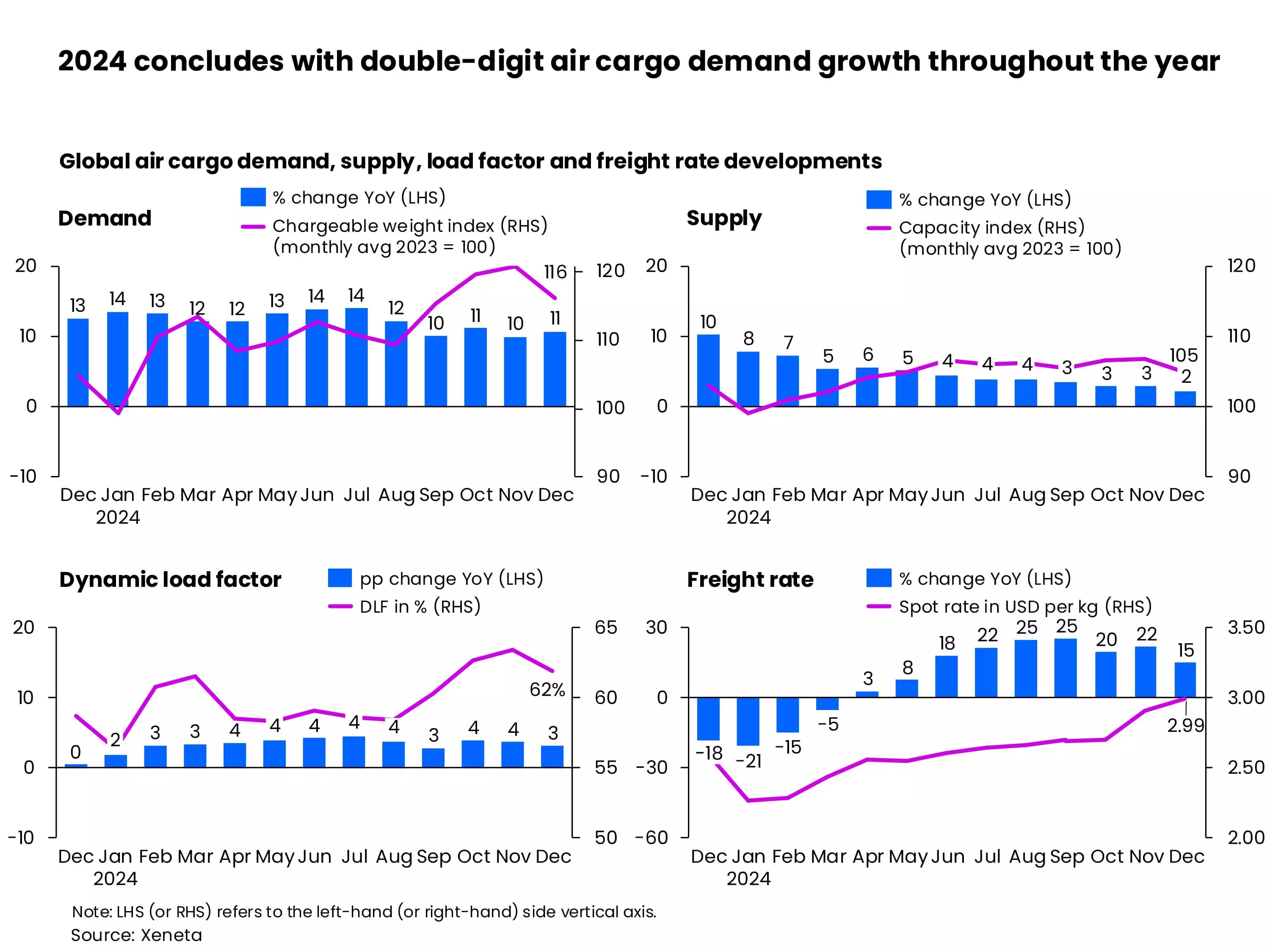

The global air cargo market cruised into 2025 on the back of 14 consecutive months of double-digit growth in demand as volumes climbed +11 percent year-on-year in December and average spot rates finished the year +15 percent higher, according to the latest update from Xeneta.

While Xeneta is forecasting demand growth of +4-6 percent in 2025, Niall van de Wouw, Chief Airfreight Officer, Xeneta says: "The air cargo industry’s cautious optimism remains tempered by its susceptibility to geopolitical tensions, a subdued manufacturing outlook, and political interventions in an increasingly volatile world."

With cargo capacity supply growth of just two percent in December continuing to lag well behind resilient demand, Xeneta’s dynamic load factor rose three percentage points year-on-year to 62 percent. (Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.)

"The December global air cargo spot rate increased +15 percent year-on-year to $2.99 per kg, although the comparison with the high-rate level in December 2023 made this the slowest growth rate in the last seven months."

The 2024 year-end peak season concluded with a more moderate spot rate increase of +11 percent between September and December. This contrasts sharply with the corresponding period of 2023, which surprised many with a much steeper +21 percent surge in spot rates, the update added.

“This rebalancing of the air cargo market from the extreme volatilities seen in 2023 is a clear reflection of the preparedness and maturity seen across the market in 2024. The efforts made by industry stakeholders ranging from strategic capacity allocation by airlines, securing capacity ahead of hot e-commerce corridors by freight forwarders, and locking-in longer-term contracts by shippers, all contributed to a healthier industry based on longer-term relationships instead of a push for short-term gains,” says van de Wouw.

Increasing reliance on e-commerce

Van de Wouw also outlined the continuing impact e-commerce will have on air freight in 2025. “We can put a ribbon around 2024. It was quite some year for air cargo. This remains a market that is increasingly reliant on e-commerce volumes while the general freight market, the bellwether of the global economy, remains muted. The signals from the manufacturing industry, particularly in Europe, are concerning but e-commerce continues to take up this slack and is projected to grow at +14 percent annually to 2026.

“So, the overall outlook for air cargo remains one of growth. But reports of countries aiming to crack down on the Chinese e-commerce platforms, for example, if this was to happen, would have a sizable impact in markets around the world because what’s going to take the place of these volumes?”

Looking at corridors

December saw the Europe-to-North America spot rate experience the most significant month-on-month increase, rising +21 percent to $3.27 per kg, its highest level in over two years, the update added. This spike is likely due to reduced cargo capacity from airline winter schedules on passenger flights and the reallocation of freighter capacity to Asia.

Concerns about potential second-round strikes at US East Coast ports failed to produce a meaningful mode shift to air freight in December. The news on January 8, 2025 of a tentative agreement between the International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) for a new six-year master contract means any further boost to air cargo volumes as a result of East Coast ports disruption is now far less likely.

As of early January, Europe to the U.S. spot rates stood at $2.56 per kg, a -25 percent drop from their peak two weeks earlier, the update added.

"On the increasingly scrutinised China-to-U.S. corridor, the spot rate, unlike other key lanes, failed to reach 2023’s peak season highs and showed a decline of nine percent from its mid-December 2024 peak of $5.61 per kg to early January 2025. This contrasted sharply with the same period in 2023, when rates dropped nearly 40 percent from a peak of $5.91 per kg. A combination of strategic allocation of cargo capacity and tightened scrutiny on e-commerce activities may have contributed to subdued peak season levels, while concerns over potential Trump tariffs likely tempered the rate decline due to increased frontloading."

Demand growth seen at 4-6% in 2025

Xeneta is projecting 2025 global air cargo demand to grow +4-6 percent year-on-year, continuing to outpace capacity supply growth of +3-4 percent.

“Heightened market volatility due to rising global uncertainties will continue to impact air cargo demand and this could force air freight rates to fluctuate significantly. Therefore, embracing more flexible freight rate negotiation methods such as indexing or transparent pricing could foster mutual understanding and better collaboration across the industry this year.

“Without this insight, what lies ahead for air cargo in 2025 may remain a guessing game for many less informed market players. Will January 2025 be the first time in 14 months we won’t see double digit growth? At the start of last year, the answer would most likely have been affirmative but now the market must wait and see what happens because this year is starting off with a much higher base,” van de Wouw added.

The continued geopolitical tensions, threats of Trump tariffs, tightened measures of de minimis threshold related to e-commerce, increased security risks from rising global tension and extreme weather and natural disasters pose many uncertainties for this year’s global air cargo demand and supply chain.

While the threat of further U.S. East Coast port strikes seems to have now been removed, any further disruptions to global ocean freight is likely to see shippers resorting to the predictability of air freight for urgent shipments, triggering further spikes in air cargo rates. October’s three-day strike at U.S. ports produced a +12 percent increase in air cargo volumes month-on-month from Europe to the US.