Will the Taiwan earthquake disrupt the global chip shortage?

While the human cost remains the primary focus, with rescue efforts ongoing, the impact on Taiwan's role as a chipmaking powerhouse is under close scrutiny from industries worldwide

A powerful earthquake measuring 7.4 on the Richter scale struck eastern Taiwan on Wednesday, April 3, 2024, sending shockwaves through the island's critical semiconductor manufacturing sector and raising concerns about further disruptions to the already strained global chip supply chain. While the human cost remains the primary focus, with rescue efforts ongoing, the impact on Taiwan's role as a chipmaking powerhouse is under close scrutiny from industries worldwide.

Taiwan’s semiconductor dominance

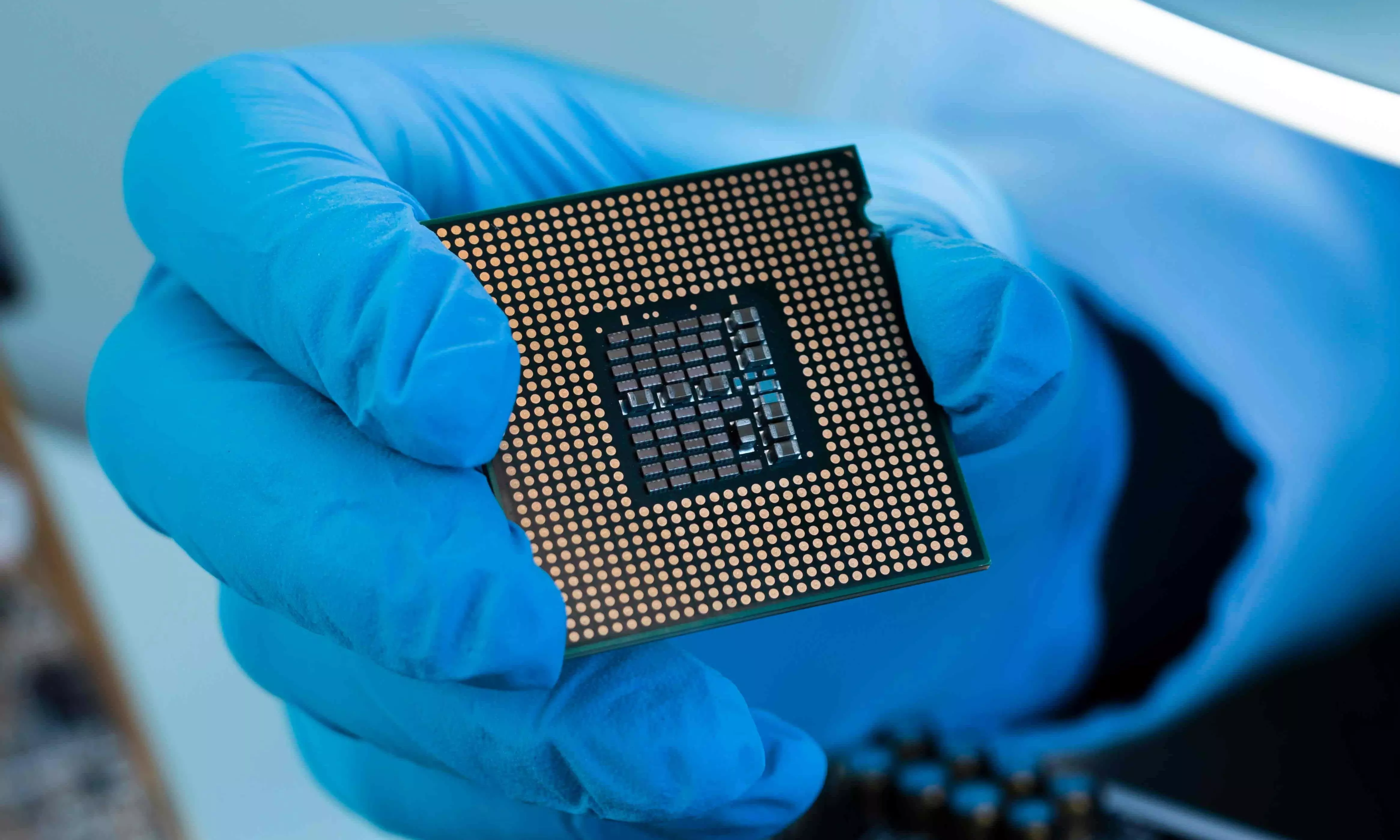

Taiwan is a global leader in semiconductor manufacturing, punching well above its weight in an industry that powers the modern world. Taiwan accounts for over 60% of the world's production of the essential microchips that drive everything from smartphones and laptops to medical equipment and automobiles. Major chipmakers like Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest contract chipmaker, have their headquarters and production facilities located in Taiwan.

Initial impact of earthquake

The earthquake caused widespread damage in eastern Taiwan, with some chip factories experiencing temporary shutdowns and evacuations as a precautionary measure. According to some media reports, the Taiwan earthquake may have caused an estimated $62 million in damage and disruptions for TSMC (after deducting insurance compensations), however, Extreme Ultraviolet (EUV) light equipment was reported to be safe. TSMC released an official statement that "equipment in Taiwan fabs have been fully recovered" as of April 5th.

On the other hand, this dominance has made the world heavily reliant on Taiwan, and geopolitical tensions have prompted several large Taiwanese manufacturers to consider establishing a second headquarters overseas to ensure business continuity in the event of a potential Chinese attack on Taiwan. These preliminary plans underscore the global efforts to secure supply chains, forcing companies crucial to manufacturing networks, especially in the tech sector, to make extensive changes. China's claim over Taiwan and threats of annexation, coupled with increased military pressure from Beijing, have prompted many foreign companies and Taiwanese groups' customers to initiate contingency planning, despite Taiwanese experts considering an imminent attack unlikely.

Furthermore, at least nine Taiwanese chip firms have set up shop or expanded operations in Japan over the past two years, reflecting the industry's efforts to diversify locations, according to a report by the Economic Times. Moreover, companies like Topco, a chemicals and parts supplier for semiconductor plants, have laid out 10-year plans to establish additional units in various regions and train mid-level executives for rotation through different countries, according to Financial Times.

In response to rising costs in China, the US-China trade war, and customers' demands to "de-risk" from China, major Taiwanese companies like Apple suppliers Foxconn and Pegatron are shifting production capacities to Southeast Asia, India, Mexico, the US, and Europe, moving away from their traditional concentration in China.

According to a report by Wion, Taiwan's Foreign Minister Joseph Wu raised concerns about China's reliability as a partner in high-tech production, suggesting India could fill the gap and emerge as a major semiconductor manufacturer. This news comes alongside a landmark collaboration between Taiwan's Powerchip Semiconductor Manufacturing Corporation (PSMC) and Tata Group, who are partnering to establish India's first semiconductor fabrication facility in Dholera, Gujarat by 2026.

Potential disruptions

However, despite the recovery reports, the full impact of the earthquake may still unfold in the coming weeks and months. While major production lines seem operational, some chip fabs might experience delays due to infrastructure damage, power outages, or logistical hurdles. These delays could impact chip production schedules and delivery timelines, worsening the existing supply chain bottlenecks that have plagued the industry for the past few years due to the pandemic and geopolitical tensions.

The chip shortage has been a persistent problem, and any disruption in Taiwan, even minor, could further strain the delicate global supply chain. This could lead to production slowdowns for chip-dependent industries like consumer electronics, automotive, and medical devices, which have already been grappling with shortages and delays.

Speaking about the potential disruptions, Peter Guinto, President Aerospace and Defense Division of supply chain mapping and analytic company Resilinc told STAT Trade Times, “Companies should closely monitor the potential impact on semiconductor materials, especially wafer fabrication, as most of it happens in Taiwan. Supply chain disruptions, particularly at lower tiers like semiconductor components or silicon wafers, can have cascading effects up the chain. By the time the end client becomes aware of the issue, it might be too late to mitigate the impact. Such disruptions can lead to higher costs, delivery delays, and revenue disruptions.”

Ripple effects on global logistics

The impact of the Taiwan earthquake is poised to send shockwaves rippling through global logistics networks that have become deeply intertwined with and reliant upon the island's semiconductor output. Air cargo carriers like FedEx, UPS, and DHL could see a decrease in demand for shipments of finished electronics products out of major manufacturing hubs in China, South Korea, and Southeast Asia if chip shortages force production slowdowns. This could lead to reduced cargo volumes and potentially lower freight rates on transpacific routes and high-traffic routes out of Asia.

Similarly, ocean freight shipments of electronics and other chip-dependent goods could face disruptions if Taiwan's semiconductor fabs experience prolonged delays. Major shipping lines like Maersk, MSC, and CMA CGM might be forced to adjust schedules or see a slowdown in bookings for routes serving manufacturing centres in China's Pearl River Delta, as well as export hubs in Malaysia, Vietnam, and Mexico that rely heavily on Taiwan's chips.

However, it is China's logistics networks that stand to be impacted most severely in the fallout. As a major consumer of Taiwanese semiconductor chips, even temporary hiccups in chip deliveries could derail production schedules at Chinese factories in sectors like consumer electronics, automotive manufacturing, and telecommunications equipment.

Brands like Huawei, Xiaomi, Oppo, and major automotive firms could face parts shortages. This ripple effect could disrupt trucking, rail, and warehousing within China as idled factories cut shipments. Ports like Shenzhen, Shanghai, and Ningbo could see falling export volumes of finished goods reliant on Taiwanese chip inputs. The repercussions have the potential to strain China's domestic logistics ecosystem and impact its exports to the United States, Europe, and other major markets. While Shanghai-based Semiconductor Manufacturing International Corporation (SMIC) offers some cushion, their production might not be sufficient or advanced enough to meet all of China's needs.

The US tried to curb China's tech growth by limiting access to materials and technology, but this backfired and spurred China to develop its own chip-making capabilities. SMIC is now producing good-quality chips and the country is heavily investing in domestic chip production. However, China still relies on foreign equipment to make the most cutting-edge chips. While China is developing its own version, it's a challenge. Despite this hurdle, China is likely to become self-sufficient in chip-making eventually, significantly impacting the global tech industry. This has the US scrambling to improve its chip production capabilities by announcing an investment of $6.6 billion for the expansion of the TSMC facility in Arizona.

Overall, the US-China chip race is heating up and could reshape the technological landscape. On the other hand, China is also supporting the development of indigenous industries: Guangzhou City has taken the lead with an initial investment of $30 billion, demonstrating its commitment to this domestic industry. Beijing is further bolstering these efforts by pledging an additional $143 billion in subsidies and tax breaks. This substantial financial backing underscores China's ambition to become a major player in chip production and reduce its reliance on foreign sources.

In the current scenario, while China's SMIC producing chips lessens the impact of a Taiwan earthquake, they're not completely in the clear. SMIC's production might not be enough or as advanced, and existing supply chains could face hiccups. The severity depends on the damage in Taiwan, SMIC's ability to ramp up production, and the specific chip needs of China.

The coming weeks will be crucial in assessing the true impact of the earthquake on chip production and the global supply chain. While initial reports offer some optimism, continued monitoring and communication from chipmakers is essential. Governments and industry leaders will need to work together to ensure efficient logistics and mitigate any potential delays.

TSMC, which operates 14 sites on the island and several construction developments, evacuated some areas as a precautionary measure and paused production at some of its plants on the West Coast, according to various media reports. The company is currently evaluating the impact of the earthquake and while some production lines have been affected, "equipment in Taiwan fabs have largely been fully recovered," the company said in a statement.

"Certain production lines in areas which experienced greater seismic impact are expected to require more time for adjustment and calibration before returning to fully automated production," TSMC added. Contract semiconductor maker United Microelectronics Corporation stated that the event had "no material impact" on its operations and that wafer shipments are resuming as normal after a brief pause triggered by automatic safety measures.

TSMC provided further reassurance, stating: "A small number of tools were damaged at certain facilities, partially impacting their operations. However, there is no damage to our critical tools including all of our extreme ultraviolet (EUV) lithography tools. Certain production lines in areas which experienced greater seismic impact are expected to require more time for adjustment and calibration before returning to fully automated production."

US memory chip manufacturer Micron Technology noted in an announcement that it is currently evaluating any impact on operations and will communicate with customers about any delivery schedule changes once the review is complete.

As the dust settles and the full extent of the damage becomes clear, the world will be watching closely, hoping for a swift recovery and minimal disruption to the fragile global chip supply chain. The earthquake serves as a stark reminder of the world's reliance on Taiwan's semiconductor manufacturing prowess and the need for continued investment in resilient supply chains.