Strong, slow January pushes air cargo volumes up 10%

General air cargo spot rates in January declined 12% month-on-month to an average $2.27 per kg

Global air cargo volumes rose by a surprise but welcome 10 percent year-on-year in January as shippers’ concerns over hostilities in the Red Sea and an early Lunar New Year more than compensated for an anticipated post-Christmas drop in ecommerce traffic, according to the latest weekly market analysis by Xeneta.

"With plenty of available air cargo capacity in what is traditionally a quieter month for demand, fuller cargo holds are yet to translate into higher rates. Globally, general air cargo spot rates in January declined 12 percent month-on-month to an average $2.27 per kg, consistent with the trend of the global dynamic load factor, which dropped three percentage points to 56 percent versus December. Xeneta’s dynamic load factor analysis measures air cargo capacity utilisation by considering both cargo volume and weight perspectives of cargo flown and capacity available."

Overall, the year-on-year growth of global air cargo market supply slowed down in January as much of the missing capacity was restored last year, the update added.

Compared to the previous year, January’s global average spot rate continued to show a decline of 21 percent, although at a slower pace compared to the -38 percent decline seen in January 2023.

“We saw a relatively strong January from a volume perspective but the market fundamentals have not changed," says Niall van de Wouw, Chief Airfreight Officer, Xeneta. "This is not consumers buying more, it is likely linked to Red Sea disruption as well as the upcoming Lunar New Year and some indicators that the general cargo market is busier than expected. We don’t see this reflected in rates but that’s not surprising in January because there’s not the same pressure on capacity.

“The situation in the Red Sea has brought nervousness to many supply chains and possibly encouraged some shippers to have a knee-jerk reaction, shifting to airfreight, bringing volumes forward, and securing capacity. However, the consensus seems to be that this will not produce a long-term positive effect on airfreight. Once the initial nerves and uncertainty subsides, stability will return once shippers simply accept that ocean freight may just take two weeks longer, causing the need for airfreight to then dwindle. I’m not hearing it is turning the air freight market upside down like we saw, for example, during the ports strike on the U.S. West Coast.”

Whilst uncertainties due to economic anxiety and geopolitical tensions continue to linger, the air cargo market, van de Wouw said, might be more focused on what happens to e-commerce following the crazy air freight volumes online sales generated in the weeks leading up to Christmas. "The shrinking German economy, the slowdown of China's economic growth, and the still-elevated interest rates due to high inflation could also mute global air cargo demand at least in the first half of 2024."

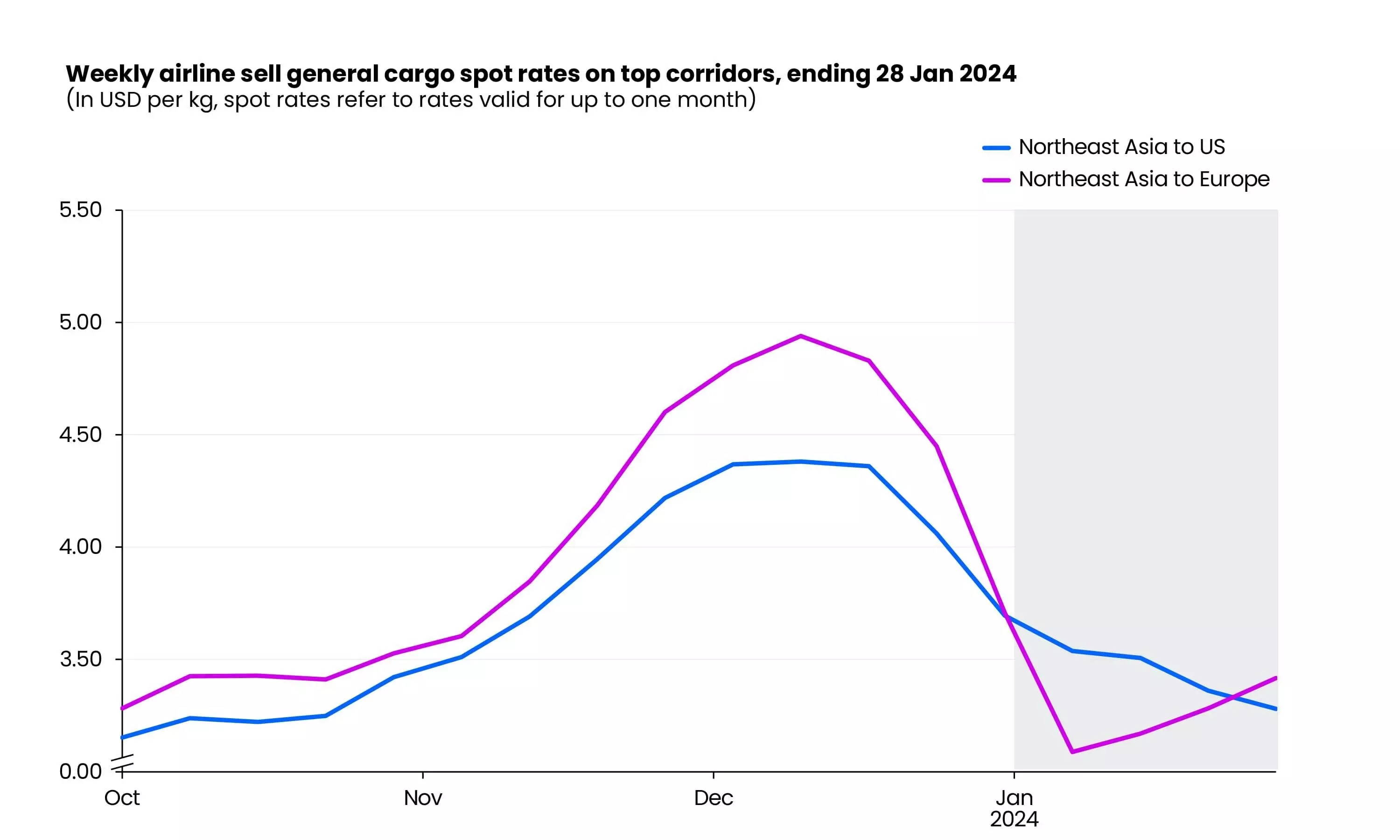

Xeneta observed ‘extraordinary’ surges in air cargo volumes from China and Vietnam to Europe for three consecutive weeks in January, surpassing even their peak season highs, the update added. "In response to this, the market also saw an increase in some air cargo spot rates. General cargo spot rates from Northeast Asia to Europe rebounded by 11 percent to $3.42 per kg in the week ending January 28, after reaching their lowest point in the first week of January. Northeast Asia refers to mainland China, Hong Kong, Japan, South Korea, and Taiwan."

This contrasts with the trend of freight rates from Northeast Asia to the U.S. where general cargo spot rates continued their downward trend since mid-December, reaching $3.28 per kg in the week ending January 28, down seven percent compared to three weeks prior. "This suggests that the demand growth on the Northeast Asia to Europe corridor is more of a spillover from ocean transport rather than actual growth in consumer spending."

van de Wouw adds: “The market remains extremely difficult to predict. Let’s wait and see what happens in February when we might see air and ocean volumes as well as rates fall back if more stability returns to the market. But January was a strong slow month, and, after a difficult year, the air cargo industry will not be complaining about starting the year on a positive note."